Data is supplied by Pillar 9™ MLS® System. Pillar 9™ is the owner of the copyright in its MLS® System. Data is deemed reliable but is not guaranteed accurate by Pillar 9™. The trademarks MLS®, Multiple Listing Service® and the associated logos are owned by The Canadian Real Estate Association (CREA) and identify the quality of services provided by real estate professionals who are members of CREA. Used under license.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

Have a great weekend!

Posted by Liv Real Estate

on

Have a great weekend!

Posted by Liv Real Estate

on

11 Responses to Weekly Market Update, July 13/18

Everyone will remember Ben Bernanke when the entire world implodes from zero and negative interest rates and excess debt (a product of Bernanke's zero interest rates). It really is a shame millennials are so lazy and thus zero demand for everything and consequently interest rates are at all time lows.

Posted by Tony on Thursday, July 12th, 2018 at 10:31pmYup and this means a lot of millennial will rent which will push up rental Costs and thus prices will likely stay stable.

Posted by Curtis on Thursday, July 12th, 2018 at 11:27pmTom, yes it is really nice to see prices going down 150k -200k at the high end and pick up those houses at a nice discount... I saw even $300k down from the initial listing... I would say the average will stay up as people will buy those high end discounted houses in the near term... 1% more in the next year added to the mortgage will offer even more opportunities.... low end market will stay leveled....

Posted by bubu on Friday, July 13th, 2018 at 12:23amBabu,

Posted by Tom on Friday, July 13th, 2018 at 1:57amYeah, for houses $800K+, there is a single buyer for every 10 houses in this price range, mostly high paid government managers from my experience. I've also seen huge price reductions ($200k+) in this range. But only those that NEED to sell are reducing prices. The rest will just pull it from the market and relist in the fall or the following spring.

correct... the issue in the fall or spring is the interest rate... it will be higher....

Posted by bubu on Friday, July 13th, 2018 at 4:40ambtw... high paid managers in the gov? What is considered high? 120-140k salaries for houses over $800k?

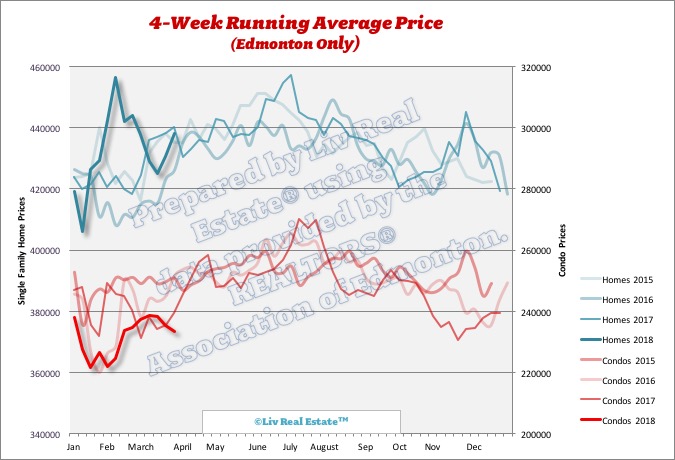

Posted by bubu on Friday, July 13th, 2018 at 4:57amWe just hit a multi year high price for this time of year in SFH!

Posted by Tom on Friday, July 13th, 2018 at 7:11amYeah, about $140K. They get a mortgage around 5x their income, which is manageable in today's low interest rate environment. And then the difference comes from the equity of selling a condo or starter home.

Posted by Tom on Friday, July 13th, 2018 at 8:43pmThere has got to be a psychology lesson in this week's comments. Apparently government managers make waaaaay more money than they do, banks lend them waaaay more money than they do, and the government managers are waaaaay stupider than the rest of us. What's this cognitive bias called? Anyone?

Posted by Anonymous on Saturday, July 14th, 2018 at 9:37pm5x their income ? I think banks offer only 4 x but yes, there are other options.... Hopefully they will keep the jobs if UCP will win the elections... They don't have any marketable skills in case the loose the jobs...

Posted by bubu on Sunday, July 15th, 2018 at 3:56amMore like 3x.

Posted by Tony on Sunday, July 15th, 2018 at 7:14amLeave A Comment