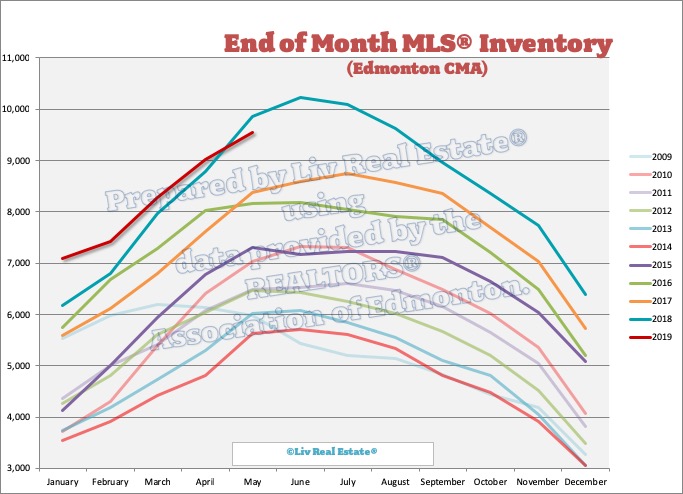

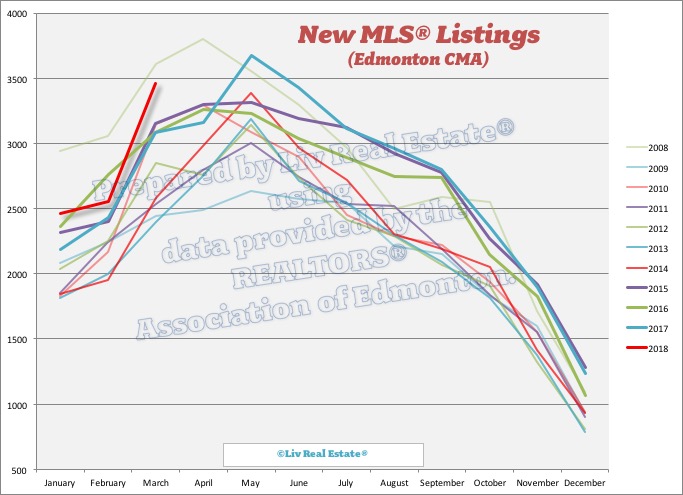

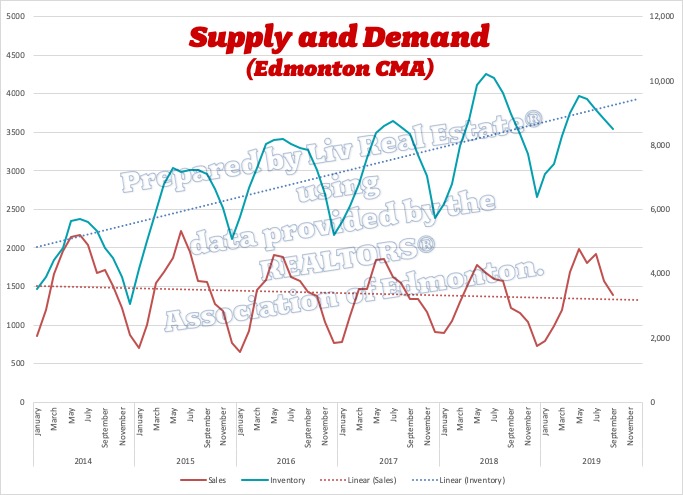

I've added a few new charts to our monthly report including this supply and demand comparison, followed by a look at the absorption rate in two ways. As you can see, the story for the past few years has been one excess supply, with demand trending slightly downwards:

I've added a few new charts to our monthly report including this supply and demand comparison, followed by a look at the absorption rate in two ways. As you can see, the story for the past few years has been one excess supply, with demand trending slightly downwards:

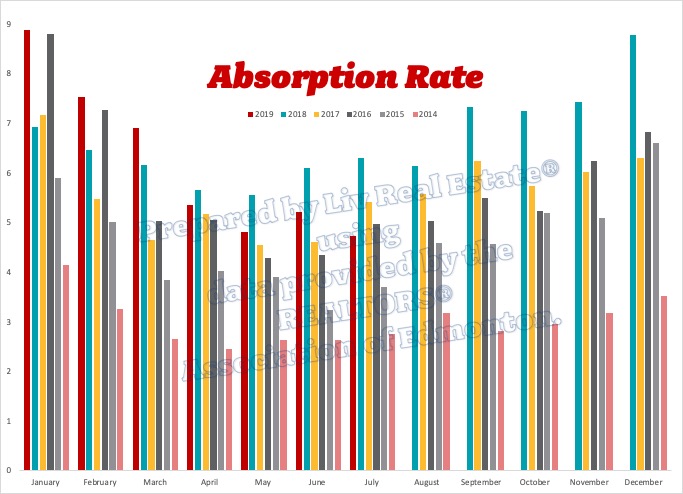

The absorption rate is still lower than the past two years and is following the normal upward trend for the second half of the year:

The absorption rate is still lower than the past two years and is following the normal upward trend for the second half of the year:

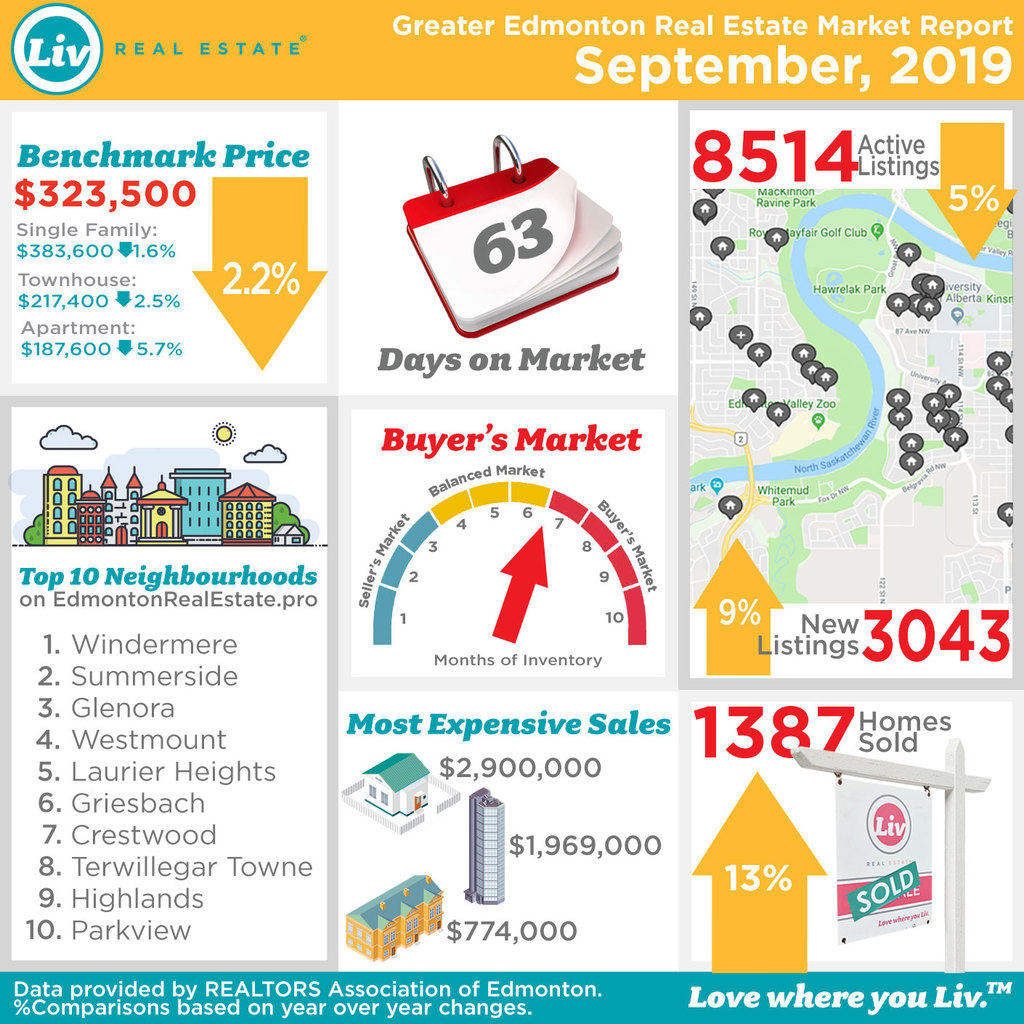

City of Edmonton Stats

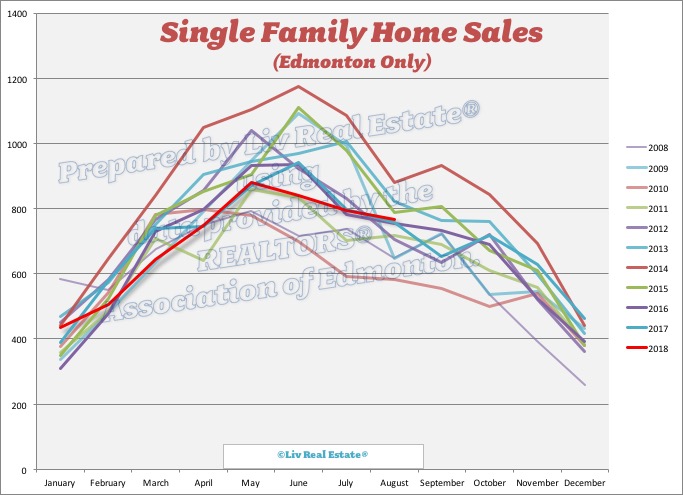

Our preliminary look at the real estate market in Edmonton shows things cooling off in September, which is fairly typical for this time of year. 614 single-family homes were reported sold in September, down 8% from last year: 290 condos were reported sold in September, down 16% from last year:

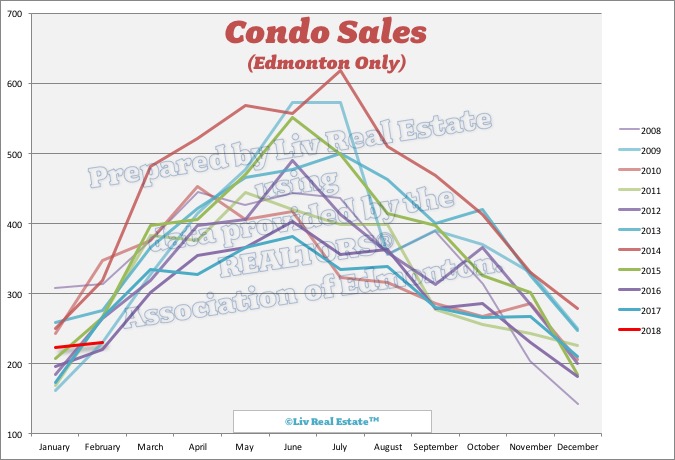

290 condos were reported sold in September, down 16% from last year:

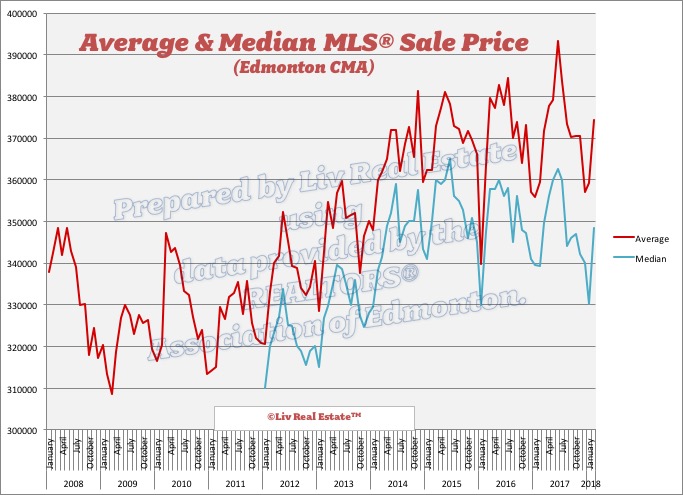

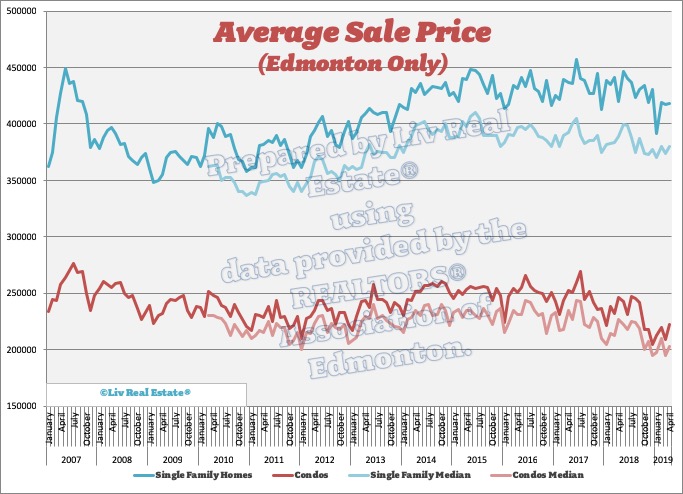

The average sale price of single-family homes was down 2.5% to $420,251 and the median price was down 2.5% to $377,750. The average price for condos was down 12% from last year to $211,945 and the median was down 10% to $197,750:

The average sale price of single-family homes was down 2.5% to $420,251 and the median price was down 2.5% to $377,750. The average price for condos was down 12% from last year to $211,945 and the median was down 10% to $197,750:

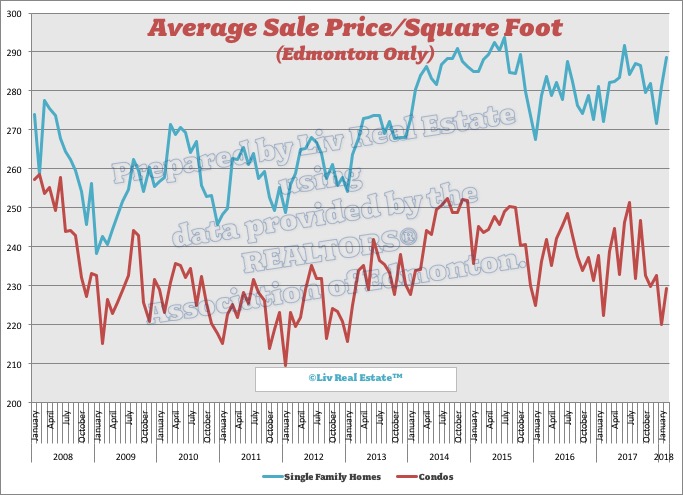

The average price per square foot for single-family homes was down $4 to $272 and for condos was $19 to $208:

The average price per square foot for single-family homes was down $4 to $272 and for condos was $19 to $208:

Posted by Liv Real Estate

on

Posted by Liv Real Estate

on

3 Responses to September Real Estate Market Report - UPDATED

It is what it is.

Posted by Wally on Tuesday, October 1st, 2019 at 4:33amAt this rate it will be 2027 by the time we hit 2007 prices again.

Posted by Karlhungus on Wednesday, October 2nd, 2019 at 12:41amA Bank of Canada interest rate cut is a done deal this October 30th after the U.S. jobs report and the Canadian PMI. Mortgage rates will be cut again at the start of this November. The jobs numbers this October 11th won't affect anything.

Posted by Tony on Friday, October 4th, 2019 at 4:13amLeave A Comment