Data is supplied by Pillar 9™ MLS® System. Pillar 9™ is the owner of the copyright in its MLS® System. Data is deemed reliable but is not guaranteed accurate by Pillar 9™. The trademarks MLS®, Multiple Listing Service® and the associated logos are owned by The Canadian Real Estate Association (CREA) and identify the quality of services provided by real estate professionals who are members of CREA. Used under license.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

Go confidently in the direction of your dreams. Live the life you have imagined. –Henry David Thoreau

Posted by Liv Real Estate

on

Go confidently in the direction of your dreams. Live the life you have imagined. –Henry David Thoreau

Posted by Liv Real Estate

on

31 Responses to Weekly Market Update Mar. 12/21

You may be right Tony, but I also remember white hot housing markets back in the '80's when interest rate were quite a bit higher. So who knows.

Posted by GM on Thursday, March 11th, 2021 at 8:42pmBut you are probably smart to get out at a profit. Trudeau is likely to win again which will be the death knell to Alberta.

Tony,

Posted by John on Thursday, March 11th, 2021 at 10:44pmCongratulations on getting your 2 houses sold. I was going to pull the trigger, but just thought the market is not there yet. I will definitely sell at least 2 houses next year, whatever price I get.

I agree with you, going to be looking for returns somewhere else.

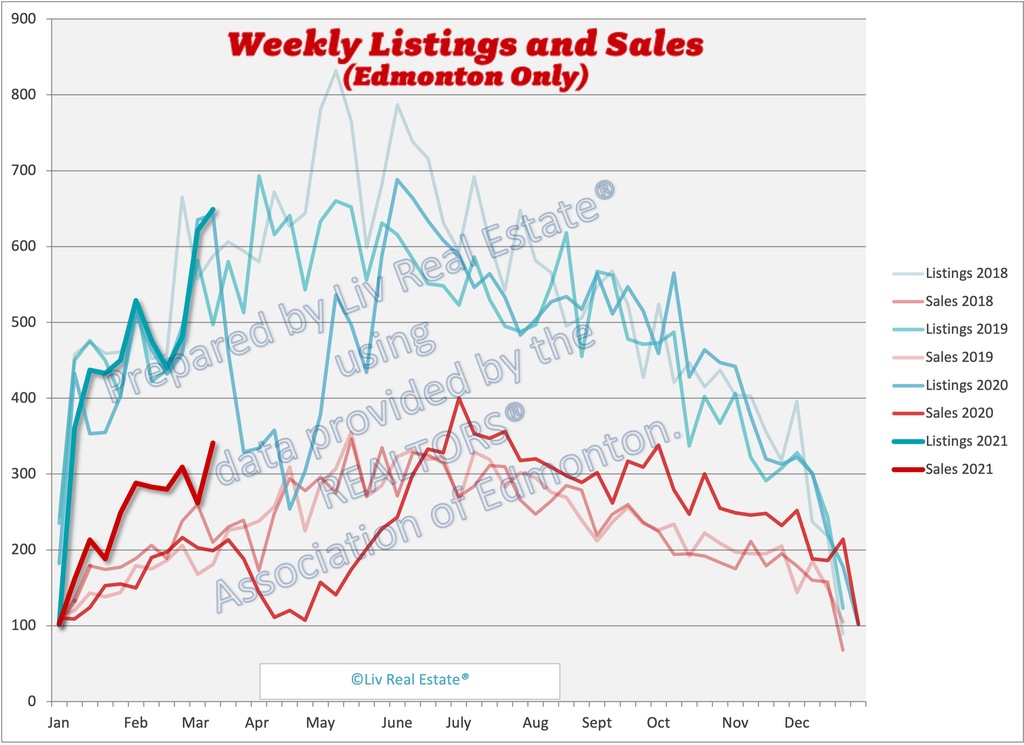

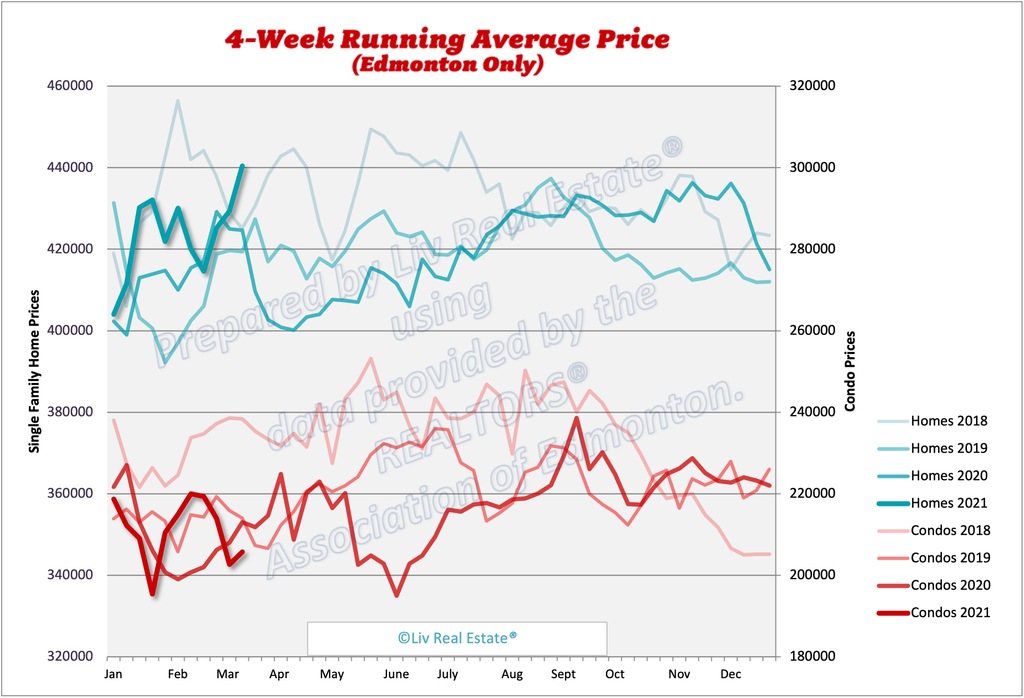

Sara, is that a new SFH all time high for this time of year?

Posted by GM on Friday, March 12th, 2021 at 4:30amOver sold two of my 4 properties in 2 weeks, two more to go. I think by this time next year when the markets down due to lenders bottle-necking buyers by higher interest rates and the poor judgment individuals who are now going with a variable rates because of it, house prices will drop and listings will flood the market.

Posted by Tony skyward on Friday, March 12th, 2021 at 6:23amI hope this year goes hard and I sell my remaining two listings. I’m gonna cash in and invest in another way. I’ve waited longer than many of us had originally anticipated to see the little profit from home investing. Gonna look elsewhere to get my gains. Good luck to all the new home buyers and upgrade buyers. Wallets are gonna get really tight in the upcoming years.

Thanks Sara! As usually, we're white hot right now. I think we'll hit $500K average price this spring. Though with bond yields soaring in anticipation of insane inflation soon, that may put a damper on mortgage qualifications and in turn home prices.

Posted by Tom on Friday, March 12th, 2021 at 6:54amTony: You're making a huge mistake. Home prices are just starting to following sales upward in Edmonton.

Posted by Tom on Friday, March 12th, 2021 at 6:55amI'm still shaking my head at people selling in Edmonton now, just as prices are starting to catch up to hotter real estate markets in Canada.

Posted by Tom on Friday, March 12th, 2021 at 10:26pmTom,

Posted by John on Friday, March 12th, 2021 at 11:55pmWhy would you be shocked, there are so many people that have hanged on for so long, without making money for so many years. If you put money in stocks, card collectibles, even GIC would have made more money. If your able to recover something, break even, why wouldn't you do that. If your really lucky like Tony you are ahead.

I’m not so sure the overall market is hot. For a certain subset containing suburban SFHs and small acreage within 5 minutes of the burbs certainly. Definitely better (not sure if it’s “hot) for many SFHs than it has been in years so for those who have been holding on, it’s a godsend opportunity to get out.

Posted by T-Rev on Sunday, March 14th, 2021 at 6:02amCondos still blow. The promise of the ice district and high density living has faded, at least for now. Sold my rental condo recently. Took a massive hit but it’s time to move on with life. Downtown has turned into a slum. Might come back after Covid, might not. I think we’re about to witness a growing ghetto-ization of inner cities across Canada as a rapidly shifting economy that leaves many behind combines with stretched police budgets, government enabled drug use, and police forces that are neutered at the alter of identity politics. Even if I’m being dramatic, not sure I want to be a landlord when Justin wins a majority and we get Notley v2.0 in 2023.

Low interest rates, Work from home, record household saving, and urban flight are all contributors to the current market. Covid catalyzed all four, and it’ll be interesting to see if the end of the pandemic reverses the trend. There’s still deep underlying problems in the Alberta economy, so I’m not so sure the current market is sustainable.

I have to agree with T-Rev. A Trudeau-Notley two punch combination will knock Alberta out of the ring, unconscious.

Posted by GM on Sunday, March 14th, 2021 at 6:27amAnd the crime, as everyone can see, is increasing at an alarming rate.

Governments at all levels have borrowed obscene amounts of money and now a large portion of the tax revenue is going merely to pay the interest on the debt. What is going to happen when interest rates inevitably go back up?

Enjoy the party for now, but don't stay too late.

Edmonton has

Posted by Still employed in AB on Sunday, March 14th, 2021 at 6:38amFalling rents

2 bedroom apartment vacancy is 12.2%

Unemployment at 11.9%

Office vacancy 21%

https://edmontonjournal.com/business/local-business/covid-pandemic-edmonton-downtown-impacts

There are a few green shoots but I still think next year could be very rough. https://economicdashboard.alberta.ca

T-Rev,

Posted by Tom on Sunday, March 14th, 2021 at 6:44amI was reading an article about how young people prefer urban living, and not having a car. Hence why we are building all these LRT lines. So urban areas are set to boom, which is why they're building all these downtown units. I also think a Trudeau majority this year will provide Alberta with more stability. Keep in mind that the large oil companies like Suncor WANT a carbon tax, and they agreed with Notley on a lot of her policies (so with the latest poll showing Notley in majority territory and the UCP at 20% support should help them).

Also keep in mind that Alberta is basically the most affordable housing market in Canada, with the highest incomes. With oil increasing, it should rebound strongly in the next couple years. I think we could easily be up 50% by 2023.

Tom,

Posted by T-Rev on Sunday, March 14th, 2021 at 6:59amI hope you’re right. A thriving, safe, dense downtown drives the value of all properties in the greater metropolitan area. As for the Alberta’s overall economy, I also hope you’re right.

Alberta should change its name to Quebec. Then we'd be booming.

Posted by GM on Monday, March 15th, 2021 at 12:50amWow, I didn't realize the downtown vacancy rate had gotten that high. That's a good read.

Posted by Sara MacLennan on Monday, March 15th, 2021 at 4:50amMy average price stats only go back to 2011, but this is a record going back to at least 2011.

Posted by Sara MacLennan on Monday, March 15th, 2021 at 4:56amPeople need to realize that it's low rates that drive housing prices higher, not the economy, jobs, immigration, etc. How else do you explain why prices across Canada, including decimated Alberta, are white hot?

Posted by Tom on Tuesday, March 16th, 2021 at 6:17amHey,

Posted by Sara MacLennan on Tuesday, March 16th, 2021 at 7:46amI agree, the low mortgage rates are one of the primary drivers of the market right now. The other big factor is covid... lots of people want more space, a nice home office with a door (to keep kids and pets out), people are moving out of downtowns, young adults are moving back in with their parents because downtown condos aren't fun right now and they can save to buy a home. People who have kept their jobs are generally in a very good position - they've saved money over the past year because they couldn't travel or go out. There are a lot of factors at play. There is also FOMO that happens when the market heats up - buyers see what they could've paid last month and want to get in before they're "priced out." On the flip side, low mortgage rates can also cause big payout penalties for existing homeowners looking to move.

I just got off a zoom meeting with our team and they told me they are typically competing with 3-5 offers when they write at the moment. In other markets it's double-digit competing offers with listings selling WAY over list price. So we're hot.... but I wouldn't say "white-hot."

Thanks for the update, Sara! Wow, so many bidding wars! I think we're just starting to see the price increases.

Posted by Tom on Tuesday, March 16th, 2021 at 7:57amWow, from what I’ve read there’s mostly logical thinking.

Posted by Curt matseki on Thursday, March 18th, 2021 at 2:46amSara, I agree with your last post. A lot of people are wanting to move to acreages right now. Not so much the city unless they have a larger home and yard space.

The general amount of sales are coming by families or individuals who are seeking more room due to the low mortgage rates, they are mostly all buying on conditions to selling their current homes. These people are “covid shopping”. By this I mean they are looking to fill a void from the past year. So many people right now “think” they can get into a larger property and afford it, because they can pay the same amount or slightly above their current mortgage payments to own a bigger better property. Now, what most people will realize in a few years is how much more expensive it is to own these properties. Some will realize that acreage living isn’t actually for them as it’s definitely not the same as being in the city. More fuel for gas, yard equipment, work around the house and they can’t get oober or skip the dishes.

This combined with rising interest rates is gonna change things drastically down the road. Don’t forget, the government & banks will need to make their money back and they will.

Cost for everything is going up & Wages are not! Have a read,

https://nationalpost.com/news/canada/inflation-is-coming-signs-that-everything-is-about-to-get-much-more-expensive

Interest rates are already behind the current inflation rate. Tom, your in the wrong place to be betting on making lots of cash & I agree with the others. We are not going to see another crazy hike in house prices past this year. The market has not had a proper correction like it needs cause the government keeps stepping in to try and delay it & it can only be delayed for so long.

So many people are locked in right now for the max 120 day low fixed rate. Many can’t afford the place they want to upgrade to if rates go up 0.5-1.0%. The banks will tell you you can but who in the right mind would want live at their employer office/shop/trade just to be able to skim by making their mortgage payments with no room for play or R&R? It’s gonna get old fast. Lots of people haven’t realized this yet, neither have they even taken into account the extra they will be paying in property taxes.

3-5 years down the road there is gonna be a lot of upset people that are living for their house and will want out. They’re gonna realize they will regret buying properties outside their means of living. They won’t get near what they payed for.

{comment deleted}

Posted by Tony on Thursday, March 18th, 2021 at 9:52pm@Tony, this is your last warning. We do not tolerate racism, you will be blocked from our site if you post racist comments again.

Sara, when you say "In other markets it’s double-digit competing offers with listings selling WAY over list price." which markets are you referring to? Outside of Alberta?

Posted by GM on Thursday, March 18th, 2021 at 9:57pmTony, race has nothing to do with home buying and pricing trends.

Posted by Tom on Thursday, March 18th, 2021 at 10:22pmhttps://www.google.com/amp/s/beta.ctvnews.ca/local/winnipeg/2021/3/6/1_5336973.html

Posted by John on Friday, March 19th, 2021 at 1:02amMarket is even hot in Winnipeg and Saskatchewan market is pretty good too. The thing, I still don't understand is why Edmonton is so behind in terms of real estate appreciation compared to whole Canada. Maybe people are just too cautious here.

Where's the March 19th Weekly Market Update?

Posted by GM on Friday, March 19th, 2021 at 3:02amGM,

Posted by Sara MacLennan on Friday, March 19th, 2021 at 7:54amYes, other provinces in Canada. I have heard from colleagues in BC, Ontario and the Maritimes about the market, and have read about the market in Quebec, and they're all very hot. I haven't heard anything about Saskatchewan or Manitoba, but I suspect they would be more similar to Alberta.

Re: Where’s the March 19th Weekly Market Update?

Posted by Tony on Saturday, March 20th, 2021 at 2:29amI've noticed the updates always come out early Friday when they're good. I'm guessing the one for this week shows prices falling in both single detached homes and condos.

Rents to skyrocket in the golden horseshoe while wage are stagnate. Soon there will only be the rich and the poor with no middle class. Something will obviously be talked about in the upcoming budget speech about the extreme housing bubble and likely measures taken to quell it. Sellers beware you may only have a couple of weeks left.

Posted by Tony on Saturday, March 20th, 2021 at 2:42am@ Tony RE: “ I’ve noticed the updates always come out early Friday when they’re good. I’m guessing the one for this week shows prices falling in both single detached homes and condos.”

Posted by T-Rev on Saturday, March 20th, 2021 at 5:12amThat’s simply BS. There’s no correlation between time the updates come out and price change. Been following for years.

Sorry about that I published it yesterday but forgot to mark the category correctly so it would appear on the homepage.

Posted by Sara MacLennan on Saturday, March 20th, 2021 at 5:14amHaha no it was just a mistake, sorry.

Posted by Sara MacLennan on Saturday, March 20th, 2021 at 5:14amLeave A Comment