Data is supplied by Pillar 9™ MLS® System. Pillar 9™ is the owner of the copyright in its MLS® System. Data is deemed reliable but is not guaranteed accurate by Pillar 9™. The trademarks MLS®, Multiple Listing Service® and the associated logos are owned by The Canadian Real Estate Association (CREA) and identify the quality of services provided by real estate professionals who are members of CREA. Used under license.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

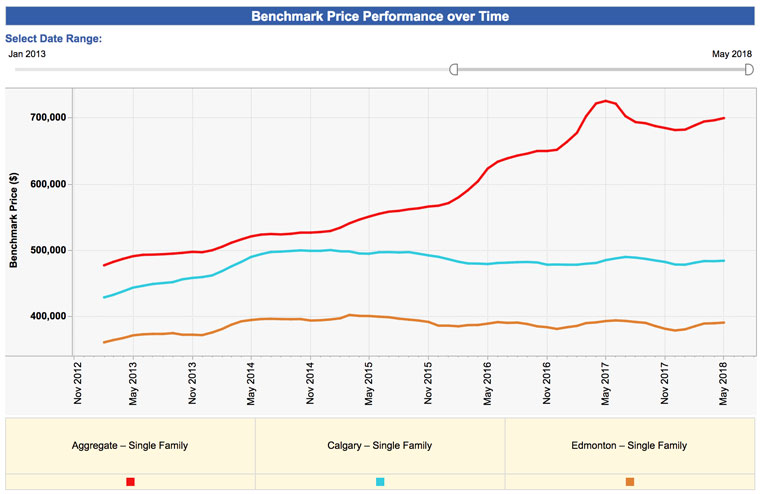

The national HPI Index has been updated to include May's benchmarks; you can easily see how Calgary and Edmonton have basically done the opposite of the national "aggregate" which has been hugely affected by the Toronto and Vancouver markets:

The national HPI Index has been updated to include May's benchmarks; you can easily see how Calgary and Edmonton have basically done the opposite of the national "aggregate" which has been hugely affected by the Toronto and Vancouver markets:

Have a great weekend!

Posted by Liv Real Estate

on

Have a great weekend!

Posted by Liv Real Estate

on

14 Responses to Weekly Market Update, June 15/18

I'd say Edmonton and Calgary will bottom out next year in 2019 when the benchmark will be lower but by how much I don't know. Could be 3% or 5% or even more because I expect more defaults going forward.

Posted by Wally on Thursday, June 14th, 2018 at 8:23pmWally, it will take 2-3 years until the interest rate will get back to normal so I see flat or lower prices for at least this period. The question is what happens with this inventory going up, interest rates raising and jobs paying less and less.... there are no raises for a lot of companies and government now and I don't see any improvement soon... I don't talk about minimum wage here...

Posted by bubu on Thursday, June 14th, 2018 at 11:13pmInterest rates will never get back to normal. The Millennial generation is ultra lazy and until there's demand for anything tangible interest rates will never go back up. Trump is raising interest rates independent of the economy in America. Paul Volcker did the same thing. After 2020 interest rates should be zero or negative again if the entire worldwide banking system doesn't implode first.

Posted by Tony on Friday, June 15th, 2018 at 12:39amI agree that we're about 18 months from big interest rate cuts, which will occur when the US enters their next recession (which is overdue, continual growth has been occurring for 10 years now).

Posted by Tom on Friday, June 15th, 2018 at 1:21ambubu, that's correct.

Posted by Wally on Saturday, June 16th, 2018 at 5:17am5 year saving interest rate up to 3% now. How banks still can give %2 mortgage?

Posted by Sharon on Sunday, June 17th, 2018 at 12:05amLower wages, higher interest rates, more taxes = stagnation

Posted by arfmoocat on Sunday, June 17th, 2018 at 12:34amLast thing you want is a plate of debt to eat

Tony ,your economic knowledge depth is stunning , especially about ' lazy ' and Canada economy can develop separately from US . Who would buy Canada bonds if US have higher return ? Interest on mortgage depends of bond interest rate . Educate yourself .

Posted by Andrii on Sunday, June 17th, 2018 at 5:03am@Tony please elaborate how the Millenials are to blame for low interest rates?

Posted by Stu on Sunday, June 17th, 2018 at 11:07pmTom, you are talking about reception in Canada maybe.... look at the auto industry, Alberta Wheat, etc.. I hope other than your home you don't have any other investment in Canada... Who is buying houses for investment or even for living now takes a huge risk....

Posted by bubu on Tuesday, June 19th, 2018 at 12:46amrecession not reception :)

Posted by bubu on Tuesday, June 19th, 2018 at 12:49amBubu,

Posted by Floyd on Wednesday, June 20th, 2018 at 3:27amWhat are "normal" interest rates??

In today's environment between 3 and 3.5%.... If Trump will put more taxes ( 25% on auto) expect 5-6%

Posted by bubu on Thursday, June 21st, 2018 at 12:51amUmm... so if Trump puts more taxes on auto's going into the US... that will push interest rates up to 5-6%?

Posted by GM on Thursday, June 21st, 2018 at 5:35amUh... okay.

Leave A Comment