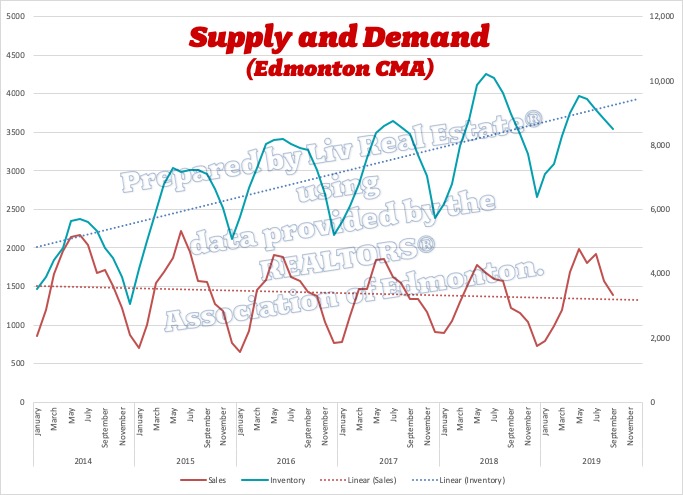

- Job growth drives demand for housing - the employment outlook is not particularly rosy

- Population growth also drives demand but Alberta lost more people than it gained in the second quarter for the first time since the 90's

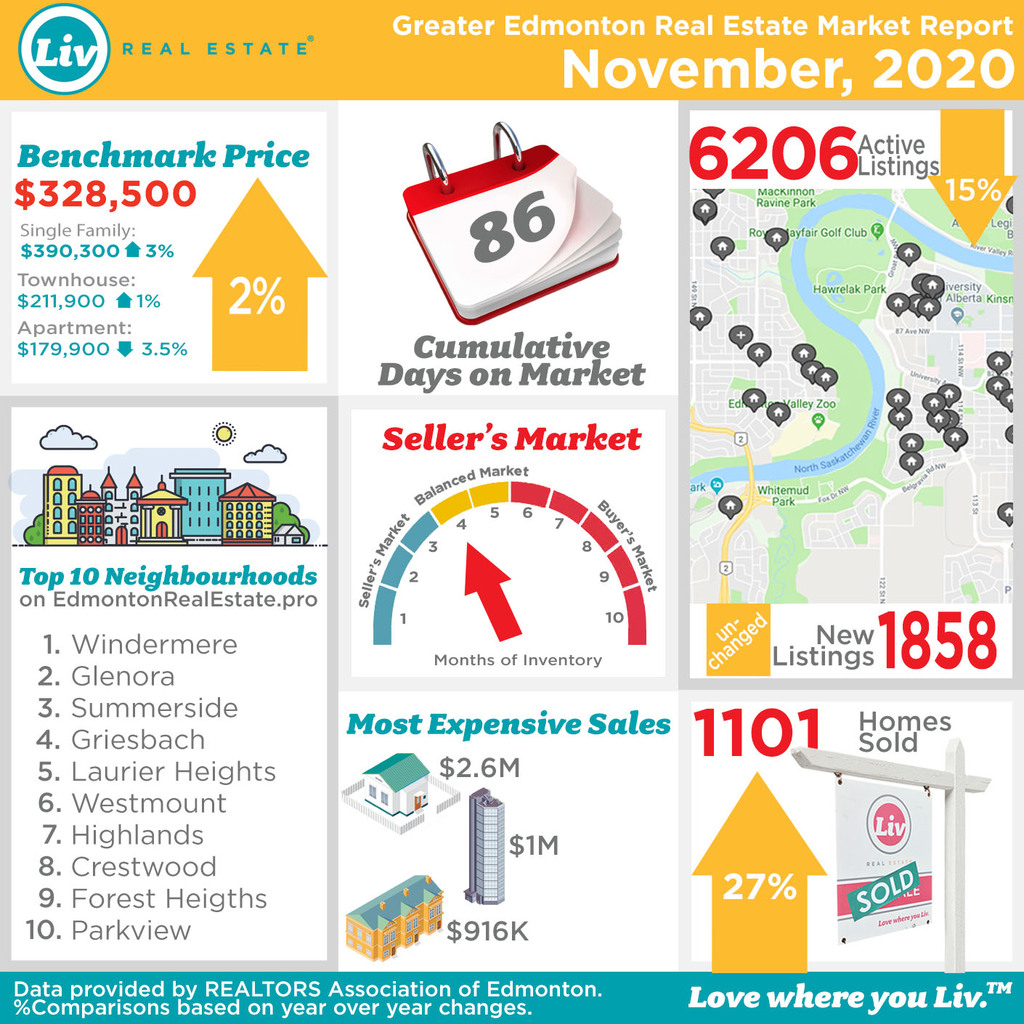

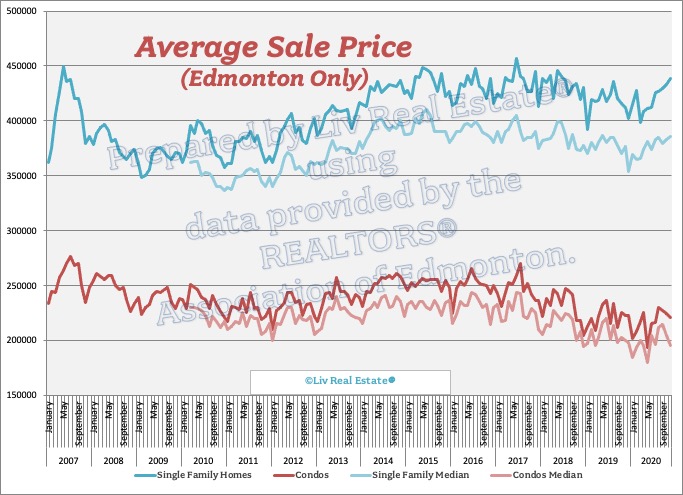

City of Edmonton Stats

Posted by Liv Real Estate

on

Posted by Liv Real Estate

on

3 Responses to Busier Than Normal Market in the Greater Edmonton Area

The Altus Group are clueless. Home prices in Edmonton are lagging the rest of the country by a good 20 to 30 years. With the U.S. set to destroy the U.S. dollar we'll see oil prices well above the 100 dollar mark even with no demand for oil. The cremation of the U.S. dollar and the Covid vaccine will cause Edmonton home prices to double or triple in the next 3 to 5 years.

Posted by Tony on Tuesday, December 8th, 2020 at 10:07pmTwo things:

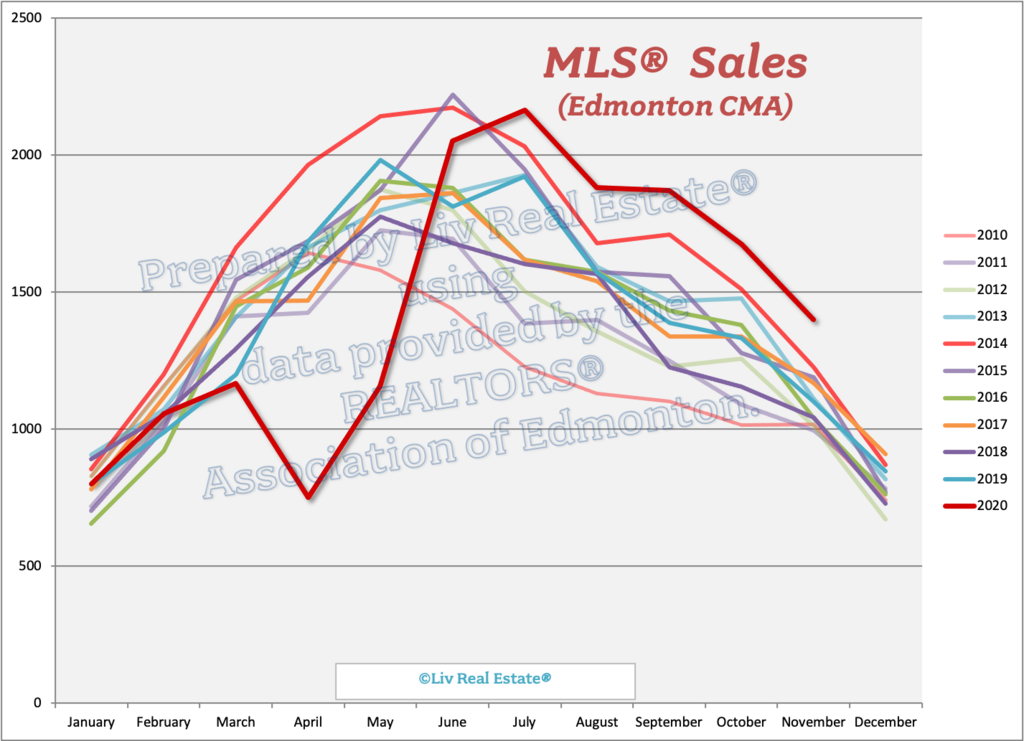

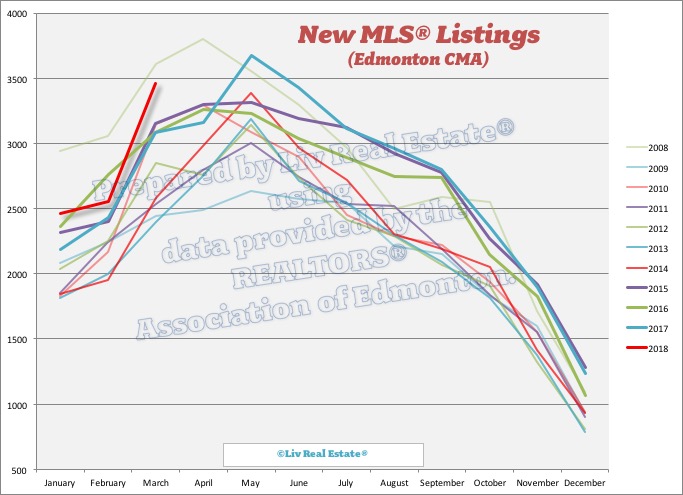

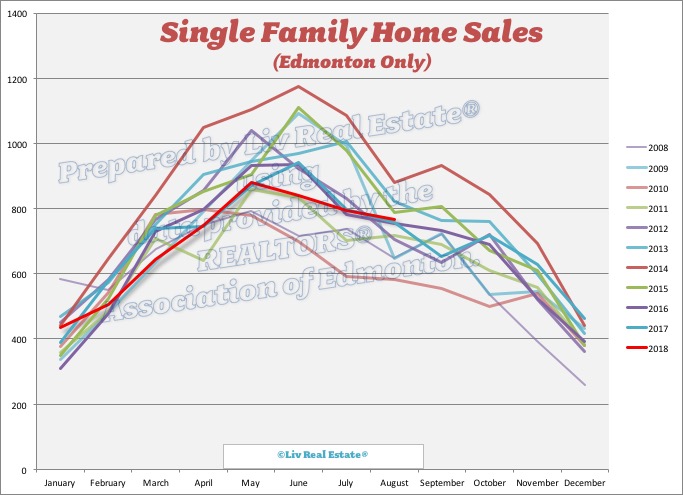

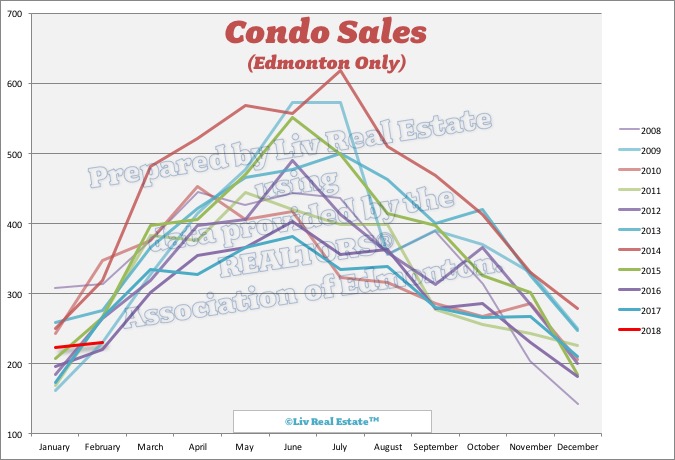

Posted by T-Rev on Friday, December 18th, 2020 at 3:05am- Sales for Edmonton CMA are above any point in the last ten years, while in Edmonton city limits they are high-average. This would indicate the suburbs are doing proportionately much better than the city. It would be great to see a piece on the activity and prices in each of the major burbs surrounding town.

- I've been bearish on Edmonton and Alberta housing for four years- the long term fundamental drivers of the economy just aren't there anymore. That said, I'm changing my outlook for 2021 to "fair" from "disaster" for the first time since 2015. The price disparity between Alberta's major cities and the rest of the country is too large to persist. We're not Vancouver, Toronto, Montreal and we never will be, but employment is available, we do have some economic green shoots in non oil and gas sectors, and even without a growing energy industry we still collect more royalties than any other province on existing production. Climate change has mercifully taken the edge off the winters here, and will continue to make them milder yet. And when a house in Calgary, on the doorstep of the Rockies, is worth 1/3 what it is in Toronto, the disparity can't last. People will come here for the lower cost of living and better standard of living. Just need to get some economic activity rolling outside the energy sector, and I think we're beginning to see it.

T-Rev, you make some excellent points. You are correct - the areas surrounding Edmonton are doing extremely well, I've discussed this in our monthly reports and on live broadcasts. The only way your predictions will come true is if people actually do start moving here from other parts of the country - the most recent numbers showed more people left Alberta than came here... hopefully, that trend reverses.

Posted by Sara MacLennan on Friday, December 18th, 2020 at 4:56amLeave A Comment