Data is supplied by Pillar 9™ MLS® System. Pillar 9™ is the owner of the copyright in its MLS® System. Data is deemed reliable but is not guaranteed accurate by Pillar 9™. The trademarks MLS®, Multiple Listing Service® and the associated logos are owned by The Canadian Real Estate Association (CREA) and identify the quality of services provided by real estate professionals who are members of CREA. Used under license.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

“You Are Never Too Old To Set Another Goal Or To Dream A New Dream.” – C.S. Lewis

Posted by Liv Real Estate

on

“You Are Never Too Old To Set Another Goal Or To Dream A New Dream.” – C.S. Lewis

Posted by Liv Real Estate

on

10 Responses to Weekly Market Update Mar. 19/21

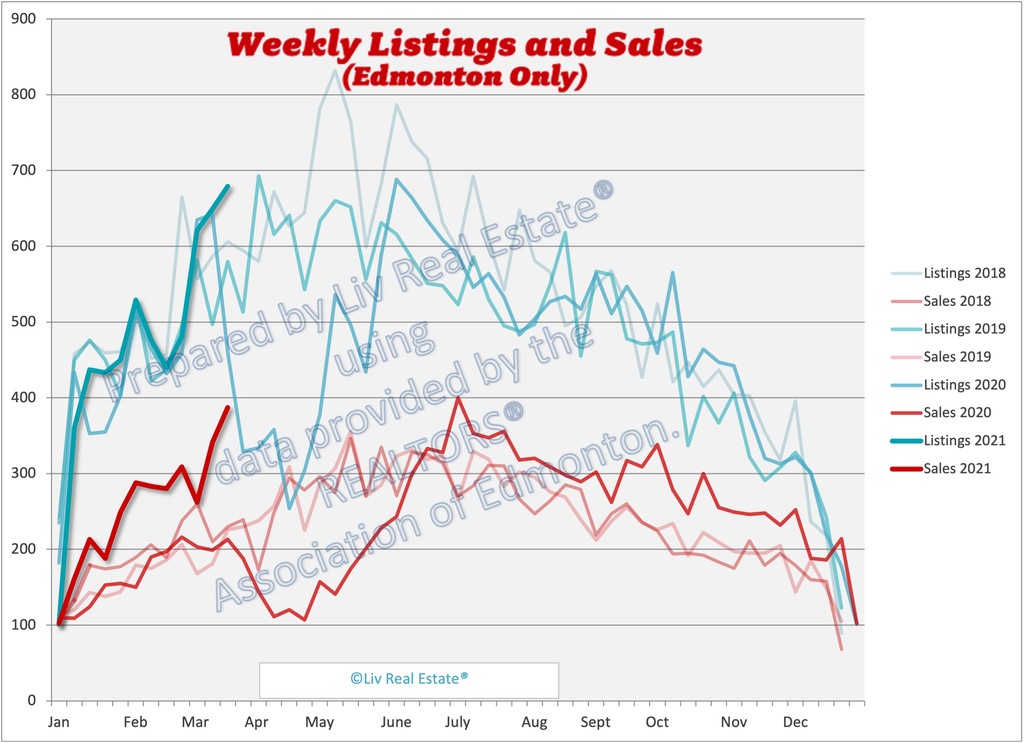

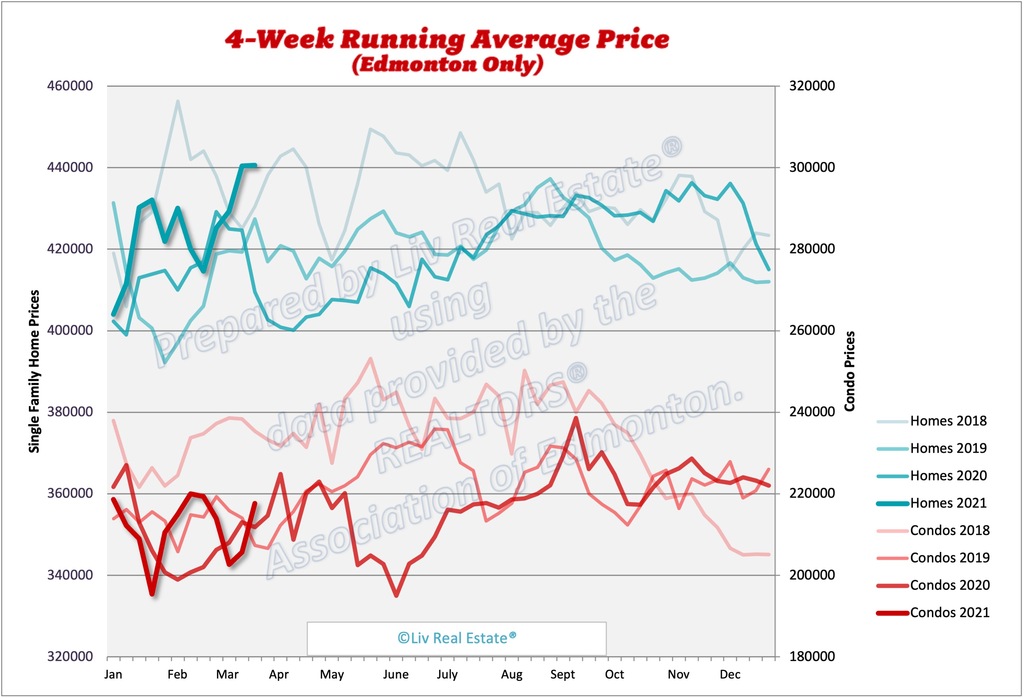

SFH prices leveling off...

Posted by GM on Friday, March 19th, 2021 at 6:41amSales are increasing due to mortgage 120 day preapprovals as the 5 year bond rate spikes in Canada. The buyers know its now or never. As the U.S. dollar falls interest rates can only go higher even in a dead or moribund economy.

Posted by Tony on Friday, March 19th, 2021 at 9:06pmWow! We keep heading higher and higher every week now for SFD! And those sales number! Wooh!

Posted by Tom on Saturday, March 20th, 2021 at 5:37amI agree. Panic buying because they're going to lose their 1.5% mortgage rate if they don't buy something quick.

Posted by GM on Saturday, March 20th, 2021 at 11:43pmMaybe I can finally firesale my rental condo in Callingwood in this market.

Posted by Greg on Thursday, March 25th, 2021 at 4:23amI wonder how many other Edmonton condo owners are thinking about getting rid of a condo and just waiting for the right time.

Posted by Still employed in AB on Thursday, March 25th, 2021 at 6:54amHi Sara: - Is this really the March 26 report?

Posted by Rick on Thursday, March 25th, 2021 at 9:43pmThe March 26 stats are here: https://www.livrealestate.ca/blog/2021/03/weekly-market-update-mar-26-21.html

Posted by Sara MacLennan on Thursday, March 25th, 2021 at 10:08pmThe Bank of Canada tapers bond purchases on the open market the first G7 country to do so. I know the reason, everyone knows the reason but I can't state the reason. This means long term rates will rise in Canada. Even if this is an election year something will be done about the Canadian housing market in the upcoming budget speech. Renters will have to move from one province to another province or leave the country due to lack of funds for 50 to 100 percent rent increases.

Posted by Tony on Friday, March 26th, 2021 at 3:21amThanks for the laugh Tony, That is the funniest thing I’ve read in a long time. 50% to 100% rent increase?? Does that come with 300$/bbl oil?? I’ve rented for a decade in Alberta and never paid a rent increase. Sure I’m paying more but renting a much nicer place. Renters don’t care about an owners cost of capital or ROI. Even one of my old landlords has figured that out and is trying to sell their lowrise apartment building with 15% vacancy at the moment.

Posted by Still employed in AB on Friday, March 26th, 2021 at 3:54amLeave A Comment