Listing information last updated on October 16th, 2025 at 12:37am CDT.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

Have a great weekend!

Posted by Liv Real Estate

on

Have a great weekend!

Posted by Liv Real Estate

on

12 Responses to Weekly Market Update, Mar. 1/19

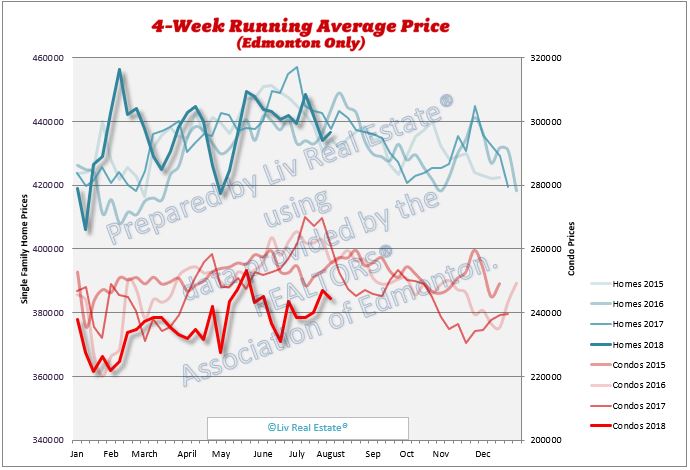

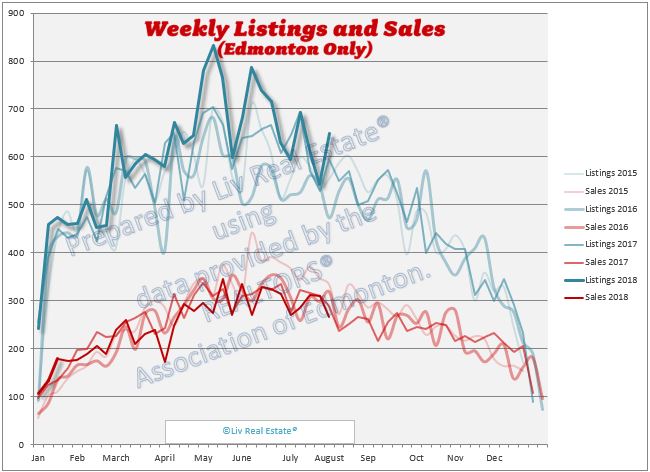

That's quite a rebound in SFH price in one week. Were there many high $$ houses sold (more outliers) or in general prices have rebounded that much? Surprising to see people have been house shopping in this damn Feb! It's cold!

Posted by a common guy on Thursday, February 28th, 2019 at 7:35pmYes, it is. There were 10 sales over $1million in the past 30 days and none in the previous 30 days.

Posted by Sara MacLennan on Friday, March 1st, 2019 at 1:28amTony,

Posted by Brendan on Friday, March 1st, 2019 at 8:09pmBecause if they bought they would be down around 30k by the chart, plus condo fees, repairs, liabilities and maintenance etc.

I also wouldnt be so quick to call a bottom based off a couple data points.

Tony,

Posted by Brendan on Friday, March 1st, 2019 at 8:10pmBecause if they bought they would be down around 30k over the last threes yearsby the chart, plus condo fees, repairs, liabilities and maintenance etc.

I also wouldnt be so quick to call a bottom based off a couple data points.

@Sara

Posted by Anonymous on Saturday, March 2nd, 2019 at 1:24amThe real question is if no $1M houses selling in the previous 30 day period is more unusual.

Looking at historical seasonal trends, January weakness isn't that unusual. I guess we'll see soon just how far down we are come April...

Looks like resale apartments and townhouses have finally put in the bottom. With falling mortgage rates and 30 year amortizations the renters will finally figure it out. Why pay double to rent when you can buy with spare pocket change and never pay rent again?

Posted by Tony on Saturday, March 2nd, 2019 at 6:11amI don't get anything wrong when it comes to money. I guarantee the bottom is in for resale apartments and resale townhouses.

Posted by Tony on Saturday, March 2nd, 2019 at 8:37pmBrendan, and the utilities cable and internet that are all included in my rent.

Posted by arfmoocat on Sunday, March 3rd, 2019 at 12:28amhttps://www.facebook.com/photo.php?fbid=10156858131435751&set=pcb.10156858137610751&type=3&theater

Posted by arfmoocat on Sunday, March 3rd, 2019 at 12:37amGreat rebound! I feel like we'll set new record for price in the spring with this trend!

Posted by Tom on Sunday, March 3rd, 2019 at 5:05amThis is the most bullish chart on the internet https://www.atb.com/learn/economics/the-owl/Pages/record-number-of-new-homes-sitting-vacant.aspx

Posted by Still employed on Sunday, March 3rd, 2019 at 8:10pmThose latest GDP numbers just want me to run out and buy

@Tony - "never pay rent again". I know the point you are making but its an oversimplification that in recent years (decade now) has led a lot of young people to make major property investments before they were ready to. If you're going to super simplify it, a better way to look at it is you're either paying rent or the place to live in, or paying rent on the money you need to borrow and buy. Yes, interest "rental" costs go down over time, but you also have other significant costs you can't ignore, eg. maintenance. I debated this point with my friends back in 2008, and turned out to be a very good call (though I'm modest enough to recognize I could have been wrong). Renting cheap and investing the difference into equities has netted me far more than an RE investment over that period. Long term, equities always outperform RE though. The real unfortunate part for buyers since 2008 has been the steady/slightly declining market has been truly horrible when counting inflation as well.

Posted by Matt on Monday, March 4th, 2019 at 12:37amLong term I'm bullish on Edmonton RE, he cold aside it's a great place to live and will always grow. We are however seeing people pay dearly for irrational exuberance in RE over the last 12-15 years.

Leave A Comment