Well, it's that time of year when I get to try and predict what's going to happen with the real estate market and check back on last year's prediction. I attended the REALTORS® Association of Edmonton annual forecast last week and the Calgary Real Estate Board (CREB®) forecast earlier today, and I have some interesting insights to share with you. But first, let's have a look at my prediction from last year:

"We don't expect the pace of sales to stay ahead of previous years for much longer, we're still dealing with pent-up demand due to extremely low-interest rates and people wanting more space for working and learning from home. The Bank of Canada has committed to keeping rates low for 2021, but the Alberta economy is not expected to get back to pre-pandemic levels for a couple of years, and a weak labour market is expected until the end of next year. Some fundamental shifts are needed (employment, migration) before improvements in the market will be sustainable."

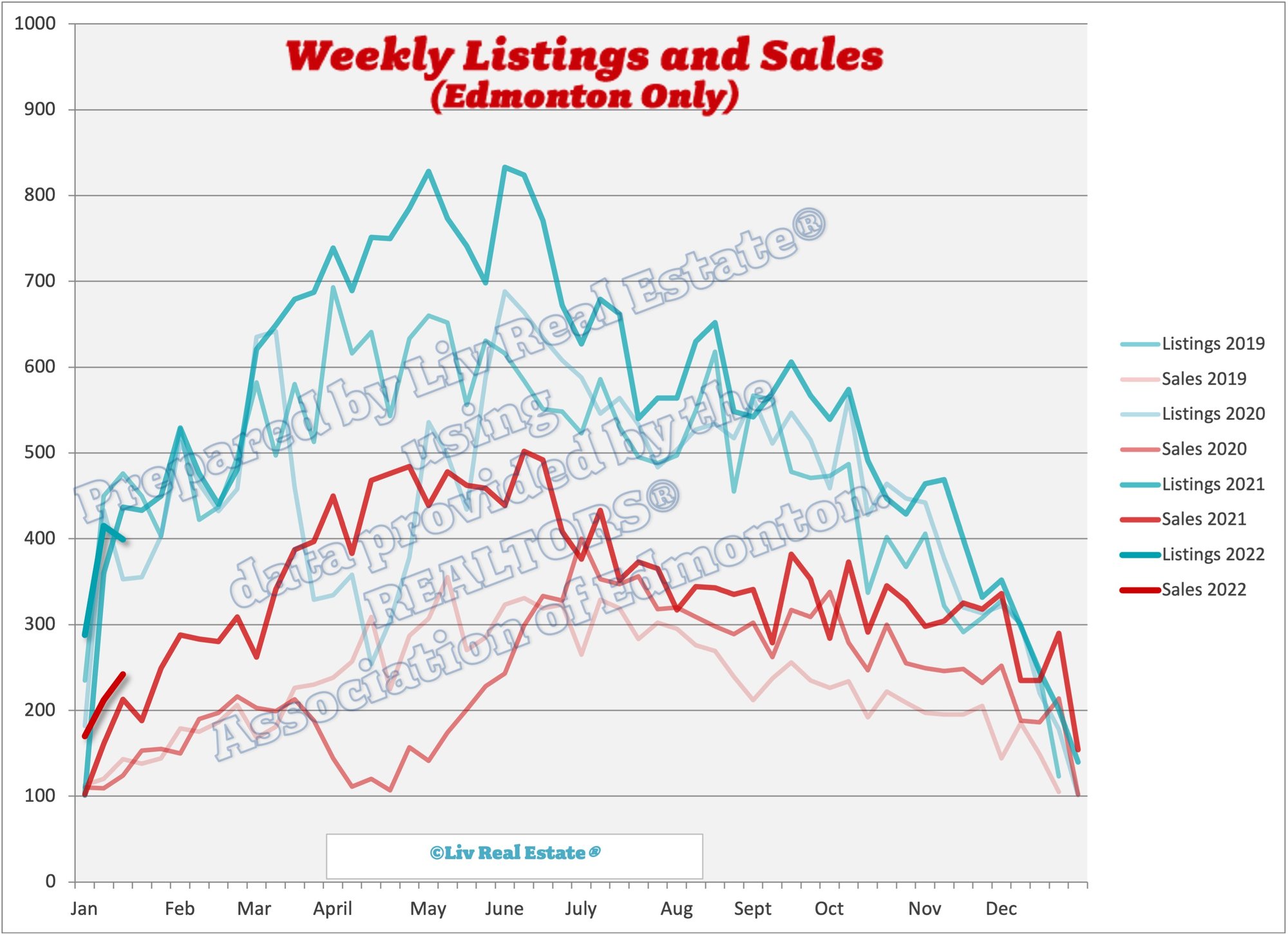

So, sales in 2021 did stay well ahead of 2020, in fact, sales increased 45% over the year previous and were well ahead of recent years, possibly setting a new record (I can't say for certain because the cities included in the reported sales figures were changed a number of years ago). Interestingly, Calgary's sales were up 71% in 2021! So, it turns out there was a lot more pent up demand than we expected, plus low-interest rates, improved savings, better than expected job growth, a stronger than expected energy sector, and an increase in inter-provincial migration all contributed to increased confidence in our real estate market and way more sales than we were expecting.

2022 Forecast

Interest Rates

Let's have a look at the major factors that affect our local real estate market. First off, interest rates. It is expected that the Bank of Canada will increase the overnight lending rate in small increments (25 basis points) over the course of the year, for a total increase of 1-2%. Major banks have already increased mortgage rates, and the discounts off the posted rates have decreased. The first decision on rates is expected to be announced tomorrow. Rate increases naturally change what people can afford, I think we will continue to see a strong market as people want to get in before there are MORE rate increases. If rates go up too quickly, they can derail the housing market, but the Bank of Canada is expected to take "baby steps" that the market should be able to handle. In our weekly updates, we've already seen sales ahead of last year; I think it's overly optimistic to expect sales to continue ahead of last year's pace for much longer, but expecting higher than normal sales is certainly reasonable.

Economic Outlook

In 2021 Alberta was one of the strongest provinces in terms of GDP growth at 5.9%. CREB®'s Chief Economist Ann-Marie Lurie said 4.7% growth in GDP is expected this year in Alberta. Expectations for covid restriction reductions, tech sector growth, and a stronger energy sector will all be good for Alberta's economy. Felicia Mutheardy, City of Edmonton Corporate Economist said that the Edmonton unemployment rate is now lower than before the pandemic, and she expects the labour market to continue to improve in 2022.

Migration

Alberta has been losing people to other provinces since 2015, and in Q3 2021 we finally saw that start to turn around. Interestingly, we've lost people to BC and the Atlantic provinces and gained residents from Ontario, Manitoba and Saskatchewan. I received an inquiry the other day from a family moving to Edmonton from Ontario, simply because our homes are less than half the cost of homes there. Positive net migration to Alberta is expected to continue in 2022.

Supply and Demand

We see lots of indications that demand will be strong in Edmonton in 2022. Of course, there are a number of risks to consider: covid, inflation, interest rates (if interest rates increase more than expected this could have a downward risk in terms of sales). On the other hand, higher energy prices might support more job growth, creating more confidence and more demand.

What about supply? Last year we averaged about 3.5 months of supply, which kept us in a seller's market all year. Keeping in mind different parts of the market performed quite differently (affordable single-family homes were in a severe seller's market while high-rise condos were extremely over-supplied), and buyers had high expectations for the design and condition of listings. So far, new listings seem to be keeping pace with previous years (you can see all the charts for 2021 including sales, inventory, absorption and more in my last monthly update). With prices improving, and in many cases "recovered" we could see more owners motivated to list their properties. I have noticed an increase in the number of inquiries we've received from potential sellers over the past few weeks. With that said, we saw the highest number of listings in at least 10 years last year, so if new listings and sales both come down a bit from last year's highs, it's reasonable to expect inventory to remain relatively similar to last year, keeping us in a slight seller's market or moving slightly to a balanced market.

Summary and A Word of Advice

In summary, I expect the first half of the year to be more active than the second half when interest rates are expected to rise, so overall sales will decline from last year's highs but remain above the norm set in the 20-teens. The benchmark price for single-family homes will increase in 2022, but only by 2-3%. I would like to say that I think condo prices have bottomed out, but there is a huge shadow inventory of listings that failed to sell in the past 5-6 years that could come back on the market with any sign of price appreciation, which will keep condo prices in check.

My advice to you:

- If you're thinking of buying, get a rate hold NOW.

- If you're thinking of moving up or down, talk to your current lender about any payout penalties you could be facing.

- If you're selling, staging has become more important than ever. Today's buyers expect "designer homes," and listings that don't look like they belong in a magazine are simply being ignored.

So, what are your thoughts on the market? What do you think Edmonton real estate prices are going to do in 2022? How was your crystal ball last year?

Posted by Liv Real Estate on

1 Response to 2022 Edmonton Real Estate Market Forecast

Sara, when you say "new listings seem to be keeping pace with previous years", what do you mean? It seems that for SFDs, we're at half the inventory compared to January 2020.

Posted by Tom Smith on Friday, January 28th, 2022 at 1:31pmLeave A Comment