Listing information last updated on October 16th, 2025 at 9:23am CDT.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

"It's never too late to be what you might've been.” – George Eliot

Posted by Liv Real Estate

on

"It's never too late to be what you might've been.” – George Eliot

Posted by Liv Real Estate

on

8 Responses to Weekly Market Update Apr. 9/21

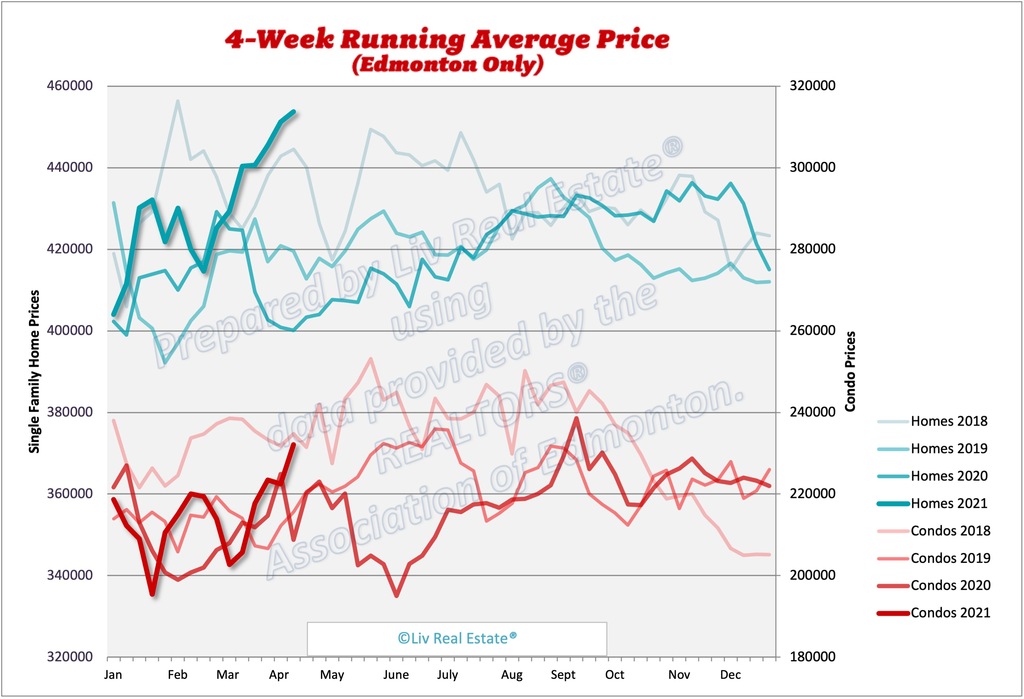

The prices for homes in Edmonton are getting crazy! The new OSFI stress test tightening is good news for Edmonton. It's not healthy how fast home values are climbing. We saw what happened starting in 2008 when prices soared 50% the prior 18 months. This will slow the growth, and hopefully make the market healthier longer term to avoid a crash.

Posted by Tom on Thursday, April 8th, 2021 at 8:01pmThough overall I don't think it will change much in Edmonton, as it mostly impacts houses over $1 million, as there is no mortgage insurance available for those. And then tighter stress test is for homes without CMHC insurance. It might impact larger homes in great neighbourhoods though out Edmonton

They had to do something or rents in southern Ontario will double when Covid-19 blows over. Can't keep on taking in immigrants if their rent is more than their gross yearly income. Unfortunately the new stress test will just push everything at the low end up to $999,999 in price even studio apartments in Toronto.

Posted by Tony on Thursday, April 8th, 2021 at 10:25pmWhat will happen is the buyer will approach the seller and offer a cash donation equal to the amount the house is priced over $999,999, and sign the contract for the selling price of $999,999.

Posted by GM on Friday, April 9th, 2021 at 4:37amThere are always ways around the moronic laws.

And like always, the politicians are too stupid to realize this will affect all of Canada negatively and probably won't have much impact at all on Vancouver and Toronto house prices.

What’s the proposed stress test change?

Posted by T-Rev on Saturday, April 10th, 2021 at 5:03amWhat’s the proposed stress test change?

Posted by Tony on Sunday, April 11th, 2021 at 2:35amYou have to show you can carry a mortgage at 5.25 percent effective this June the 1st. That's a lot of income in a year.

Did some reading- it’s just an increase in the stress test for non insured mortgages, not a new application. From what I read it could potentially reduce the max borrowing you 4%. Might have some effect on the most stretched of Non-CMHC-insured borrowers.

Posted by T-Rev on Sunday, April 11th, 2021 at 6:23amProbably not a huge deal.

Re: Probably not a huge deal.

Posted by Tony on Sunday, April 11th, 2021 at 11:29pmThe average new home in southern Ontario is around the 2 million dollar mark and is gaining around $100,000 every week. The new stress test will chop about $200,000 off the selling price assuming everyone is leveraged to the hilt or max. .An increase from 4.79 percent to 5.25 percent is almost 10 percent. A huge spike is prices of around 20 percent will be seen from April 13th to May 31st. A 20 percent increase all in about a 6 week span pushing the average new home price beyond the 2.5 million dollar mark. From there an air pocket will hit prices as America is supposed to have everyone vaccinated by the end of May. Its not just a coincidence this comes into affect June the 1st Mortgage rates to spike upwards starting June the 1st as Canadian rates follow American interest rates.

Budget day got pushed forward to April 19th.

Posted by Tony on Tuesday, April 13th, 2021 at 12:01amLeave A Comment