Listing information last updated on October 16th, 2025 at 12:37am CDT.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

Have a great weekend!

Posted by Liv Real Estate

on

Have a great weekend!

Posted by Liv Real Estate

on

8 Responses to Weekly Market Update, Jan. 18/19

Fun Stat for Average fans:

Posted by GPC on Thursday, January 17th, 2019 at 8:38pm2018 12 mos. Sales to Listing Ratio was 45%

Buyers market territory all last year, trend continuing for 2019.

I call what's happening a win win for most everybody. Why?

Posted by Wally on Friday, January 18th, 2019 at 10:00pmFor those who bought before the bubble of 2006-2007 even if they reduce the price today by 20-30% they're still ahead.

Whoever bought after the bubble of 2006-2007 up until lately they still have time for the price to grow above today's prices considering the usual time frame is 25 years which means say if you bought in 2014 and resell in 2039 I guarantee you the price will be way higher in 2039.

If you're an investor and buying in 2019 to resell in 2046 you're going to be a big winner.

If you're a regular homeowner buying in 2019 you're also going to make a big buck in 2046.

If on the other hand you're a speculator who bought in 2014 to resell in 2019 guess what? Good luck for you!

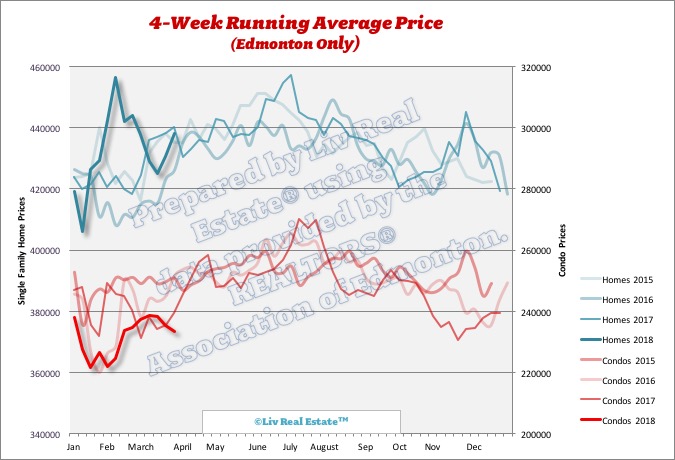

Homes 4-week running average: $403k ($414k, $431k, $423k)

Posted by arfmoocat on Saturday, January 19th, 2019 at 1:51amLooks like $3's are coming

I predict the only money in the market this spring is going to be the smart money looking for extreme discounts. Sellers are going to go out of their comfort zone in terms of price if they want to find a dance partner.

Posted by Greg on Saturday, January 19th, 2019 at 4:36amWally , just a couple questions left for your prediction . How big will be Canadian "big buck " compare to Peso and big will be income to buy a house for big buck if According to a Statistics Canada release based on census data, the Canadian median household income increased from the inflation-adjusted equivalent of $63,457 in 2005 to $70,336 in 2015 .

Posted by Andrii on Sunday, January 20th, 2019 at 6:28amMike, What have you been leagally smoking? If you haven't heard, Canada and China are hardly on good terms lately.

Posted by Bill on Sunday, January 20th, 2019 at 8:05pmFolks....dont get excited.

Posted by Mike on Monday, January 21st, 2019 at 3:06amEither Chinese buyers, or the fed government itself will rescue the housing prices. BC is already sold out to Chinese, and AB govt should market AB in Shanghai, HK and Beijing right away.

RE only goes up and up in Canada on year or two basis. Ignore the small blips.

That's why I showed the sales to listing average over a year and if you go back further, it's been a buyer's market for more than a year.

Posted by GPC on Monday, January 21st, 2019 at 4:39amHardly a blip.

Leave A Comment