Benjamin Tal, Deputy Chief Economist CIBC Capital Markets

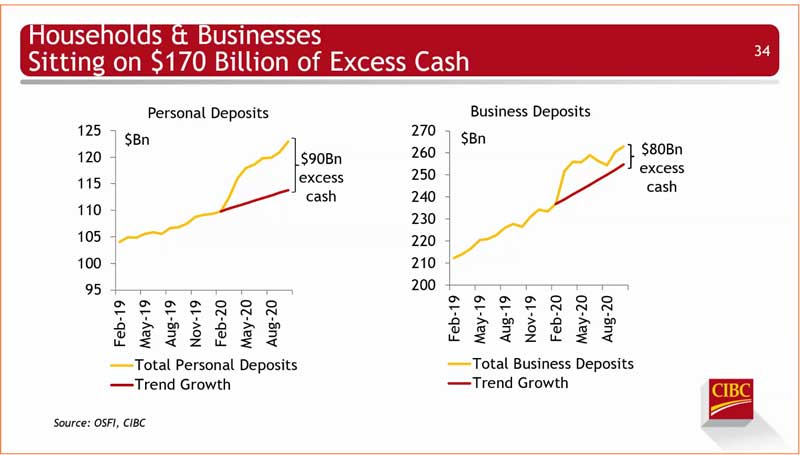

The recession we're seeing as a result of COVID-19 is primarily a "service industry" recession, which suggests when the turnaround comes, it will come quickly, because the demand for services will be extremely high, and because it is easier to open a restaurant than open a new manufacturing plant (as an example). Service-based businesses can generally get up and running faster than product-based businesses. Household income is rising during a recession for the first time ever. The Canadian government is spending A LOT. Canadians are sitting on a mountain of cash, that is "dying to be spent" and will be spent in a significant way, as soon as we "get the green light."

Canadians are sitting on a mountain of cash, that is "dying to be spent" and will be spent in a significant way, as soon as we "get the green light."

Most of the money will be going to services when they re-open.

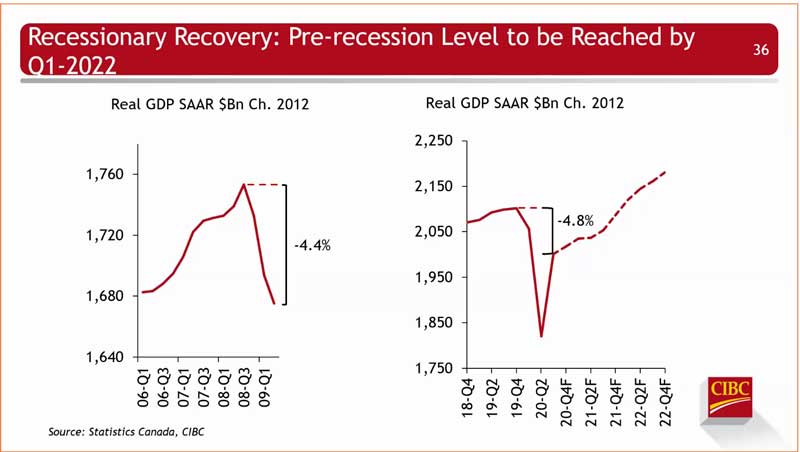

Mr. Tal is optimistic about the second half of the year. He expects the economy to shrink over the next couple of months, and then expand in the second half of the year. He cautioned that all of his predictions are based on the vaccine being effective and widely distributed by the end of the summer.

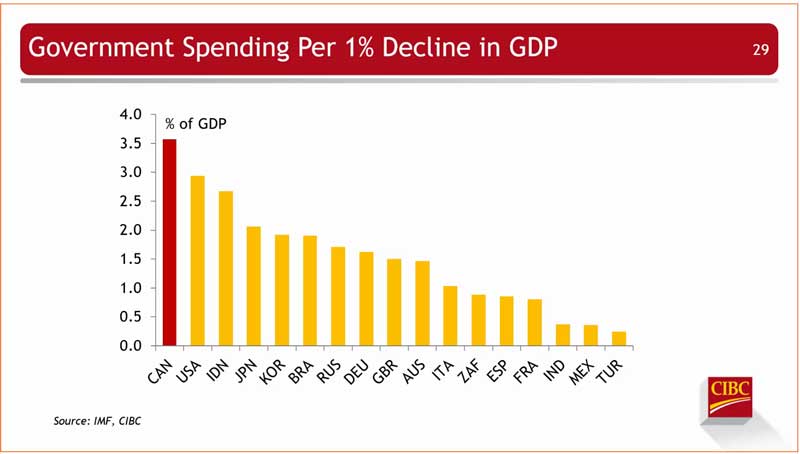

Government spending rose from 15% of GDP to about 35%, and he expects it will go down to about 17% when this is all over with. He said we will see a "permanent increase in government spending" to pay for more social programs such as national childcare, a new employment insurance program... In other words, taxes are going to go up, they may even increase the GST.

Most of the money will be going to services when they re-open.

Mr. Tal is optimistic about the second half of the year. He expects the economy to shrink over the next couple of months, and then expand in the second half of the year. He cautioned that all of his predictions are based on the vaccine being effective and widely distributed by the end of the summer.

Government spending rose from 15% of GDP to about 35%, and he expects it will go down to about 17% when this is all over with. He said we will see a "permanent increase in government spending" to pay for more social programs such as national childcare, a new employment insurance program... In other words, taxes are going to go up, they may even increase the GST.

With all this spending, how inflationary is this situation?

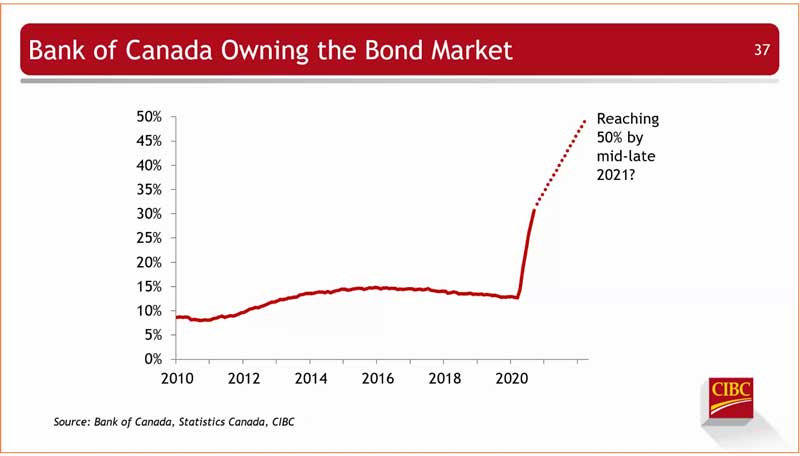

We are in a disinflationary environment, so the government is using inflationary tactics to counteract it. "Don't lose too much sleep over inflation." The federal government has bought a lot of bonds, primarily focused on 5-10 year terms, to keep mortgage and interest rates low.

With all this spending, how inflationary is this situation?

We are in a disinflationary environment, so the government is using inflationary tactics to counteract it. "Don't lose too much sleep over inflation." The federal government has bought a lot of bonds, primarily focused on 5-10 year terms, to keep mortgage and interest rates low.

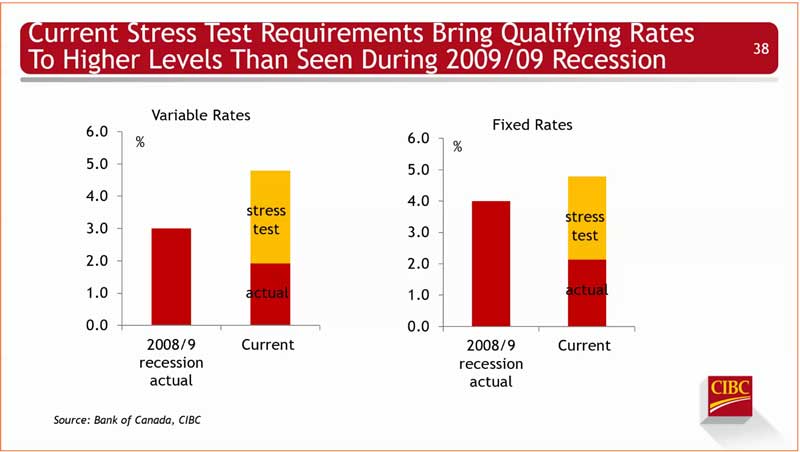

This has been the friendlies housing market recession ever, because of interest rates. Another interesting point was that because of the stress test, consumers still have to be approved at a relatively high interest rate in order to take advantage of the low interest rates.

This has been the friendlies housing market recession ever, because of interest rates. Another interesting point was that because of the stress test, consumers still have to be approved at a relatively high interest rate in order to take advantage of the low interest rates.

The secret behind the success of the housing market is that most of the people impacted by unemployment were in lower-income brackets and not participating in the housing market anyway. How sustainable is this market? Quite sustainable... but he expects the market will soften in the first quarter of the year compared to the fall. When it comes to Alberta, "the worst is over." We are seeing some signs of improvement in oil prices, I predict a very strong spring and summer. Much of the activity will be at the lower end of the market. The trend of moving out of condos, into homes will slow in 2022, when things get back to normal; the gap in pricing between condos and houses and the "return to the office" will make condos more attractive. "I see the fundamentals for a strong market."

After COVID-19

"I think we will be back in the office, pent up demand for offline shopping, people will be lining up for restaurants, leisure travel will explode in 2023, business travel will not fully recover."

The secret behind the success of the housing market is that most of the people impacted by unemployment were in lower-income brackets and not participating in the housing market anyway. How sustainable is this market? Quite sustainable... but he expects the market will soften in the first quarter of the year compared to the fall. When it comes to Alberta, "the worst is over." We are seeing some signs of improvement in oil prices, I predict a very strong spring and summer. Much of the activity will be at the lower end of the market. The trend of moving out of condos, into homes will slow in 2022, when things get back to normal; the gap in pricing between condos and houses and the "return to the office" will make condos more attractive. "I see the fundamentals for a strong market."

After COVID-19

"I think we will be back in the office, pent up demand for offline shopping, people will be lining up for restaurants, leisure travel will explode in 2023, business travel will not fully recover."

Lynette Tremblay, Vice President - Strategy & Innovation, Edmonton Global

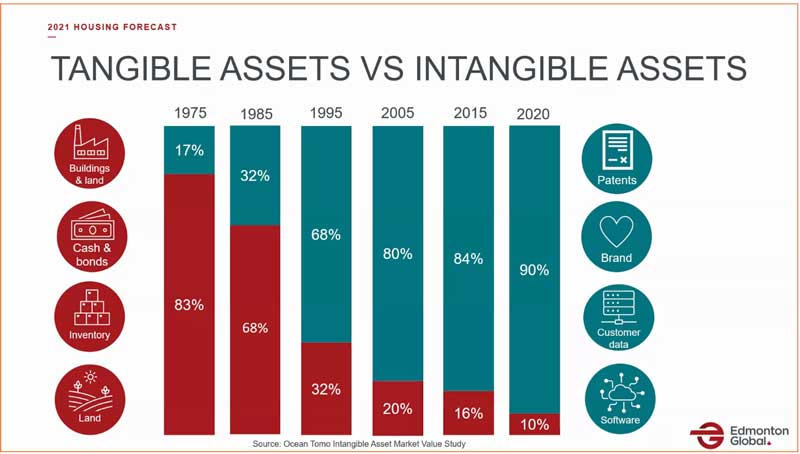

"I've seen a lot of hardship and loss of the past year, but also a lot of achievements." Over 4000 new business started in our region last year; a UofA researcher was awarded the Nobel Prize; 5 people from our region received the Order of Canada; two local tech companies - Drivewyze and Jobber - each raised over $70million in growth funding; and, another local company Tevosol won the NASA iTech competition - they created a technology that preserves donor organs for a long period of time. That's a tremendous amount of innovation coming from our region. The global economy has been transforming creating new challenges and opportunities. The global economy has been transforming from being based on tangible products to the knowledge economy. The value of intangible assets has far outpaced the value of tangible assets. This phenomenon marked the beginning of the 4th industrial revolution. Alberta has been a bit of a digitization hold out, but COVID brought us forward and we've more than caught up. When the world around us changes, we have to change with it or be left behind. We need to lead in our new reality. Investors are spending less on bricks and mortar and more on technology and R&D. Talent has become the primary driver of investment for most businesses. We have the talent here and we can attract it with our high quality of life, low cost of living and diverse housing options.

Consumer spending and exports are key to our economy, there is pent up demand that will become unleashed once lockdowns are lifted. A new term describes this unleashing of pent-up demand as "Revenge shopping." Consumers are committed to buying local, online shopping, and virtual experiences, and are spending more on technology, health and home.

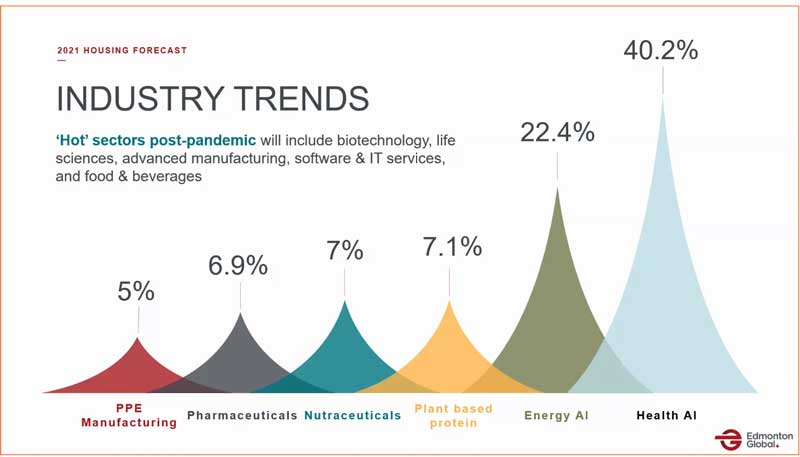

Hot sectors post-covid include biotech, life sciences, software & IT and food & beverages.

Alberta has been a bit of a digitization hold out, but COVID brought us forward and we've more than caught up. When the world around us changes, we have to change with it or be left behind. We need to lead in our new reality. Investors are spending less on bricks and mortar and more on technology and R&D. Talent has become the primary driver of investment for most businesses. We have the talent here and we can attract it with our high quality of life, low cost of living and diverse housing options.

Consumer spending and exports are key to our economy, there is pent up demand that will become unleashed once lockdowns are lifted. A new term describes this unleashing of pent-up demand as "Revenge shopping." Consumers are committed to buying local, online shopping, and virtual experiences, and are spending more on technology, health and home.

Hot sectors post-covid include biotech, life sciences, software & IT and food & beverages.

We can now compete in areas we couldn't before... energy & clean technology, health & sciences, advanced manufacturing. Canada exports more plant protein than any country in the world, most of that coming from our region... on top of that, we have a lot of land near vibrant urban communities (people and product close together). What if we took those crops, added value by creating plant protein-based foods and beverages here, and sold them to global consumers - we'd get a much better return on the crops. Also, we are one of the few Canadian jurisdictions certified to produce drugs for human consumption, our airport is certified for special handling and shipping of pharmaceuticals, world-class talent and inputs from petrochemical sectors that can be used for pharmaceutical manufacturing, and we have the research expertise helping to develop leading-edge innovations. We are the only region among our competitors with Artificial Intelligence expertise and a massive energy sector right in our region, along with the largest single health authority in Canada.

Collaboration and innovation are the keys to our regions' economic success. One of our greatest assets is the people who already live here; we find ways to come together and support each other, it's what we do. We're the volunteer capital of Canada! We have a great story to tell, lets tell it to the world. Everyone needs to get involved and promote the Edmonton area. Love where you Liv baby.

We can now compete in areas we couldn't before... energy & clean technology, health & sciences, advanced manufacturing. Canada exports more plant protein than any country in the world, most of that coming from our region... on top of that, we have a lot of land near vibrant urban communities (people and product close together). What if we took those crops, added value by creating plant protein-based foods and beverages here, and sold them to global consumers - we'd get a much better return on the crops. Also, we are one of the few Canadian jurisdictions certified to produce drugs for human consumption, our airport is certified for special handling and shipping of pharmaceuticals, world-class talent and inputs from petrochemical sectors that can be used for pharmaceutical manufacturing, and we have the research expertise helping to develop leading-edge innovations. We are the only region among our competitors with Artificial Intelligence expertise and a massive energy sector right in our region, along with the largest single health authority in Canada.

Collaboration and innovation are the keys to our regions' economic success. One of our greatest assets is the people who already live here; we find ways to come together and support each other, it's what we do. We're the volunteer capital of Canada! We have a great story to tell, lets tell it to the world. Everyone needs to get involved and promote the Edmonton area. Love where you Liv baby.

Tom Shearer, Chair, REALTORS® Association of Edmonton

Forecasting is very difficult and inaccurate, but we're going to try again. We expect consumer confidence to remain strong, but there is a high degree of uncertainty and we are taking a conservative approach in our projections. There wasn't much context or rationale given for the projections given by the Association, these charts summarize their comments:

Interest rates are expected to stay low in 2021. Consumers are "searching for value" and sales in the cities near Edmonton were way up in 2020. 2021 is likely to present many of its own challenges, be kind, help out.

Posted by Liv Real Estate

on

Interest rates are expected to stay low in 2021. Consumers are "searching for value" and sales in the cities near Edmonton were way up in 2020. 2021 is likely to present many of its own challenges, be kind, help out.

Posted by Liv Real Estate

on

Leave A Comment