Edmonton Stats

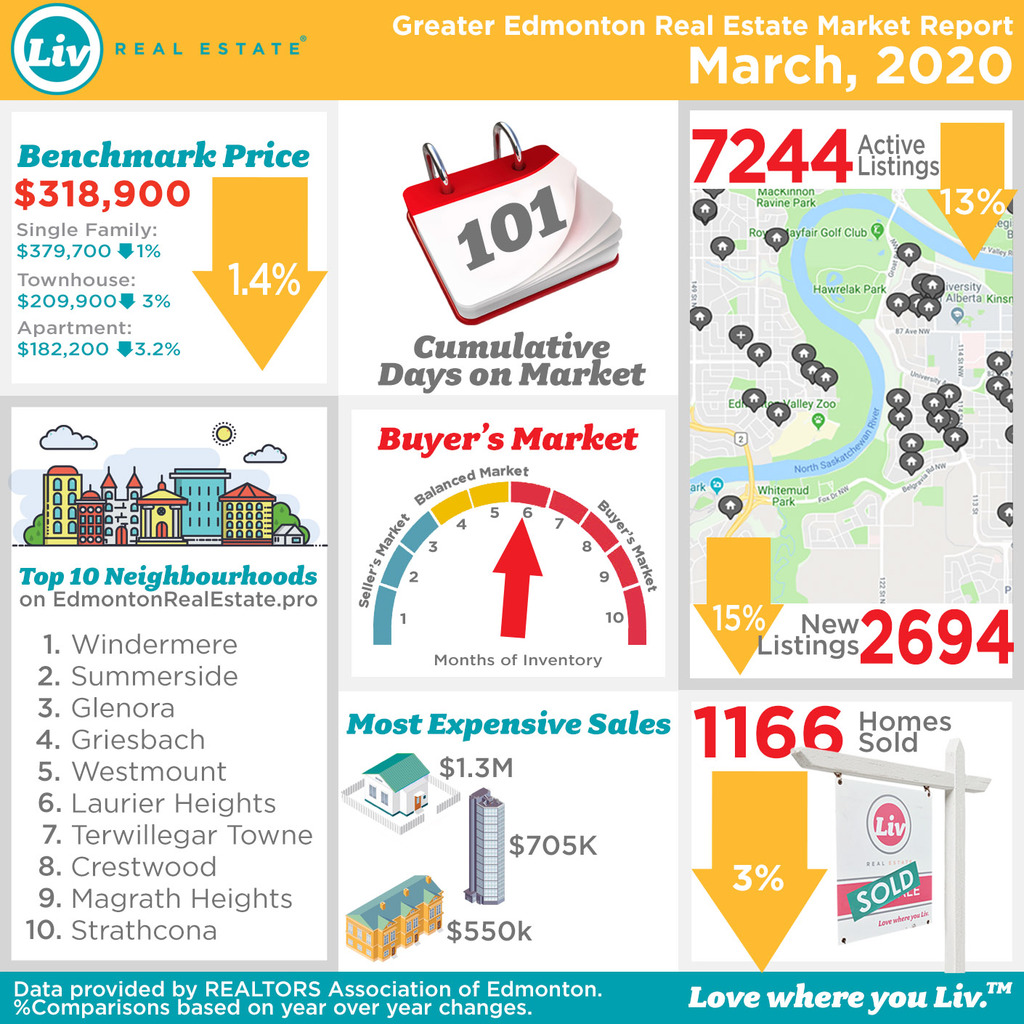

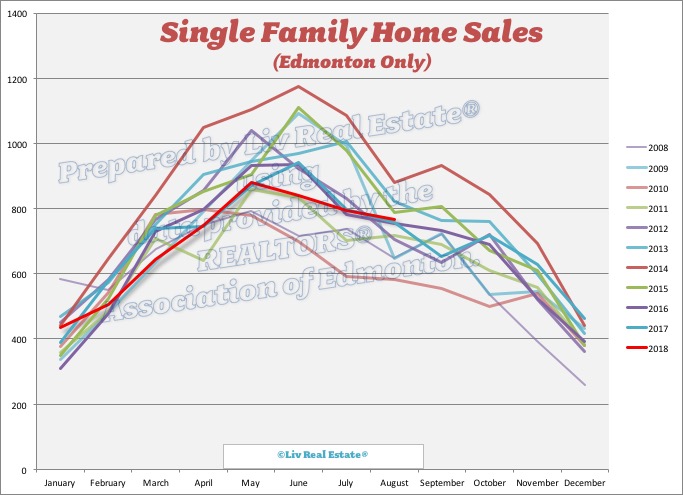

538 single-family homes were reported sold in Edmonton in March, a 9% drop from last year. Condo sales were down 8% from last year - 227 were reported sold in March:

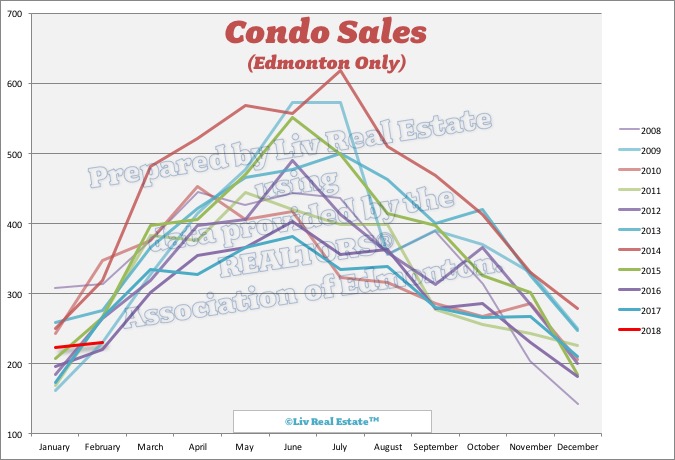

Condo sales were down 8% from last year - 227 were reported sold in March:

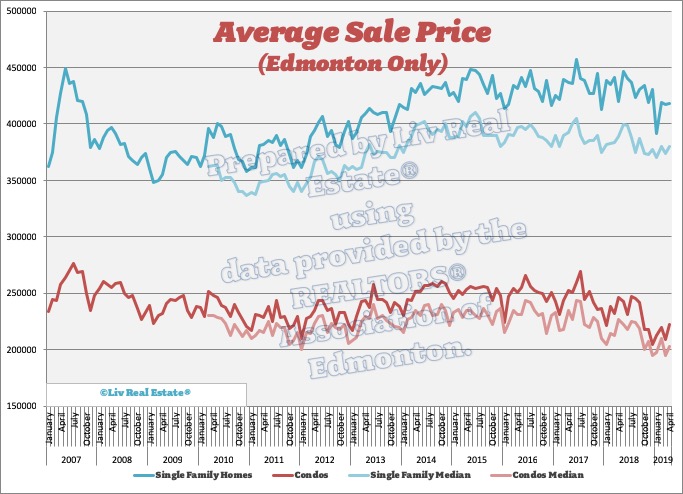

The average price of single-family homes dropped 4.5% from last March to $398,609 and the median dropped 2% to $366,000. Condo prices rebounded this month; the average price of condos rose 4% from last March to $217,613 and the median rose 2.6% to $200,000.

The average price of single-family homes dropped 4.5% from last March to $398,609 and the median dropped 2% to $366,000. Condo prices rebounded this month; the average price of condos rose 4% from last March to $217,613 and the median rose 2.6% to $200,000.

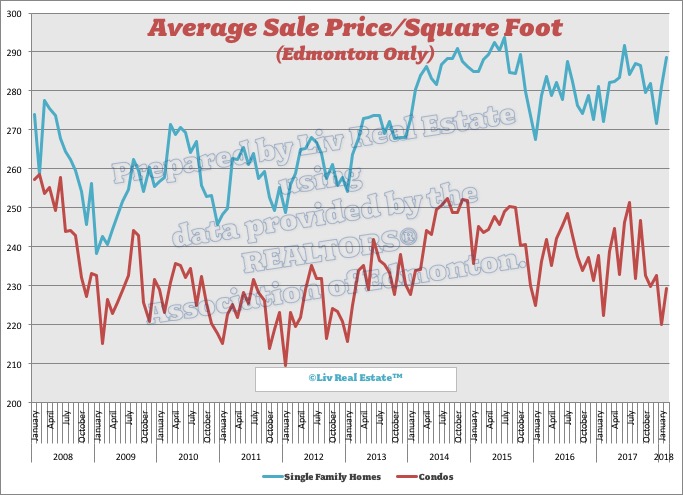

The average price per square foot for single-family homes dropped $11 to $257 and for condos dropped $3 to $208.

The average price per square foot for single-family homes dropped $11 to $257 and for condos dropped $3 to $208.

Posted by Liv Real Estate

on

Posted by Liv Real Estate

on

2 Responses to March Market Report - UPDATED

The Greater Toronto area will move the entire country upwards as prices keep on increasing due to near zero interest rates. After this liquidity crunch mortgage rates will take a big fall and all virtually all buyers and renters will be shut out of the GTA the same as we see today with California.

Posted by Tony on Tuesday, March 31st, 2020 at 9:18pm"Mortgage rates will take a big fall"

Posted by GM on Wednesday, April 1st, 2020 at 9:16pmDon't you mean bond prices will fall (interest rates rise)?

Leave A Comment