Data is supplied by Pillar 9™ MLS® System. Pillar 9™ is the owner of the copyright in its MLS® System. Data is deemed reliable but is not guaranteed accurate by Pillar 9™. The trademarks MLS®, Multiple Listing Service® and the associated logos are owned by The Canadian Real Estate Association (CREA) and identify the quality of services provided by real estate professionals who are members of CREA. Used under license.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

Have a great weekend!

Posted by Liv Real Estate

on

Have a great weekend!

Posted by Liv Real Estate

on

14 Responses to Weekly Market Update, August 3/18

Looks like the bears are winning this round

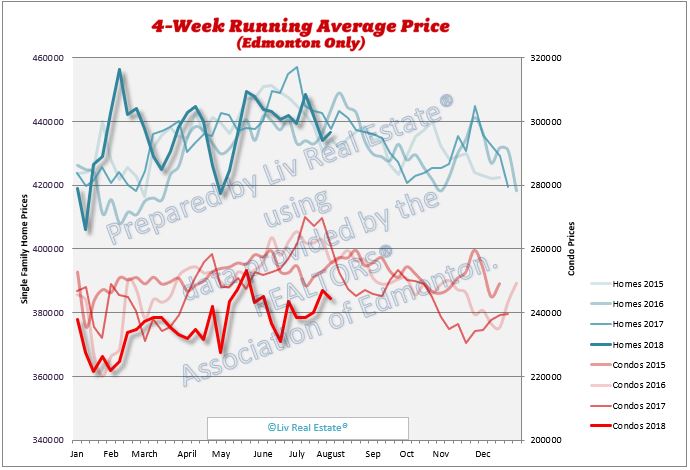

Posted by Karlhungus on Friday, August 3rd, 2018 at 9:15pmFour week average for SFH is higher than last week! Plus, Alberta's economy is now officially leading all of Canada. We're starting the next boom!!!

Posted by Tom on Sunday, August 5th, 2018 at 4:28amTom, if the economy is doing good we'll see more interest rates increases…. not good for the real estate prices... mathematically, everybody qualifies for %30 less mortgage than last June already... salary increases are not existent unless we are talking about minimum wage... It's sad to see people can't sell the houses they purchased 4-5 years ago and at least pay the realtor commission....

Posted by bubu on Sunday, August 5th, 2018 at 9:05pmI forgot but add another 0.25% September 5th.... slow but steady....

Posted by bubu on Sunday, August 5th, 2018 at 10:03pmI hope you're right!

Posted by Tony on Sunday, August 5th, 2018 at 11:27pmThanks Hungus and you can expect the Edmonton market to continue to decline for the foreseeable future.

Posted by GPC on Monday, August 6th, 2018 at 4:14amTony, hope what man? I guarantee you the interest rate will keep going up in the next few years until it reaches some point then it will stop at a certain level for a while and after that it might drop back but nobody knows exactly how long it will stay high before it drops back from the new high in 2021 or 2022.

Posted by Wally on Monday, August 6th, 2018 at 5:04amHouse prices will bottom out in 2019 or 2020 then they will start going back up slowly at first even with the higher interest rate because in 2 years Edmonton will be considered a little undervalued compared to Vancouver and Toronto. I personally expect the prices to be 20%-30% higher in 10 years, 35%-50% higher in 15 years, 70%-80% higher in 20 years and more or less 100% higher in 25-30 years.

Um yep good luck with that Tom.

Posted by Stu on Monday, August 6th, 2018 at 7:10amYup twice the carrying cost for that mortgage every newbie maxed themselves out on a year ago, Are housing bubble needed this big time.

Posted by arfmoocat on Monday, August 6th, 2018 at 11:06pmTom, Scotia Bank's forecast is for 2 increases in 2018 September and December... we'll see....

Posted by bubu on Tuesday, August 7th, 2018 at 2:43amYeah, I expect interest rates to be 100 basis points higher next year. Another 25 basis point increase this year, and 75 next year.

Posted by Tom on Tuesday, August 7th, 2018 at 6:17amWally , will be family income 70 - 80 percent higher in 20 years or it doesn't matter for such an economist like you ? BTW , could you provide a stat how changed family income for the last 10 years , just to support your theory ?

Posted by Andrii on Wednesday, August 8th, 2018 at 12:12amIf you were making significantly less money 10 years ago then you are now, you are doing something wrong

Posted by Karlhungus on Wednesday, August 8th, 2018 at 1:53amAndrii, I hear you. No, family income will not be 80% higher in 20 years and I'm not an economist and to tell you the truth I find house prices very high and more so in Vancouver and Toronto like everybody knows.

Posted by Wally on Wednesday, August 8th, 2018 at 2:35amHowever and apparently house prices may grow higher than inflation at times due to easy and cheap credit, foreign investment in the case of Vancouver, supply and demand and stronger than normal economy, fear of missing out and many other things. An example of that is what happened in Alberta in 2006 and 2007. Usually after the bubble happens there is a slight correction then stagnation for a while then the same thing repeats.

To be honest with you I don't like it this way but unfortunately that's what has been happening for maybe over a century.

Leave A Comment