Data is supplied by Pillar 9™ MLS® System. Pillar 9™ is the owner of the copyright in its MLS® System. Data is deemed reliable but is not guaranteed accurate by Pillar 9™. The trademarks MLS®, Multiple Listing Service® and the associated logos are owned by The Canadian Real Estate Association (CREA) and identify the quality of services provided by real estate professionals who are members of CREA. Used under license.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

Have a great weekend!

Posted by Liv Real Estate

on

Have a great weekend!

Posted by Liv Real Estate

on

29 Responses to Weekly Market Update, Aug. 10/18

It's interesting that around me, it seems that most houses have been reduced by $50,000 - $70,000, and they're still not selling.

Posted by Tom on Thursday, August 9th, 2018 at 9:49pmWe've looked at many a houses in the $550K+ range on the north side. Literally none of them have sold in the last 3-4 months. Wonder when we will see this reflecting in asking price.

Posted by greg on Thursday, August 9th, 2018 at 10:21pmNobody is selling at loss.

Posted by Mike on Thursday, August 9th, 2018 at 10:54pmInventory might be high, but prices are not down - atleast in 700-900k range we are looking.

Mike, you sell at a loos if you bought higher than you can get now but not if you sell at the market value.. market value is dictated by the interest rates, income and how much you can borrow.... all 3 things dictate the price not what you think you lose or gain... There are a lot of people with houses on the market for more than a year at this point but with unrealistic expectations.. If they would be realistic they would lose less... last year they would get more than this year but they didn't want to sell... next year will be even worse due to the next few more rate increases... how is your math? do some basic calculations and see people can afford to borrow 30% less than last year.. it will be 32.5% in September, 35% in December and by the end of 2019 40-45% less than in June 2018... Until the income will catch up these people will not get their prices.. When they will get the nominal price the value will be even worse than today due to the inflation but most don' even understand that... They will be happy to get "$x" for the house as they wanted.... And by the way, you are looking to sell in that range not to buy, right? :)

Posted by bubu on Thursday, August 9th, 2018 at 11:23pm@bubu, market value is NOT dictated by interest rate, income and how much you can borrow. If it is, then we should see a higher price in Edmonton, since we have higher income and identical interest rate.

Posted by wsn on Friday, August 10th, 2018 at 12:32amMarket value is simply decided by supply and demand. Factors such as interest rate are just a small part of demand and say nothing about supply.

Correction:

Posted by wsn on Friday, August 10th, 2018 at 12:34am"we should see a higher price in Edmonton" change to

"we should see a higher price in Edmonton than Vancouver"

Everyone knows that after our next election house prices will go back up.

Posted by GM on Friday, August 10th, 2018 at 1:33amThat's why nobody wants to lower their price.

Once the communists are out and sane people are running the province businesses will come back along with the people.

Just need some patience.

wsn, you are right, supply and demand is also a big factor but again dictated by the interest rates and incomes.... Vancouver prices are not influenced by the local economy... we know very well what is driving the demand and prices there...

Posted by bubu on Friday, August 10th, 2018 at 1:42amSupply and demand? There's no lack of supply in Edmonton and rising interest rates do have a direct affect on how much debt you can carry.

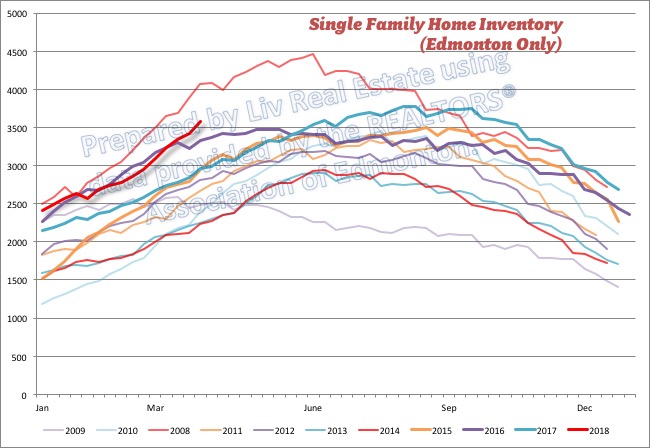

Posted by arfmoocat on Friday, August 10th, 2018 at 2:05amActive single family home listings: 4729 (4672, 4709, 4718)

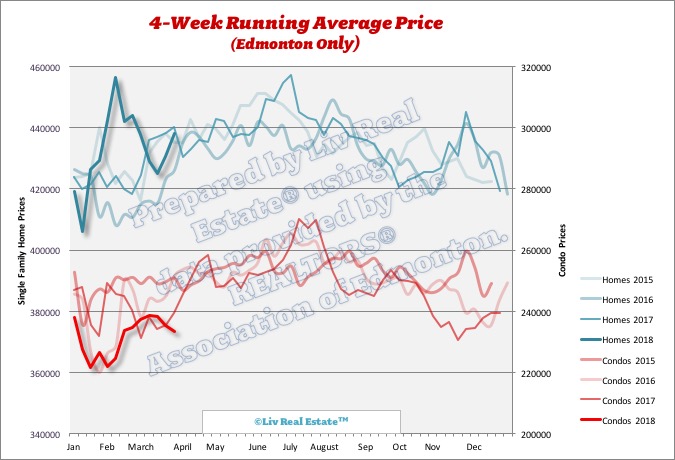

Homes 4-week running average: $422k ($436k, $434k, $442k)

arfmoocat, there is a lot of demand for houses over 700k or higher... people want them but they can't afford to buy at that price....

Posted by bubu on Friday, August 10th, 2018 at 4:11amlast week's numbers

Posted by GPC on Friday, August 10th, 2018 at 7:54amSorry...it's fixed.

Posted by Sara MacLennan on Friday, August 10th, 2018 at 7:59amA house cost 70,000 in the 70's

Posted by arfmoocat on Friday, August 10th, 2018 at 8:47pm"Rising interest rates didn’t seem to matter in Edmonton in the 70’s"

Actually I bought my first house in the early 80's for $70,000 after rising interest rates crashed the market. The people I bought that house from paid $120,000 for it.

Posted by arfmoocat on Friday, August 10th, 2018 at 8:54pmHousing prices are on a serious decline in Edmonton. With until the fall if you are buying. It is a fact houses are being listed for over 3-4 months in SW Edmonton and not selling. Sellers are hoping to keep the price up at any cost, but this is a temporary step. There is a huge inventory of new houses in Edmonton. My advice, accept reality and sell before it is too late. This is the only way to stabalize the market.

Posted by Watcher on Friday, August 10th, 2018 at 10:18pmEdmonton should be promoted as as retirement destination where housing and the cost of living are next to free.

Posted by Tony on Friday, August 10th, 2018 at 11:25pmRising interest rates didn't seem to matter in Edmonton in the 70's

Posted by Karlhungus on Saturday, August 11th, 2018 at 3:46amIf you think rising interest rates made housing crash in the 80's, you weren't paying attention to the oil market

Posted by Karlhungus on Saturday, August 11th, 2018 at 5:55am"a house in the 70's cost $70000"

Posted by Karlhungus on Saturday, August 11th, 2018 at 5:59amWhat does that even mean or prove. What's the point?

Back then you could assume mortgages, I assumed the mortgage on my $70,000 3bdr dble gar bungalow with $5000 dollars.

Posted by arfmoocat on Saturday, August 11th, 2018 at 8:09pmScammers were assuming mortgages for $1 down and then renting them out and never making a mortgage payment. They would get away with it for 9 months till the mortgage was foreclosed on by the bank.

I'm referring to the statement that just because interest rates go up, automatically means prices will go down (as Garth turner incorrectly touts). Wsn is correct, its all about supply and demand, like I said, as evidenced in the 70's.

Posted by Karlhungus on Saturday, August 11th, 2018 at 11:55pmI am so glad I bought when I did. With the stress test and higher rates, there's no way I could afford a mortgage for any SFD home these days even though my income is higher.

Posted by Tom on Sunday, August 12th, 2018 at 12:05amRising interest rates do have an effect on supply and demand. Don't mean to keep harping about 40 years ago, but was working with an older guy then who had lived in his house for 10 years and couldn't qualify when his mortgage came up for renewal.

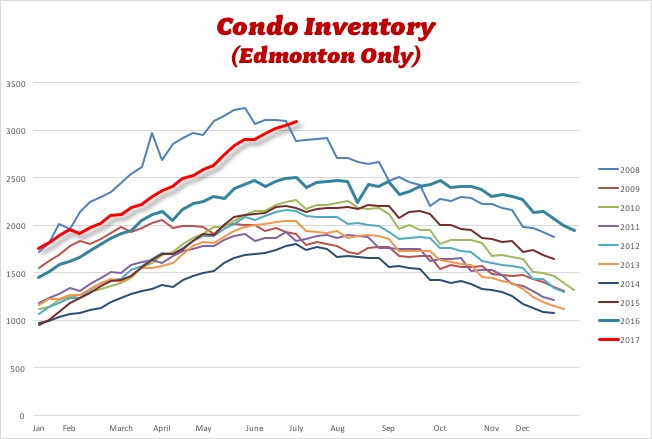

Posted by arfmoocat on Sunday, August 12th, 2018 at 12:16am2008 and 2009 are out of order on your top chart (and the corresponding colors are mixed up compared to the condo chart)

Posted by Taraz on Sunday, August 12th, 2018 at 5:05amHey Tara,

Posted by Sara MacLennan on Sunday, August 12th, 2018 at 5:53amThanks for your comment, I know the years are out of order... the only way I can fix it is to delete all the series and put them in again, which I haven't had time to do. The corresponding colours are correct for each chart, but don't compare the colours from chart to chart ;)

Well Karl I don't know if your even 40 years old but if you weren't around during the 18-20% interest rate era you haven't got a clue what your talking about.

Posted by arfmoocat on Sunday, August 12th, 2018 at 7:22amThe government had to step in and cap the mortgage rates at 12% because there were more foreclosures then sales.

I changed the 70,000 on my next post to the 80's because it was so long ago I couldn't remember exactly. I was 30 years old when I bought it and I was born in 1956 so it was 1986

Posted by arfmoocat on Sunday, August 12th, 2018 at 7:51amWe had a housing bubble back then Karl and interest rates soared, they didn't climb a 1/4 % every quarter, they were climbing by 1 1/4 % every quarter.

You probably weren't even born then Karl but my wage hasn't gone up 10 times since then.

I actually made twice as much in 2000 during the dot com era then I do now.

Why would it crash....Rents covers all expenses plus more in this City...

Posted by leslie on Wednesday, August 15th, 2018 at 4:20amWage vs. Price is still pretty good in Edmonton...why is this more likely to crash than Toronto / Vancouver..I don't get it

The replacement costs for resale townhouses and resale apartments are about 2 to 3 times what they sell for today. A resale apartment in Moncton costs twice what a resale apartment costs in Edmonton. Like I said the locals in Edmonton are dumber than daft. Of course the locals have never and probably will never figure this one out.

Posted by Tony on Thursday, August 16th, 2018 at 6:01amLeave A Comment