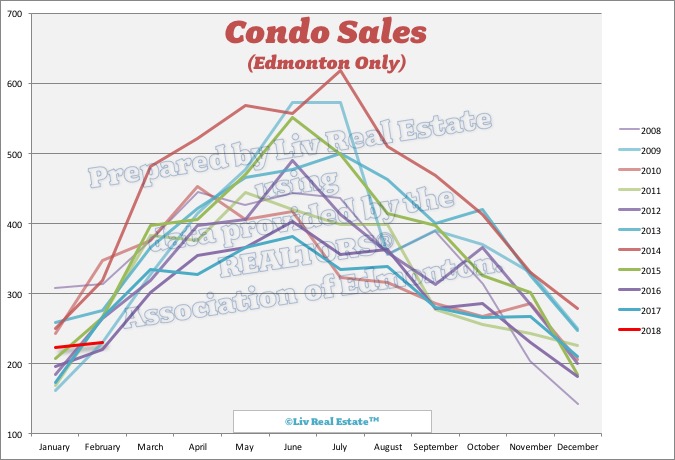

Condo sales were down 2.4% from last June - 328 condos were reported sold.

Condo sales were down 2.4% from last June - 328 condos were reported sold.

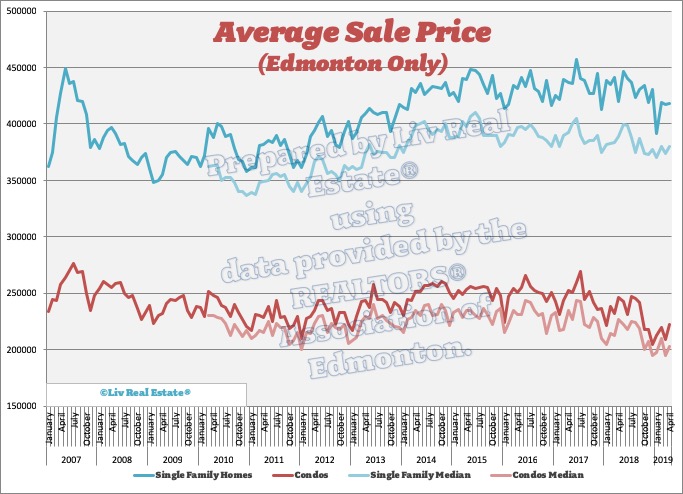

The average sale price for single-family homes was down 5% to $417,863 and the median price was down 4.7% to $379,900. The average sale price for condos was down 2% to $245,715 and the median price was down 1% to $220,000.

The average sale price for single-family homes was down 5% to $417,863 and the median price was down 4.7% to $379,900. The average sale price for condos was down 2% to $245,715 and the median price was down 1% to $220,000.

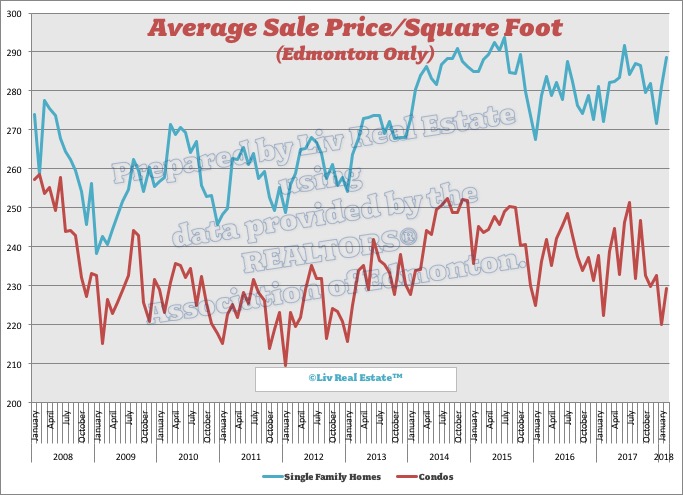

The average price/square foot for single-family homes was down $16 to $269 and for condos was down $5 to $225.

The average price/square foot for single-family homes was down $16 to $269 and for condos was down $5 to $225.

I will update this post when the REALTORS® Association of Edmonton releases their monthly report on the market in a few days.

Posted by Liv Real Estate

on

I will update this post when the REALTORS® Association of Edmonton releases their monthly report on the market in a few days.

Posted by Liv Real Estate

on

2 Responses to Edmonton Monthly Real Estate Report - June

So whether is by average, median, or $/ft^2, houses lost 5% in the last year. That brings the four year melt to what, ~15%? It’s like trying to catch a falling knife at this point. Lots of underwater owners. Even at lowered prices, I’ve modelled the investment return of rentals, and unless you can count on 1-2% annual asset appreciation, which you can’t in this market, the numbers still don’t work. They’re cash-negative, low return, high risk, big leverage. Meanwhile, my RRSPs and TFSAs are up 12% ytd , tax advantaged, and no one punches holes in the walls and the roof never leaks. Gonna be a while before I add any more real estate.

Posted by T-Rev on Thursday, July 4th, 2019 at 3:06amJust about nowhere else on Earth you can get a 10 to 15 percent return per year on resale condos. No wonder the prices have moved up from $205,000 to $236,000 over the past 3 to 4 months. People aren't stupid and in the search for yield Edmonton condos sure beats getting zero percent on GIC's when the Fed funds rate drops to zero at the end of 2021. As for the stock market everyone on Earth has the exact same line "Ill be out in time". That line will be etched in stone when the U.S. stock market drops 90 plus cent.

Posted by Tony on Wednesday, July 10th, 2019 at 6:39amLeave A Comment