Here is our update on the Edmonton real estate market. (Previous week’s numbers are in brackets). For the past 7 days:

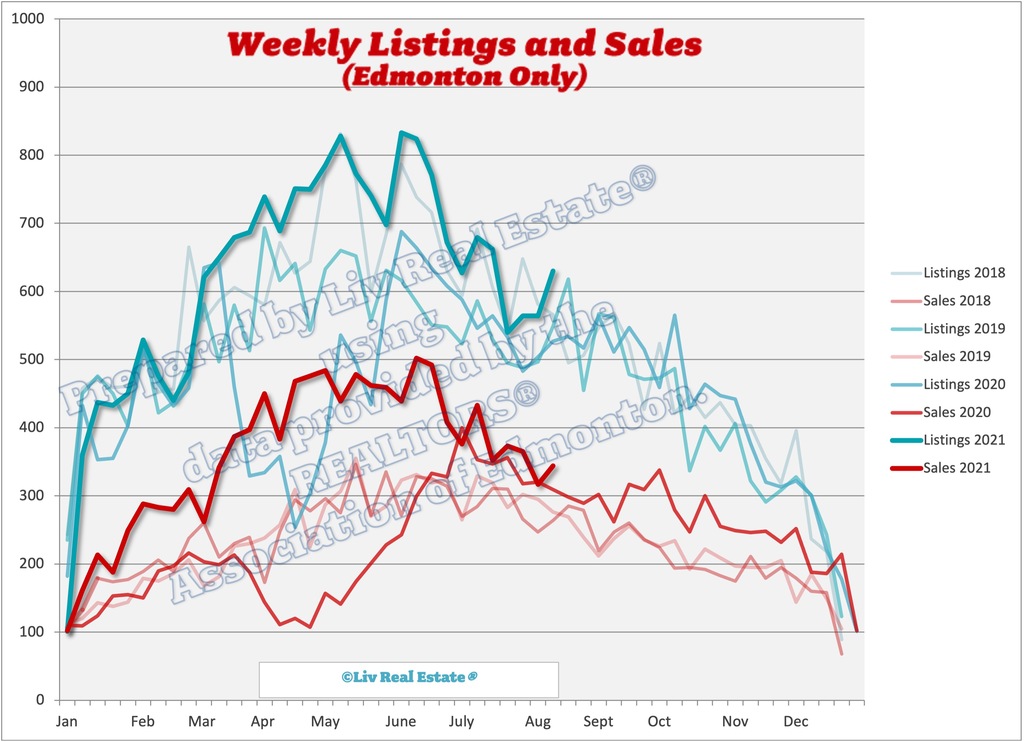

New Listings: 630 (564, 564, 540)

Sales: 344 (317, 365, 373)

Ratio: 55% (56%, 65%, 69%)

Price Changes: 446 (446, 471, 451)

Expired/Off-Market Listings: 230 (470, 221, 232)

Net loss/gain in listings this week: 56 (-223, -22, -65)

Active single-family home listings: 3355 (3301, 3400, 3385)

Active condo listings: 2938 (2909, 3039, 3021)

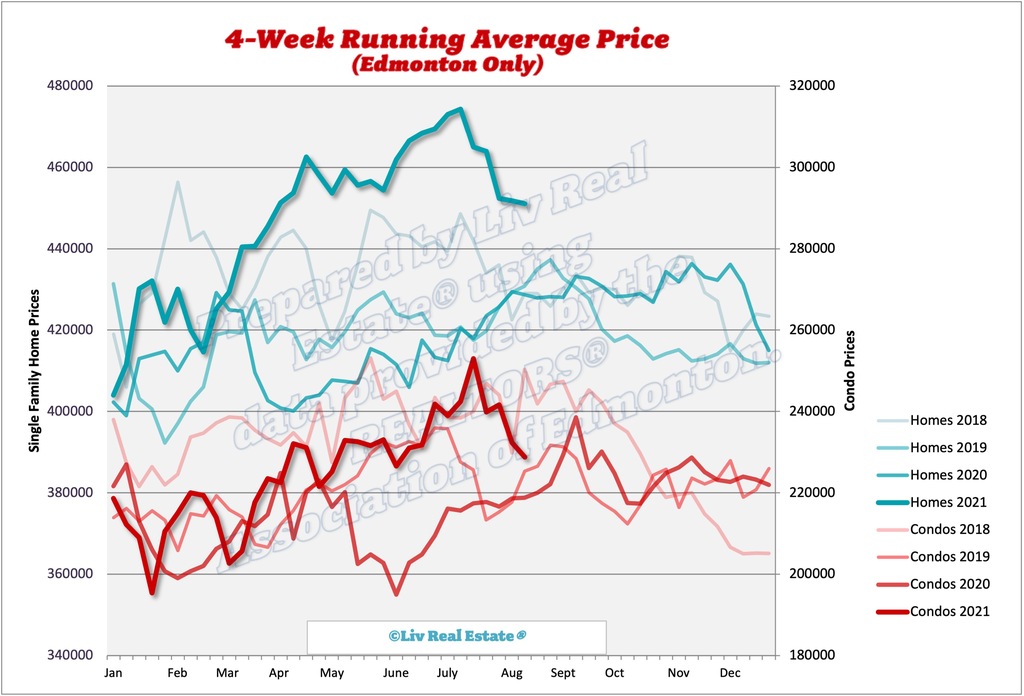

Homes 4-week running average: $451 ($452, $452, $464)

Condos 4-week running average: $229 ($232, $242, $240)

7 Responses to Weekly Market Update Aug. 13/21

And just like that, the rush is over and the Edmonton market has returned to balance. Suburban property will out perform as the city continues to ghetto-ize, as will property in a few select well heeled and well policed areas of city. But by overperform I mean it’ll hold its pandemic gains and give slow price increases while the rest of the market slips back into the 13 year rut it was stick in 2007-2020, and inflation eats away at homeowner equity.

Posted by T-Rev on Friday, August 13th, 2021 at 10:37pmOnly thing that changes that is some sort of in-migration event, but I don’t see one on the five- year horizon.

Agreed that inflation is going to be amazing for Edmonton real estate. As the chart shows, we're at an all time high, and I suspect that we have a lot more upside once Trudeau gets a majority next month.

Posted by Tom on Sunday, August 15th, 2021 at 12:02amTony, you're so out to lunch lol

Posted by Tom on Sunday, August 15th, 2021 at 12:07amRe: But by overperform I mean it’ll hold its pandemic gains

Posted by Tony on Sunday, August 15th, 2021 at 3:25amThe average condo price was more before the pandemic than today. September 2019 it was $232,000. The rest of the country tacked on 33 percent outside of Alberta since the pandemic.

Sounds like Tony got ripped off and paid too much for his condo.

Posted by GM on Sunday, August 15th, 2021 at 4:19amGM: From fall 2008-2019, SFHs basically went sideways for 11 years in Edmonton. A few hoods out performed. But on the average, if you paid $0.5M for a place in 2008, it was worth $0.5 in 2019. There were some ups, like early 2014, and some downs, like 2009, but overall pretty flat. In that time inflation ran at 2pct. Homeowners lost money inflation adjusted.

Posted by T-Rev on Sunday, August 15th, 2021 at 5:21amTony- wasn’t talking condos. Terrible investment in a town like Edmonton. Small population, plenty of land and cheap housing- why cram into some shared ownership, special assessment needing, monthly fee charging box with neighbors above below and beside? I’d get a second job and rent a house before I’d buy a condo. PS I’ve done it before and learned the hard way.

I’m just saying the market is balancing. You can see it in the sales and listings. Covid killed the urbanization trend, and other than the return of college kids it won’t be reversing. Suburban properties will be the best performers over the next ten years, as well as the usual hoods by the zoo for folks with money that want to be right in Edmonton.

Inflation will not eat away at homeowner equity.

Posted by GM on Sunday, August 15th, 2021 at 7:59amInflation is the best thing to happen to homeowner equity.

The price of the house goes up while the mortgage payment stays the same.

It's a winning combination.

Leave A Comment