Listing information last updated on October 16th, 2025 at 2:38pm CDT.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

Posted by Liv Real Estate

on

Posted by Liv Real Estate

on

15 Responses to Weekly Market Update Jun. 11/21

Still going...

Posted by GM on Thursday, June 10th, 2021 at 8:48pmBuyers coming in to beat the stress test at the absolute worst time you could possibly buy. About a month from now home prices Canada wide will start falling with very few offers. Will Edmonton follow the rest of the country downward? Pressure will be on higher interest rates as Canada reopens from Covid and the U.S. Fed holds the Fed funds rates 4 percentage points below the annual inflation rate.

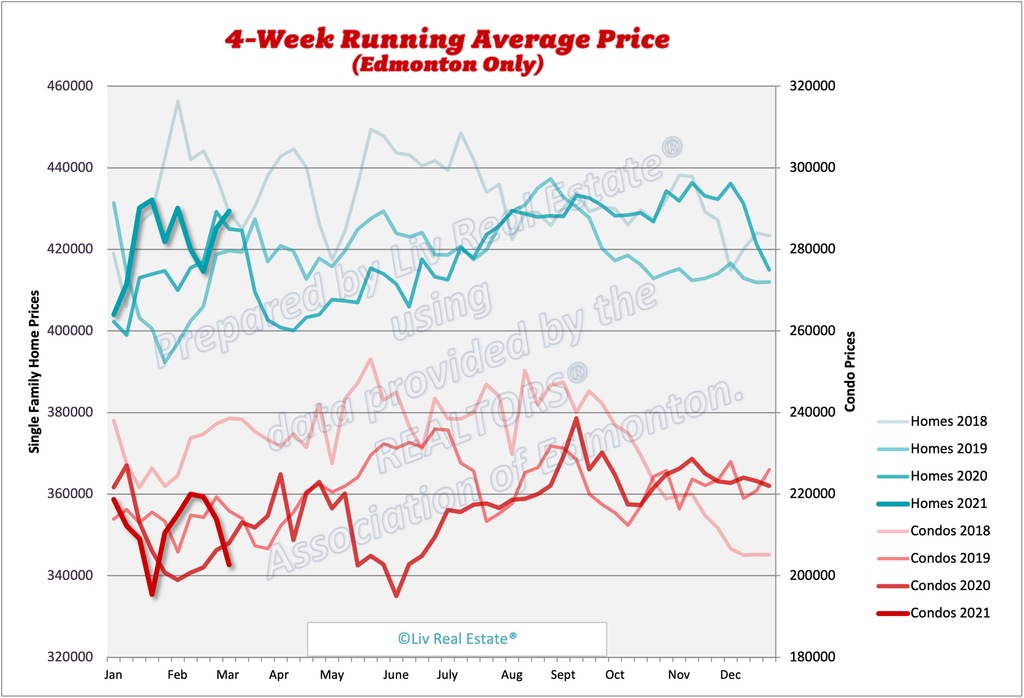

Posted by Tony on Thursday, June 10th, 2021 at 9:11pmI think that detached home prices in Edmonton will keep climbing for the next few years. Housing is so cheap compared to Toronto and Vancouver, so we'll likely continue to see big migration from other provinces. And I can't see interest rates increasing anytime soon. The Canadian economy is far too reliant on continued housing price growth and high residential construction, so any more than one or two token rate increases from the Bank of Canada just won't happen. In fact, if we see another recession in the next few years, I really think we'll see negative rates.

Posted by Tom on Thursday, June 10th, 2021 at 9:44pmWho could’ve predicted this?!?

Posted by T-Rev on Thursday, June 10th, 2021 at 11:03pmhttps://www.livrealestate.ca/blog/2021/05/weekly-market-update-may-28-21.html#comments

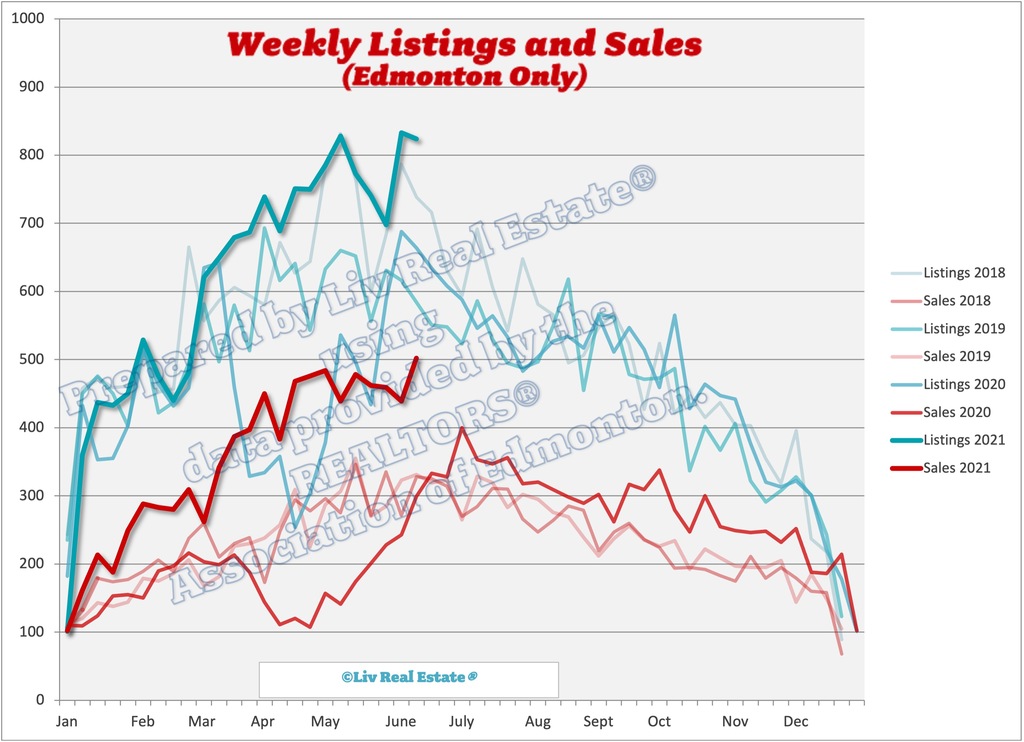

Comment #5....Listings strong as Covid declines make people feel safe to open their houses. Lots of folks have been waiting this out for 16 months. Listings will continue stronger than normal through summer. Sales will be supported by pre-stress pre-approvals that people will want to spend, although this will taper off quickly. Healthy listings coupled with declining demand will balance the market by late summer. A strong economic recovery will mean a fairly healthy, but balanced, market starting late summer and continuing through the remainder of the year.

Disagree. We'll see rising interest rates faster than people expect. Too much money injected into the economy which is already leading to increased inflation. Everyone can see this.

Posted by Karl hungus on Friday, June 11th, 2021 at 4:10amKarl, that would very much hurt real estate in Canada. I can't see the Bank of Canada deliberately crippling Canada's main GDP driver, which would almost certainly cause a recession. People have been constantly saying for years that higher interest rates are imminent, but it has not, and never will, happen. I think we'll see a 50 basis point raise in the second half of 2022 to slow down high inflation, but then that will be it.

Posted by Tom on Friday, June 11th, 2021 at 4:20amTom, interest rose 5 times before covid so not sure where you are getting this narrative about interest rates never rising

Posted by Karl hungus on Friday, June 11th, 2021 at 9:05pmYou're right that it's theoretically possible for FIVE increases (125 basis point). I'm saying that it's unlikely to happen with all of the baby boomers retiring, which will cause lower spending overall, which means we'll struggle to grow GDP. I just don't think the 400,000 immigrants a year the feds are targeting is enough to keep the economy growing very quickly over the next ten years to warrant trying to cool it off with rate hikes.

Posted by Tom on Friday, June 11th, 2021 at 9:59pmAlso, sure, we'll have 10% GDP growth in the next year, but 5% or 6% of that will be due to inflation. Take that out, and the economy will just be recovering what it last due to Covid. I'll bet you see inflation pretty steady at 2% or so a year starting in 2023, as production increases to offset supply issues. So if in the second half of 2022, the rate of inflation starts falling from 6% to 4% or 3% year-over-year, there's no way of knowing will the rate will stabilize. The Bank of Canada won't want to risk increasing rates and causing less than 1% inflation. It's a good time to buy a house in Edmonton IMO, as the 10% nominal GDP growth expected in Alberta will probably mean some more large increase in detached home prices over the next few years.

Posted by Tom on Friday, June 11th, 2021 at 10:06pmTom - are you delusional ? Why are you talking about 5 theoretical rate increases. THERE WAS 5 INCREASES BEFORE COVID

Posted by Karl hungus on Saturday, June 12th, 2021 at 6:03amThe bond market sets interest rates not The Bank of Canada. The satellite cities in the Golden Horseshoe (further than 75 miles from Toronto) will probably drop 25 to 30 percent on average in the next year.

Posted by Tony on Saturday, June 12th, 2021 at 6:37amTony: LOL. If you think house prices will decline, you should short Canadian banks and make a fortune! If that ever happened, we'd be talking about a depression, not just a recession. Reading CMHC's latest report on house prices for the next year, they're calling for another price increase in southern Ontario. I really doubt you have better data than the experts!

Posted by Tom on Saturday, June 12th, 2021 at 7:58amTom, have a look at CMHC's record on predictions. They've been wrong more often than they've been right.

Posted by GM on Saturday, June 12th, 2021 at 9:20pmI have no faith in CMHC's ability to predict anything.

Karl: If you think we'll see five rate increases within the next couple years, that will be pretty terrible for residential real estate, I think you'll agree. I encourage you to short Canadian banks and the Canadian economy. The government NEEDS continuous home price appreciation to keep the economy growing.

Posted by Tom on Sunday, June 13th, 2021 at 7:04amMaybe. But the fact remains that the feds and BoC know that housing has to continually increase, or the economy is in serious trouble. And with oil prices starting to shoot up, I believe we'll see 10% annual gains in Edmonton for the next few years.

Posted by Tom on Sunday, June 13th, 2021 at 11:27pmLeave A Comment