"Housing market conditions are expected to remain relatively unchanged in 2018," said CREB® chief economist Ann-Marie Lurie. "The market will continue adjusting to the 'new normal' in this economy. However, there was modest job growth and net migration last year, with expectations of further improvements into 2018."

Employment

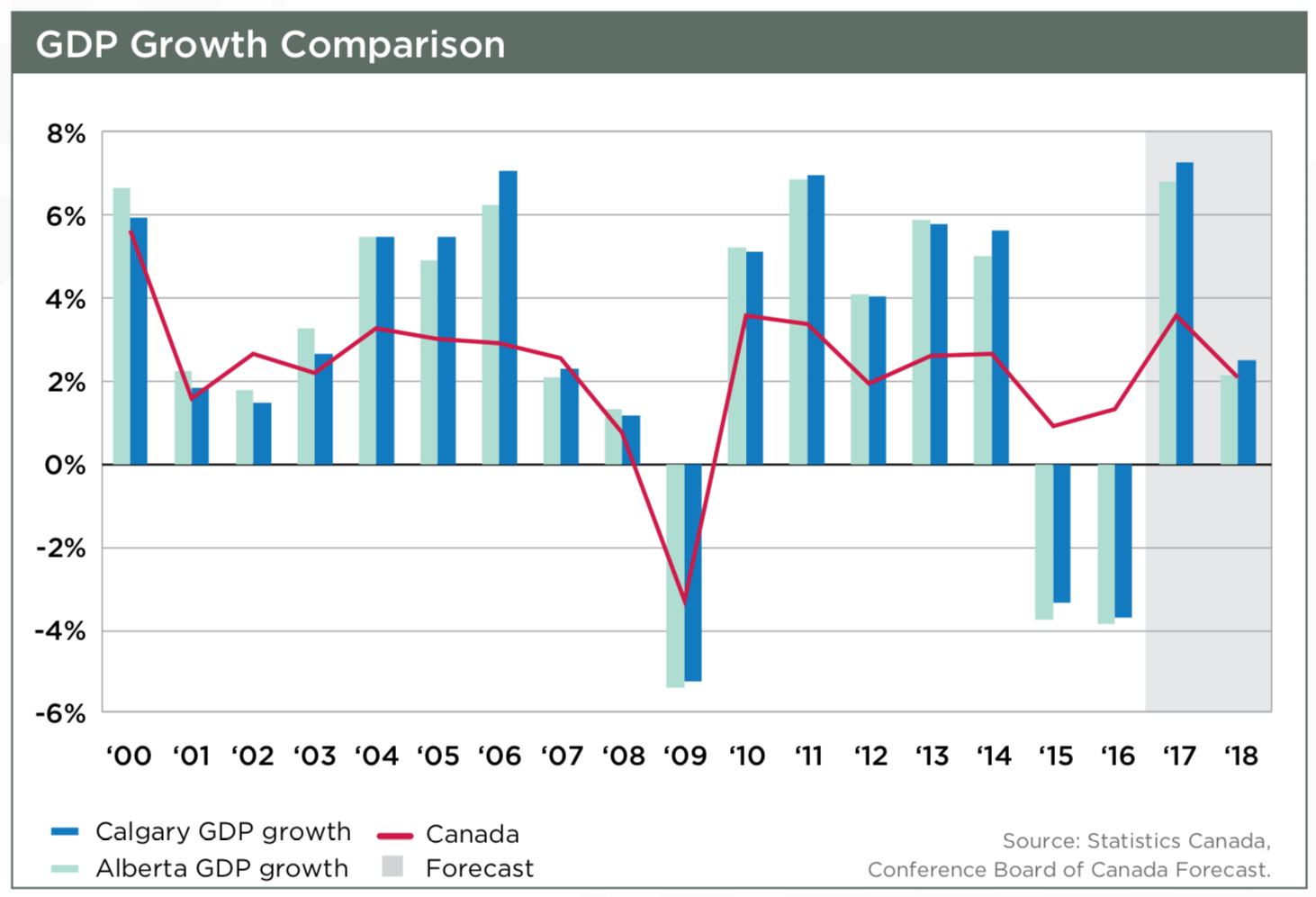

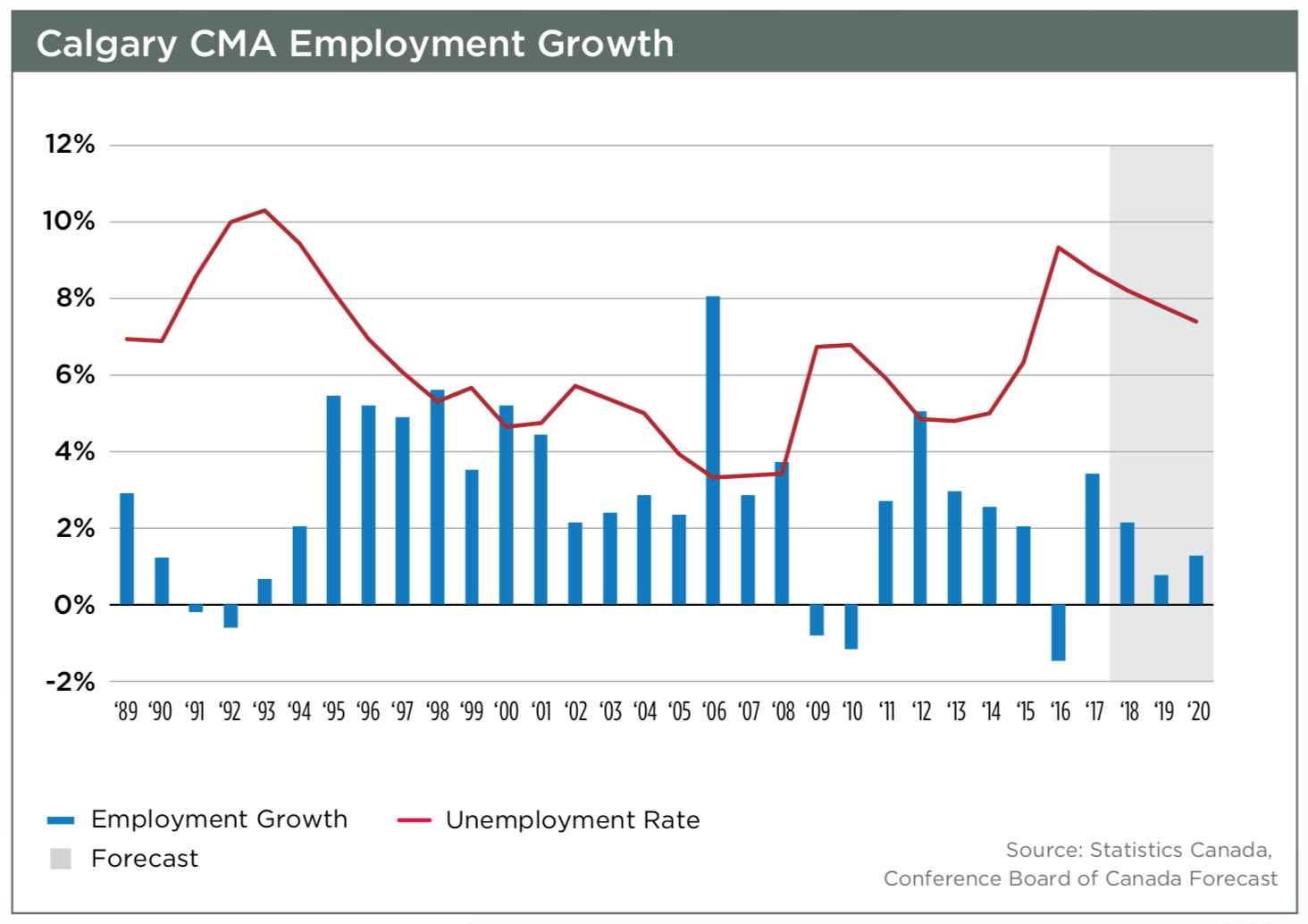

2017 saw job growth in Calgary with year over year gains in full-time jobs. The unemployment rate came down in 2017, but it's still lower than we're used to. The jobs that were lost in 2016 are not the same jobs that have been created (transportation, warehousing, health care gained, construction, manufacturing and technical services saw losses). Job growth is expected to continue in 2018 at a modest pace, but not in the energy sector, and the salaries are lower. This influences what people are able to afford.

Population

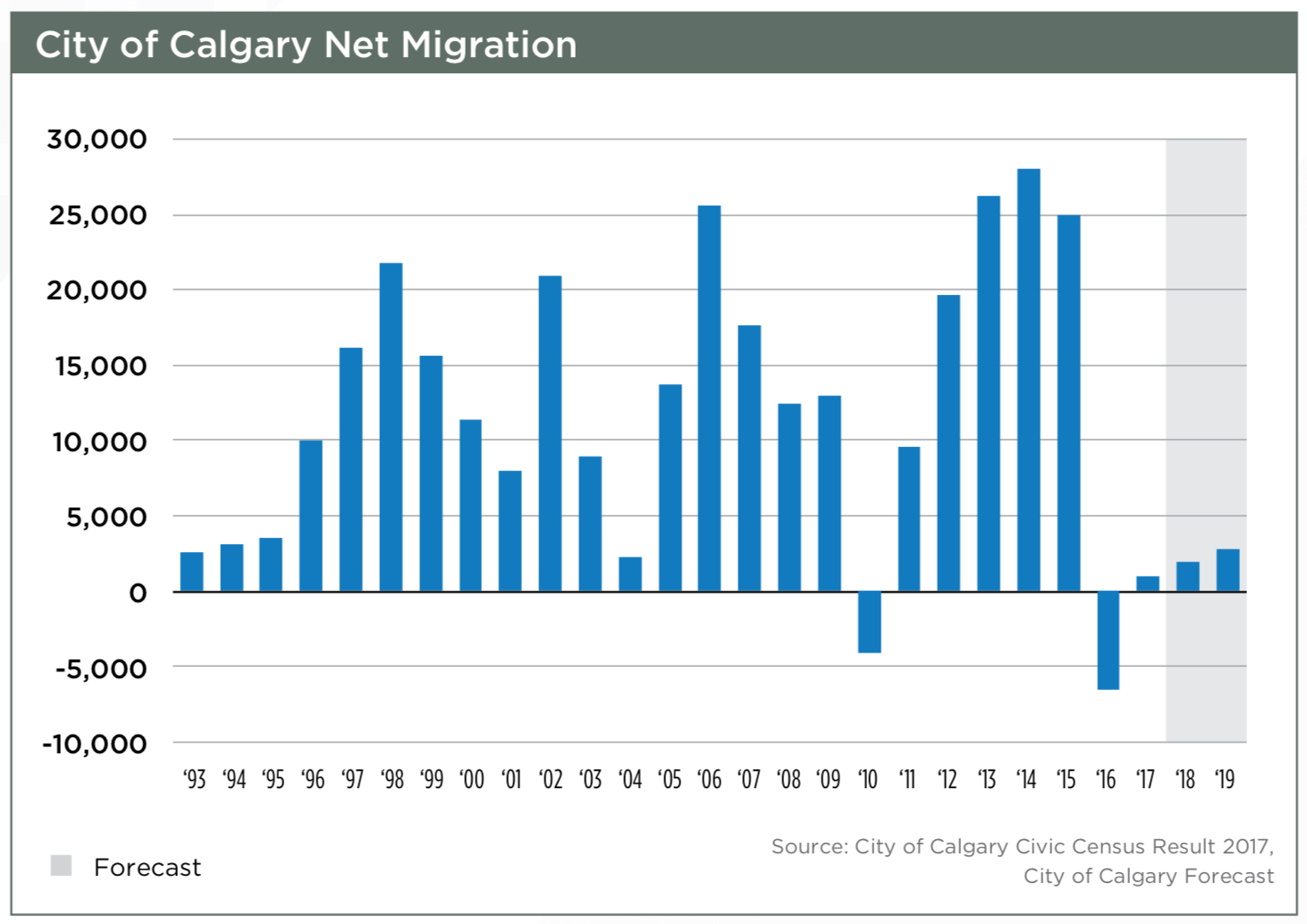

Fewer people are moving to Calgary - 2011-2015 Calgary grew by at least 20,000 people per year. Calgary lost people in 2016, and less than 5000 people moved to Calgary in 2017 - they have a similar expectation for 2018 and 2019. This means excess inventory will sit for the foreseeable future.

Lending

OFSI rules and rising rates - mortgage rates will likely be in the 4% range by the end of the year, which will be the highest rate we've seen in almost 10 years. Some people have never seen rates this high. Also, with the new rules, you'll have to qualify at close to 6% because of the new rules. This will pull down demand, while the improving economy lifts it (economy and lending will offset each other). Lending rules will impact the distribution of sales - people will be able to afford less so more sales will occur lower price ranges. There will be fewer "move up" buyers as well, since fewer people will be able to afford it.New Construction

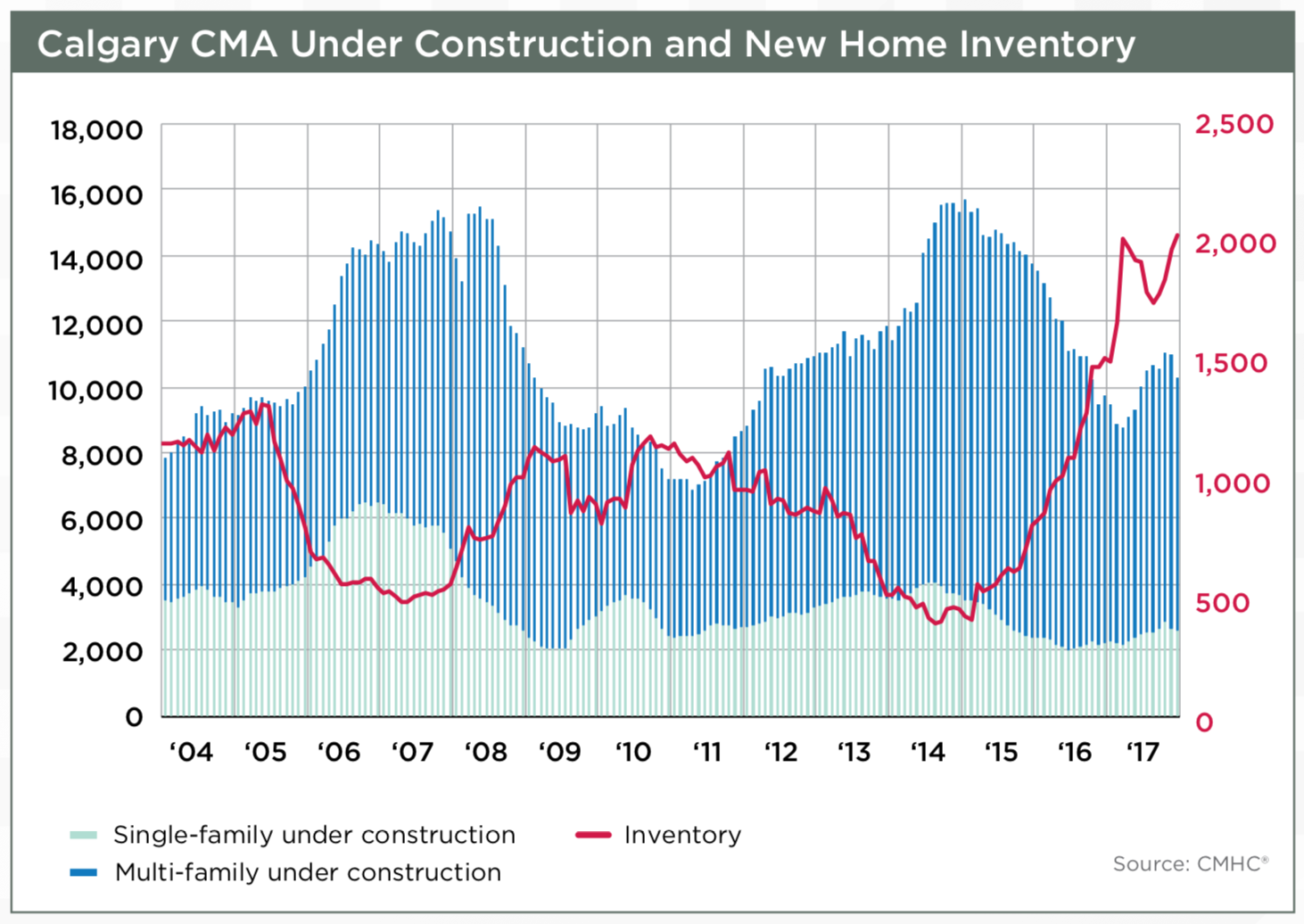

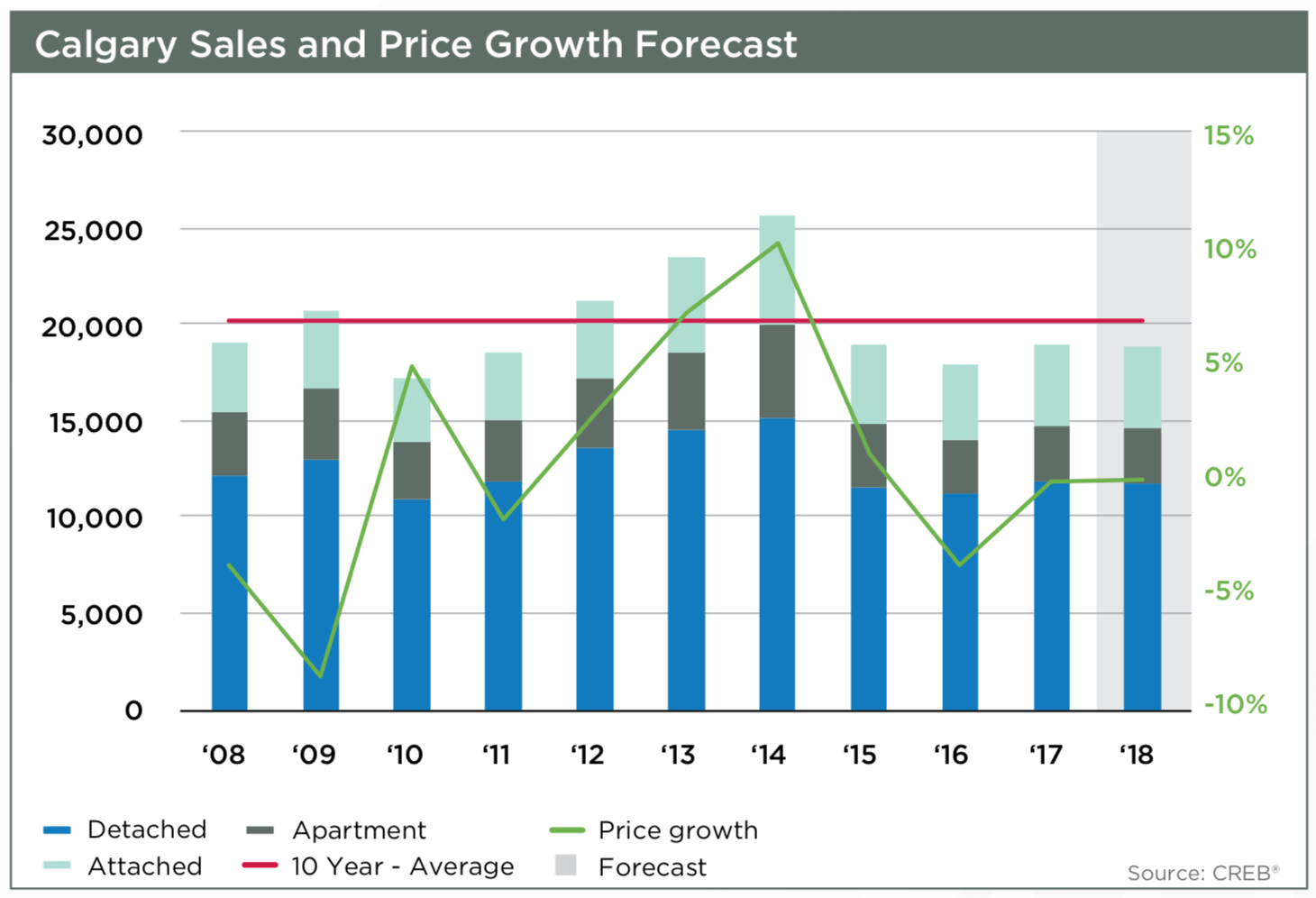

They expect slightly lower sales in 2018 in Calgary. They expect detached home sales to slow, attached sales to grow slightly, and a decrease in apartment style condos. There is a lot of competition in apartment style condos from builders, so resale is expected to suffer. Meanwhile, they expect inventory to rise slightly in 2018, as it did in 2017. "This will impact the ability for prices to improve." Multi-family construction rose quite a bit in 2017, and the inventory of new homes is at the highest level ever in Calgary. Since the population is not keeping up with construction of new homes (especially apartment style condos)

Rental Market

Vacancy rate will drop slightly in 2018 to 6%, which is still quite high. Renters have a lot to choose from, and rents are decreasing; when you consider mortgage rates are on the rise, there is not much to encourage renters to purchase.Sales Forecast

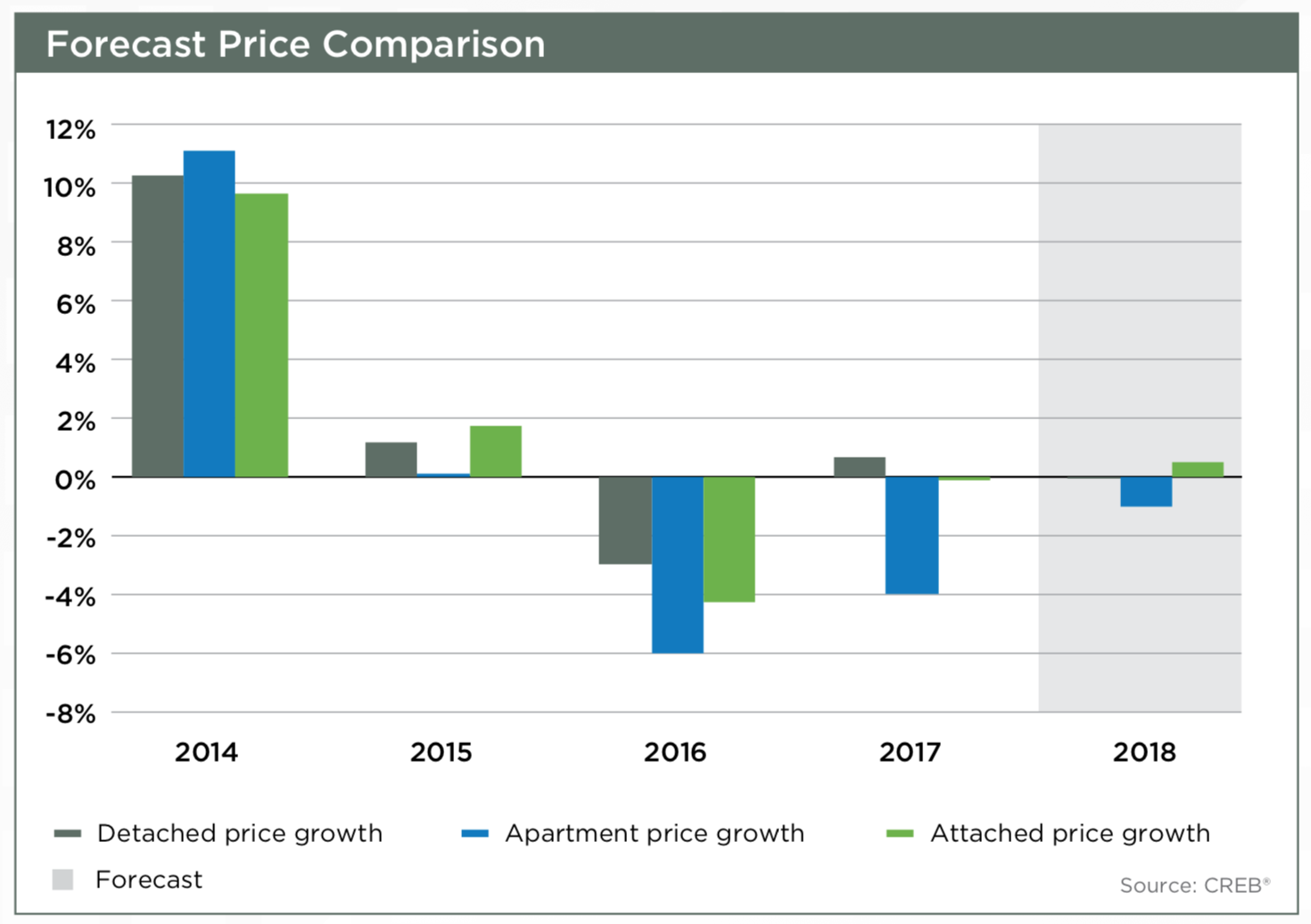

The apartment inventory matched the high from 2009 of 7 months supply in 2017, while detached homes saw only 3 months of supply. There is more pressure apartment prices than detached homes, due to high inventory and more competition from new construction. When you adjust for inflation, apartment prices have dropped 14% since the peak in 2014 while detached homes are only down 4.4%. Different areas of the city are performing differently - the west end of the city saw detached prices increase 4.32% year over year, while the northeast saw prices drop .89% - this was due to less competition from construction in the west, and more competition in the northeast (and many other areas).Pricing

Not much change is expected in the detached market in 2018, but prices are expected to come down a bit. Attached home prices are expected to rise slightly, as some buyers are priced out of the detached product (due to lending rules and rates) and move to attached homes.

Downward Risks

- Changes in lending rules and rates have more impact on demand than expected

- Supply increases more than expected

- Changes in government policy (NAFTA?)

Upward Possibilities

- Energy market improves

- Consumer confidence grows

- Population grows

1 Response to Calgary Real Estate Forecast: Live Blog

It makes no difference if the oil price increases. Alberta companies cannot get the Brent Crude prices that are announced. Since no pipelines have been approved, they are "locked in" to much lower prices for their crude oil.

Posted by GM on Thursday, February 1st, 2018 at 6:19amThanks Trudeau.

Leave A Comment