Listing information last updated on October 16th, 2025 at 8:07pm CDT.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

Very best wishes to everyone for the upcoming New Year! :)

Posted by Liv Real Estate

on

Very best wishes to everyone for the upcoming New Year! :)

Posted by Liv Real Estate

on

19 Responses to Weekly Market Update, Dec. 29/17

I'm excited to see what happens in January. There might finally be some buying opportunities.

Posted by Taraz on Thursday, December 28th, 2017 at 7:51pmNo kidding. The Trudeau government has effectively killed the housing market with their new rules.

Posted by GM on Thursday, December 28th, 2017 at 8:41pmGood luck to all who own a house/condo. You're in for tough times.

I don't agree with you. It is actually the other way around. I mean if they let the artificially created bubble continue until it bursts under its own weight the resulting recession would be way more severe than what is going to happen in the next few years.

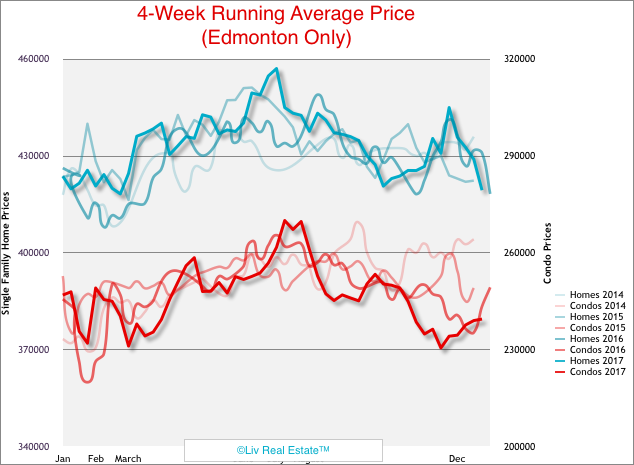

Posted by Wally on Thursday, December 28th, 2017 at 9:30pmWhat amazes me is that there are examples from history like Toronto late 80's bubble and Alberta bubble that went through 2007 and what followed was not nice but some people either forget or if they are younger they don't research history.

In Toronto whoever bought in 1989 had to wait for 12 years to break even and this is not inflation adjusted.

In Edmonton the benchmark price of single family is still about 2-3 % lower than in 2007 and it's been almost 11 years now.

GM, every house in every major market in Canada is pretty badly overpriced because the fundamentals (super low interest rates, presence of CMHC, presence of alternative lenders, etc.) are still screwed up. Toronto and Vancouver are just wildly overpriced.

Posted by Anonymous on Friday, December 29th, 2017 at 7:07pmThat said, I'm under no illusion that we'll ever get to a place where we can have sustainable growth (like Wally mentioned last week, that would involve everyone with 20%+ down payments and high single-digit interest rates) because it would bankrupt half the country and isn't politically feasible, but don't forget that one of the reasons that house prices are where they are is because normal, sustainable economic conditions would bankrupt half the country.

Until "affordability" returns to meaning "reasonable house price" as opposed to "reasonable recurring payment I can carry indefinitely", we'll continue to be in a very sad place (housing prices notwithstanding)...

2018 will see low number of transactions but not a lot of price changes... the market over 750k will be the most affected ... I'm wondering who will qualify for the 7-900k to buy a skinny... We'll see changes in 2019-2020 as the interest rate will go higher, jobs will be reduced and a potential Conservative win will try to balance the budget.

Posted by bubu on Saturday, December 30th, 2017 at 1:27amThere's been a buying opportunity as Edmonton real estate has fallen the last ten and a half years in a row.

Posted by Tony on Saturday, December 30th, 2017 at 6:01amAnd so the government solution to Toronto's and Vancouver's high prices is to drive down prices in every market in Canada. Great.

Posted by GM on Saturday, December 30th, 2017 at 6:05amThe big question is will be will the decimation of Vancouver real estate in the first few months of 2018 (with the new B20 OSFI rules and the Chinese buying drying up) drive Alberta real estate even lower? My guess is Vancouver real estate will drop another ten percent in the first 3 months of 2018. What will be the spillover effect on Alberta? Looks like oil is putting in a double top at the 60 dollar U.S. level headed back down to the 50 dollar level as the U.S. dollar puts in support around the 91 to 92 level on the DXY. Looks like another bad year for Edmonton real estate for the 11th year in a row.

Posted by Tony on Saturday, December 30th, 2017 at 6:07amIt appears Trump is trying to kill the U.S. dollar to avoid an all-out stock market crash so in theory like Venezuela interest rates could go higher in America. The effects of the new tax plan will fade fast as prices rise and everyone goes broke again very soon in America.

Posted by Tony on Saturday, December 30th, 2017 at 6:13amNot January. I just noticed on one of the banks website that you will not be affected by the new rules until the pre-approval expires which means if you're pre-approved for 90 days by late December you will be ok until March.

Posted by Wally on Sunday, December 31st, 2017 at 4:47amThis means you will not see the true and real effects until spring or summer.

Tony, not the first few months of 2018. Read my post above. It won't be until spring or even summer.

Posted by Wally on Sunday, December 31st, 2017 at 4:51amI think the doomers will be disappointed in 2018. Edmontons gdp rose 4% in 2017, we are recovering. I think prices will surprise people and even go up a bit.

Posted by Karlhungus on Monday, January 1st, 2018 at 3:47amI usually only read the comments because tony has such numerous insight .. I have not seen a single one of your predictions come true over the 2017 year

Posted by Tonysmyfav on Monday, January 1st, 2018 at 5:54amHumorous**

Posted by Tonysmyfav on Monday, January 1st, 2018 at 5:55amWhat you read isn't true just ask anyone who is quote pre-approved and is looking to buy a house right now.

Posted by Tony on Monday, January 1st, 2018 at 6:44amSo normally I'd be moderately bearish on YEG RE in 2018 (I'd say flat for yet another year, with maybe another 5% decline in the higher price ranges), but Tony just called for a bad year, chances are we're in for a boom folks. Tony, my dear tinfoil hat wearing soul, I'm pretty sure your batting average is about 0.100 on everything you've ever posted here.

Posted by Trev on Tuesday, January 2nd, 2018 at 2:06amRemember last spring, when the CAD was heading to 50c USD? Pretty sure it's up 3ct since that call at $0.77. And there's been so many others.

Got call up Sheldon and Sarah, because it's clearly time to buy.

The Canadian dollar will tank this year falling below the old record low of around 62 cents U.S.

Posted by Tony on Wednesday, January 3rd, 2018 at 3:04amhaha yup. Not sure how people can be so wrong so many times and not have their tails between their legs. I think the doomers will be disappointed again in 2018. GDP for Edmonton in 2017 was almost 4%, the economy is recovering, there will be no crash. I bet prices will even uptick a litte.

Posted by karlhungus on Thursday, January 4th, 2018 at 3:35amAnd the dollar below 60 cents? lol

Doubled my money on the Canadian dollar this morning. Sold at the open. Monday I will put in a long term short on the Canadian dollar at 30 seconds into the 9:30am open. I made everyone on Zero Hedge a lot of money as the Canadian jobs report came in exactly as I predicted today.

Posted by Tony on Friday, January 5th, 2018 at 3:49amLeave A Comment