Listing information last updated on October 16th, 2025 at 9:23am CDT.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

“Our biggest successes are born out of discomfort, uncertainty, and risk.”―

Posted by Liv Real Estate

on

“Our biggest successes are born out of discomfort, uncertainty, and risk.”―

Posted by Liv Real Estate

on

28 Responses to Weekly Market Update Mar. 26/21

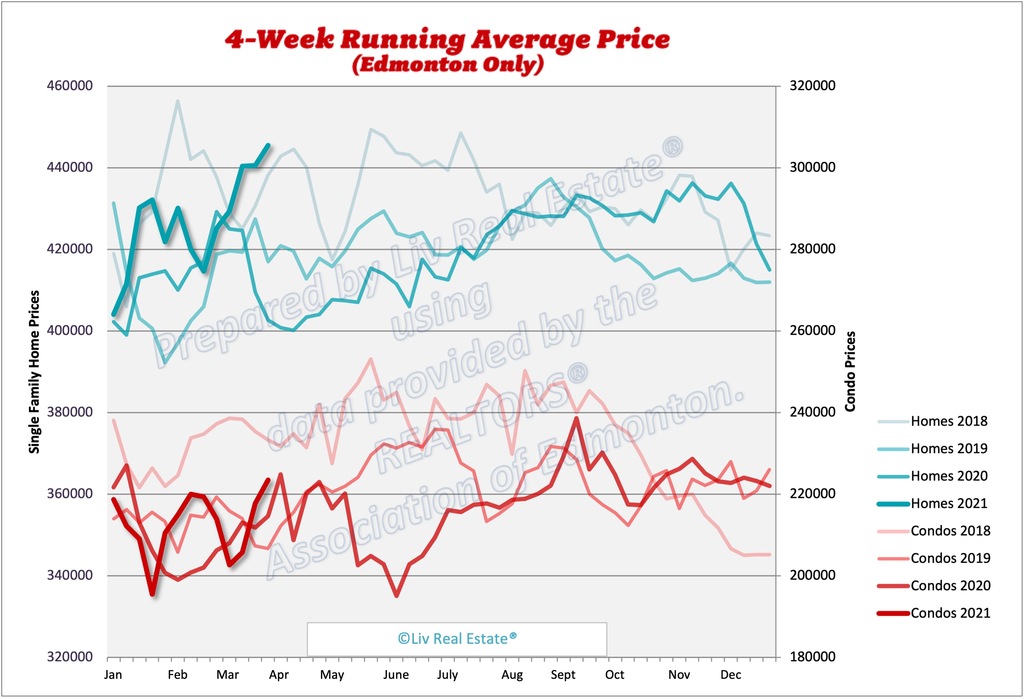

Up and up we continue to go! Though real estate is getting a bit too hot in Canada, so I expect federal policies soon to cool it off. I know there are some insane bidding wars going on in Edmonton, so an 11% annual increase, and still climbing isn't something people are happy about. People are getting priced out.

Posted by Tom on Thursday, March 25th, 2021 at 8:12pmI bought my place in 2008. Over paid for it. I'm still tryin to sell it for 95k below of what I paid for it at the moment in todays market. The viewings of my place have slowed down too. My realtor said that there has been a slight decrease in buyers since locked in rates of 1.5% are at a 120 day end. If this is true than what the hell are people even doing buying out of their means of what they can comfortable afford? If $50 increase biweekly makes and breaks your decision then you shouldn't be allowed to even be approved for a mortgage.

Posted by Luke on Thursday, March 25th, 2021 at 9:06pmI'm starting to realize that I may be sitting in my current house for at least 10 more years due to the market most likely tanking soon here unless I can sell it soon which I will still be in the red. There's a lot of talk going on like you said Tom from the government and banks according to the media. Sounds like everyone that has and is overpaying for their property right now better ensure that thy love it know what they are getting into and not think its a short 5-10 year term and then get out of it and expect to come out in the green side of things. They might not even see the return of what they paid for their full amortization period.

If I manage to sell my place before the market tanks, I'll be downsizing and maybe try a different route to investing. A home is no longer a solid market to see a return it seems. Maybe we need a good correction to happen and then real estate will once again be a good market to invest in?

Priced out of the Edmonton market? No.

Posted by GM on Thursday, March 25th, 2021 at 9:07pmPriced out of Vancouver and Toronto maybe. But not Edmonton where the price of a house is dirt cheap.

Luke, look into index funds. Better return, much less hassle.

Posted by Karl hungus on Thursday, March 25th, 2021 at 9:57pmLuke: I'm not sure how you figure that prices will fall, since we're approaching white hot growth. And I don't think anyone now is overpaying, considering we're starting out ascent to catch up to other markets. Sure, most houses are up 10%+ from a year ago, but if you compared us to Vancouver or Toronto, we have A LOT more upside from here. People today paying $50,000 to $100,000 more for a house compared to last summer won't mean much in the long term.

Posted by Tom on Friday, March 26th, 2021 at 12:35amGM: Yes, houses in Edmonton are pretty dirt cheap, although that's quickly ending. But Edmonton is still one of the cheapest housing markets in the country relative to income, to there's potentially a lot more upside. That being said, we'll see what actions the federal government and CMHC bring in to cool it off this year.

Tom,

Posted by John on Friday, March 26th, 2021 at 3:17amI'm not sure why your so bullish every week, when majority of people who bought houses 10 years ago and in Luke' case are really in the red. This could be the worse real estate market in Canada, maybe world for price appreciation. I'm really confused, since Edmonton isn't that bad a place to live. Even I have woken up and realized Edmonton real estate sucks, unless there is a miracle.

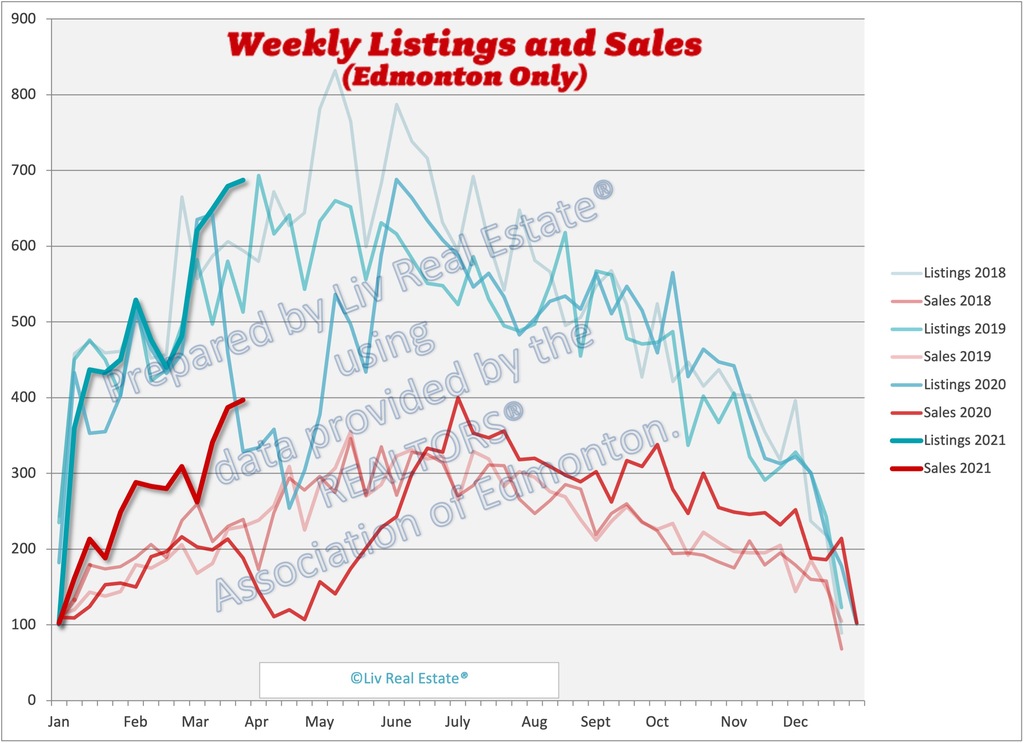

Yes, we are super affordable, cheap, rental cash flow, but who likes it when their investment goes down. The reason, why Edmonton prices can't drive up like crazy because too many owners, prices do rise will flood the market. I can tell you that a lot of people I know want out, if prices improve.

John: Yes, prices have been bad in the past. But as you can see from Sara's update, we're now starting to boom.

Posted by Tom on Friday, March 26th, 2021 at 4:24amI had to LOL at this.

Posted by Kelley on Friday, March 26th, 2021 at 6:47amTom, you can’t compare Edmonton to Vancouver or Toronto period! It will never be on the same level as those two places. Why? Because of what they have that stimulates the economy. Vancouver and Toronto both have harbours which keep us from being land locked. Major trade happens in both places. You can never change that unless you yourself can change where Canada does majority of its trading with other countries, good luck. Also, both places are considered to be better options for people to retire or start their family, there is a lot more to offer. Now, Edmonton, it’s not bad but it’s not even close never has been or never will be on par with Vancouver or Toronto. Edmonton has and is still very dependent on oil. Don’t get me wrong, I’m all for oil but If you want to deal in a market like Vancouver or Toronto then go buy real estate there, let us know how that goes for you. Or max out all your loan options and buy all the property here you can and prove us wrong. I bet you’re gonna be here in the exact same place with the rest of us home owners in 5 years time wondering if any of us will break even or it’s better off to just sell at a bit of a loss and focus elsewhere.

With money being printed at an insane rate, and the Bank of Canada saying that 2023 will be the earliest that interest rates will rise, there's going to be some really high inflation coming up (which the BoC has said they're fine with temporarily). So we should be FAR higher than 2% to 3% growth in housing prices. I have a 1.39% variable rate mortgage, so I'm hoping for 5%+ annual CPI inflation starting later this year when Covid is over, and Trudeau spends an additional $100 billion in stimulus, which he said will start going out this fall. The detail of this bonus spending spending should be released next month with the budget. It'll likely be one time checks to certain groups of Canadians IMO to get people to spend more.

Posted by Tom on Friday, March 26th, 2021 at 11:50pmGM,

Posted by Karl hungus on Saturday, March 27th, 2021 at 3:28amYou are only massively paying down your principal if you bump up your payments and/or shorten your amortization. Which im not sure how many people do that. Seems to me that most people will just take the cheaper monthly payment and blow the money on something else.

Supply and demand. That’s all that matters. Edmonton has ample supply- lots of flat land all around, no ocean barriers, and relatively pro-development Municipal governments in both the city Proper and surrounding burbs. So as long as demand doesn’t spike beyond lot development and home building capacity, prices will remain stable and predictable in most market segments.

Posted by T-Rev on Saturday, March 27th, 2021 at 7:16amIt’s typically only when the economy heats up and we get substantial in migration that demand outstrips supply, and we get a run up in prices. In this case, I think the demand is coming from people wanting to move to bigger, more detached housing options with a yard and more space inside and out, and it’s outstripping current supply. This is probably coming at the expense of smaller housing options. I have nothing to back this up than an anecdotal observation that small acreages with city services are red hot, burbs are hot, city SFH are strong, low rise multi family is just ok, and high rise condos continue to be awful. Just a view from the heap seats, but until I dumped my rental condo a month ago I Owned On both extremes of that continuum. Have seen four places move in my subdivision in the last month, $1.05M-$1.3. Three on the market less than two weeks, the fourth sold after over a year on market. That’s a years worth of sales in a month, and prices here are up 15 pct over where they would have been 18 months ago.

Even if your house doesn't go up in price, if you've got one of those 1.6% mortgages, you're paying down your principal massively every month for the next 5 years.

Posted by GM on Saturday, March 27th, 2021 at 7:41amAnd if inflation rears its ugly head then buying a house now will turn out to be a good move.

Posted by GM on Saturday, March 27th, 2021 at 7:42amTom,

Posted by John on Saturday, March 27th, 2021 at 7:47amI'm talking about the state of the market right now. Yes the market is more active, but you are probably not going to be pricing your house 5-10 percent higher from pre-covid. If you talk with any realtor, they will say multiple offers hot, but if you ask them tough questions about pricing your house, they will tell you, not much price appreciation if any and best answer this is Edmonton, not high profile.

I had one realtor tell me if you have a Westmount house, like having a Gretzky rookie. In my mind, what a difference when you go to a card shop, comic store, most people are excited, crazy atmosphere. When it comes to Edmonton real estate, most people heads are down.

I know you love to get us excited every week, but reality this market isn't really good. Do you even own any real estate?

GM

Posted by John on Saturday, March 27th, 2021 at 7:55amPaying down your principal is awesome with low rates, but did you ever think about what happens if your house comes down. What about the loss of opportunity, Michael Saylor, Microstrategy is saying costs of money, mutual fund historically is 8 percent, but thinks investors costs of borrowing is closer to 15 percent. Just gaining small mortgage knockdown, with inflation of money, you are probably screwed, real estate has to be going up 2-3 percent to be worth it.

Real Estate is not liquid, you can't never time the market. It's usually a long term investment unless you are in Vancouver and Toronto.

Posted by Jason (Toronto) on Saturday, March 27th, 2021 at 8:21pmTom, please don't compare this with Vancouver and Toronto, they are totally different kind of market. Here in Toronto, a buyer can put an offer in any house and get overbid, not by 10K, 50K, but by 100K to 150 typically. If you are outbid on this house, the next one is even worse.

Oil price is picking, thank God. However, the long term doesn't look that great; and with COVID, all level of government is in RED. If you have an investment property in Edmonton, sell it and get out. Economic policy is based on situation in Toronto, it's getting ridiculously hot and Federal will do something about it soon.

Just my 2 cents

Jason: I agree that Toronto is hotter right now. Though we could see 30%+ annual gains in Edmonton like we have in the past when the market gets hot.

Posted by Tom on Sunday, March 28th, 2021 at 3:19amAnd I don't think the feds would bring in a blanket policy to pour cold water on the housing market, as it's really only BC and Ontario that's really hot. I think they'll bring in specific policies for those regions (eg. The CMHC won't provide any insurance for over $500,000, instead of over $1 million, or a MUCH higher stress test where you have to qualify at 10% mortgage rates, or something like that. Some region specific policies to make it more difficult for people to buy their home.

Tom, when the federal government brought in the stress test for getting a mortgage they made it for all of Canada, not just for Vancouver and Toronto like they should have.

Posted by GM on Sunday, March 28th, 2021 at 4:43amI have no doubt they'll do the same idiotic thing this time as well, making their new rules apply to everywhere in Canada.

I was thinking about the exemption for the tax on the sale of your principal residence.

Posted by GM on Sunday, March 28th, 2021 at 6:51amWe all know Trudeau is going to eliminate the tax exemption for principal residences.

So if he does this, then it should also allow for capital losses if you sell your house at a loss.

So here is what I think is going to happen...

Rampant speculation in house prices, much like in the stock market.

People will realize if their house price goes down and they sell at a loss, they can use the losses against their gains in the stock market so there is very little risk in buying a house.

Plus... many will buy from their cousins and business partners at fake inflated prices because 1) they don't want to pay tax on any future gain and 2) they want to get a loss to offset gains in the stock market. Paying a fake inflated price for a house will help with this.

This might be what is going on now in Toronto and Vancouver. They know it's coming so they're already preparing for it.

He basically has a majority now since the NDP go along with anything he wants.

Posted by GM on Sunday, March 28th, 2021 at 9:41pmSo we're doomed.

In terms of changes, this is what is currently being discussed. Keep in mind that these will not be brought in all at once, but it's very likely that a couple will be introduced in next month's budget:

Posted by Tom on Monday, March 29th, 2021 at 2:12amEnding OAS universality.

Implementing the 10% luxury tax on cars, boats, RVs and other consumer items selling for a hundred grand or more.

A wealth tax of 1% on family assets of twenty million plus, as the NDP demands.

An extra percentage point on the GST/HST to help pay for the CERB.

Scaling-back RRSP contribution limits, which most benefit high-income earners.

A super-tax bracket for those making over $400,000 a year.

A hike in the capital gains inclusion rate, from 50% to 66% (or more).

A speculation tax on vacant residential property.

Changes in stock option treatment to eliminate deferred tax.

And if Trudeau gets his majority this year, most will be implemented during the next four years.

Posted by Tom on Monday, March 29th, 2021 at 2:14amGM- I don’t think Trudeau is going to mess with the capital gains exemption. It’s political suicide.

Posted by T-Rev on Monday, March 29th, 2021 at 5:52amHowever, if he does, it’ll be done with some sort of grandfathering formula that keeps the tax free gains on a property up to a certain implementation date, and taxes gains after that date. Alternatively, it will be brought in progressively: A small portion (day 10%) of gains taxable upon implementation, progressing to the max (50%? 100%???) in 25 years.

I agree that Trudeau, one he gets his likely majority this year, will increase taxes a lot. I've already heard that investment gains may be taxes at 75% income, rather than the 50% now. As well, I think it was foolish for Harper to cut the GST, so I suspect the feds will increase is up to 7% to 9%.

Posted by Tom on Monday, March 29th, 2021 at 5:55amJason TO, agree 100% that personal residences are unlikely to be taxed for capital gains, but I wouldn’t completely rule out a phased in approach where gains after a certain date are taxed according to some sort of formula, and existing gains are exempt. Still, I’d bet it doesn’t happen.

Posted by T-Rev on Tuesday, March 30th, 2021 at 12:55amWhat I disagree with is the fact they won’t “raise interest rates” because of the cost of servicing the national debt. Governments don’t set their own borrowing rates. The bond market does. Just ask the Greeks. The BoC can leave variable rates as low as they like, but the government funds deficits through the sale of bonds. If there’s risk if either inflation or insolvency, bond buyers will demand a higher yield, and the cost of servicing rolled over debt will start to rise. That’s how it works- has little to nothing to do with the interest rates set by the BoC.

It's all wishful thinking. GTA is where the majority of population is, Trudeau won't touch Principal Residence with a ten foot pole (Liberal already shut it down). Who would want to pay tax on his 1.5 to 2 million family home. Nobody.

Posted by Jason (Toronto) on Tuesday, March 30th, 2021 at 6:04amEnding OAS universality ? No way. He is the one that cancel the phase in of age 67 for OAS, remember?

They won't raise interest rate as that would mean they will be paying higher interest on the national debt. Canadian dollar is already very strong in comparison to usa, and if he raise the interest rate, it would mean CAD is even stronger, bad for export which is bad for Ontario and even bad for Alberta.

Trudeau is Trudeau, he just won't do anything, it is all just lip service. He is hoping that usa economy will pick up, which it would eventually, and he just take a ride with it.

Re: GM- I don’t think Trudeau is going to mess with the capital gains exemption. It’s political suicide.

Posted by Tony on Tuesday, March 30th, 2021 at 9:31pmHowever, if he does, it’ll be done with some sort of grandfathering formula that keeps the tax free gains on a property up to a certain implementation date, and taxes gains after that date.

A V-Day or valuation day will be announced and everyone will remember that day in history. All the capital gains after the V-Day will be taxed at the capital gains rate and speculation will be taxed at 100 percent... anything held for less than two years upon sale. I remember the V-day or valuation day for capital gains was way back in either 1966 or 1968.

All you people who think Trudeau won't do the unthinkable...

Posted by GM on Wednesday, March 31st, 2021 at 6:48amJust look at what he's been doing to Canada these last 4 or 5 years. Trying his utmost best to completely destroy this country.

Once he has a majority he'll do what nobody could even imagine today.

He is so corrupt and compromised it is beyond belief.

So look for all kinds of taxes that you never dreamed of. His goal is to make everyone equal by destroying the wealth of those with ambition, rather than encouraging those without ambition to do something about their lot in life.

Leave A Comment