Listing information last updated on October 16th, 2025 at 12:37am CDT.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

Have a great weekend!

Posted by Liv Real Estate

on

Have a great weekend!

Posted by Liv Real Estate

on

11 Responses to Weekly Market Update, Feb. 1/19

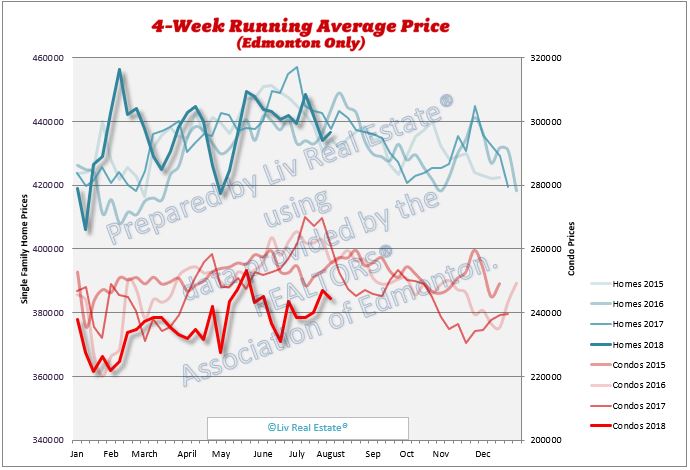

So we're down around 15% year over year now that the average SFH is $3xxk. With the UCP getting in, I could see a $2xxk in the next 36 to 48 months if they decide to cut back on government spending and rates keep rising. I would actually love that, as I could buy a good house in Glenora for $550k instead of $800k!

Posted by Tom on Thursday, January 31st, 2019 at 7:01pmAlso, the people who have bought in the last 24 months have probably lost almost all of their equity with this plunge.

Posted by Tom on Thursday, January 31st, 2019 at 7:03pmGross. By my estimate, I've lost about $150k in equity in the last two years spread over two places. I feel like such a loser-clown for putting so much into real estate- I don't mind the primary residence going down as it's a long term thing, but buying the second place was dumb. Should've bet on a diversified financial portfolio and rode the Trump wave instead. Full liquidity, good returns, no special assesment risk, and no renter. Not that he's bad; awesome actually. But Dammit.

Posted by T-Rev on Thursday, January 31st, 2019 at 8:47pmVery sad. What I was trying to warn everyone about two years age that everyone mocked. Still got a ways to go before this all ends folks.

Posted by Rick on Thursday, January 31st, 2019 at 9:29pmT-Rev - Kudos for taking ownership of that decision and not blaming the government like so many people do. If you went heavy into real estate while the price of oil was at its peak and interest rates were at their bottom, you should have priced in significant down side risk to your buying decisions. Most people did not. Is that the conservative party's fault not to warn people when most of these buying decisions were made? Is it the NDPs for not bailing everyone out? No.. we have a free market which everyone loves and that means sometimes people are going to get burnt.

Posted by Greg on Thursday, January 31st, 2019 at 10:02pmWin some, lose some, try and learn from my mistakes. Life goes on, and they make more money every day. Stay healthy, stay learning, stay hungry, stay smiling, and success will find you.

Posted by T-Rev on Saturday, February 2nd, 2019 at 6:07amHomeowners will feel a little less rich right now which impacts their spending habits. however the reality is if you have purchased a 'home' then you will likely be in it for enough time to see the value appreciate. If you are an investor then hopefully you have the cash flow to ride this out and not have to realise losses.

Posted by Stu on Sunday, February 3rd, 2019 at 9:08pmStu, what you said is true and I'd like to add that many of those who need to sell today for whatever reason have bought their house before 2006-2007 which was the bubble time and we all know prices more than doubled then so even if prices drop 30% or more today those sellers are still more than fine to move ahead with the sale while keeping a huge amount of profit in their pockets.

Posted by Wally on Monday, February 4th, 2019 at 12:16amInvestors on the other hand who bought right before 2014 i.e. the oil crisis year might be the most affected in today's market if their properties are cash flow negative however I as an investor myself would blame them for that if they didn't account for rainy days so if an investor stretched themselves thin and over borrowed then it's their own fault unfortunately.

dropping 40k is only a few hundred a month not too bad long term if there is a renter or you are living there. at least everything is affordable here

Posted by leslie on Tuesday, February 5th, 2019 at 12:49amStu,

Posted by Tom on Tuesday, February 5th, 2019 at 3:16amgood point. Real estate will always go up in the long term. Not once in history has it not.

Tom ,but don't forget , after boom house prices always return to historical level unless this time it's different.

Posted by Andrii on Wednesday, February 6th, 2019 at 6:23amLeave A Comment