Listing information last updated on October 27th, 2025 at 8:52pm CDT.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

Have a great weekend!

Posted by Liv Real Estate

on

Have a great weekend!

Posted by Liv Real Estate

on

16 Responses to Weekly Market Update, July 21/17

Is there anything called fundamentals - home price to income ratio in Canada?

Posted by Mike on Thursday, July 20th, 2017 at 10:17pmAverage home prices 5x, 10x than average income....

I mean here we are in AB - supposed recession with lowest adjusted revenue from its main resource oil(with bleak future until unless there is a war somewhere), and home prices are at historic peak. Canada is absolutely special.

BTW, thanks Sara for the info. You info is better than economists who were predicting 5% price drop in 2017. I will definitely contact you if I ever buy house. For now happy renting.

Nobody commenting?

Posted by GM on Sunday, July 23rd, 2017 at 5:34amNothing has changed everything is still falling in price. If Edmonton doesn't become a retirement community it'll end up a ghost town.

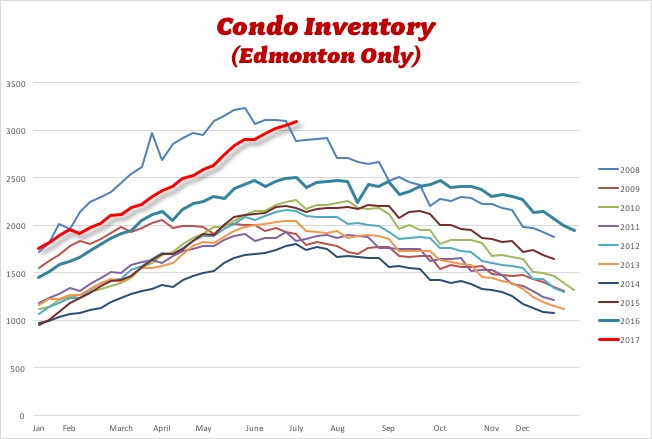

Posted by Tony on Monday, July 24th, 2017 at 2:59amThat condo inventory is very concerning. It's record high, even when compared to the GFC years. And the CHBA is showing record high new, unabsorbed condo inventory as well. There's over a years supply of condos on the market, and climbing. Doesn't bode well for condo valuations in general.

Posted by Trev on Monday, July 24th, 2017 at 4:37amTony, did you read the chart correctly? We just hit a record high for this time of year.

Posted by Tom on Monday, July 24th, 2017 at 5:18amAnd despite that the condo price is up to $270k

Posted by Wally on Monday, July 24th, 2017 at 5:55amDont worry at all. This is Canada.

Posted by Mike on Monday, July 24th, 2017 at 8:44pmRE Inventory goes up - Prices go up(not down).

Economy tanks - Residential RE prices go up.

We are special. Fundamentals don't work here.

Product mix Wally- I'll bet that price increase has zero to do with price appreciation of any one condo. People are just buying more expensive units right now, vs cheaper product. Even if you just look at list prices, which I know don't reflect sold prices, you will see that same-building list prices are down significantly in many cases. And nothing is moving in that market it seems.

Posted by Trev on Tuesday, July 25th, 2017 at 1:03amhow are the proposed OSFI new qualifying rules for uninsured mortgages going to affect Edmonton? Or they will not? Also, there are assumptions about the 5 year mortgage rate to reach 4$ in Q1 2018... Does it matter or Edmonton real estate is ok with these changes?

Posted by bubu on Wednesday, July 26th, 2017 at 3:21am4% not 4$ :)

Posted by bubu on Wednesday, July 26th, 2017 at 3:22amThe stress testing for uninsured mortgages should have been introduced last year or even before to contain the craziness in Vancouver and Toronto. Now it's too late because there won't be a correction in prices if they introduce it. All it will do now is slow down the market only.

Posted by Wally on Wednesday, July 26th, 2017 at 5:58amI think it will affect Edmonton and Calgary to a lesser extent because these two cities have been stressed the last few years.

@bubu

Posted by wsn on Wednesday, July 26th, 2017 at 8:19pmWhat you need to understand is that there is a difference between the posted rate and the actual rate. The current posted rate of a 5 year fixed is 4.79% now (CIBC). You don't need to wait till 2018.

But then, if your credit history is decent, you should have no problem getting something under 3%.

@wsn - I'm not talking about the rate today.. I know you can get something under 3%... I'm talking about the rate in Q1 2018... look at the 5 year bond trend... that will determine the rate in Q1-Q2... You can lock now for 25 years but to renew in 5 years at 4.5-5% is going to be a huge hit.... On top of that I think people will not qualify in Q1-Q2 next year or the same amount as the posted rate will also go up.. I hope I'm not right but it is a possibility...

Posted by bubu on Thursday, July 27th, 2017 at 1:48amYes bubu if in 5 years the mortgage rate is 5% or higher it'll add a huge amount on the bill.

Posted by Wally on Thursday, July 27th, 2017 at 4:16amThe rate should never have went below 5% to 7% so buyers could be balanced on their payments the longest possible. And guess what if they didn't Lower the rate that much the house price would have been way Lower and even at 7% it would have been more balanced and more affordable.

Even for investors it would have been way more comfortable and stable.

I think if mortgages all move to $4 it will have an inflationary impact on prices.

Posted by Stu on Thursday, July 27th, 2017 at 6:40amI'm not sure it will have an impact on the prices.,. but it will on the life style of some....

Posted by bubu on Thursday, July 27th, 2017 at 8:14pmLeave A Comment