Listing information last updated on October 16th, 2025 at 5:52am CDT.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

Act as if what you do makes a difference. It Does. - William James

Posted by Liv Real Estate

on

Act as if what you do makes a difference. It Does. - William James

Posted by Liv Real Estate

on

40 Responses to Weekly Market Update Mar. 5/21

Plenty of listings whereas outside of Alberta there's no listings at 5 times the price.

Posted by Tony on Thursday, March 4th, 2021 at 8:12pmYou would think that investors, looking at the rest of Canada, would see Alberta properties as a steal, most immediately cash flowing. In other parts of the country it is impossible to cash flow, or even get close to it.

Posted by GM on Thursday, March 4th, 2021 at 8:43pmAnd what's with the condos? Falling in price from last week???

Sara, is this price a new record for this time of year? Anecdotally I know there are insane bidding wars now, and houses going for $100K+ over ask in Edmonton.

Posted by Tom on Thursday, March 4th, 2021 at 8:55pmGM: I would never buy a condo. They're building too many, and Covid taught us communal living can be dangerous.

Posted by Tom on Thursday, March 4th, 2021 at 8:56pmHey Tom,

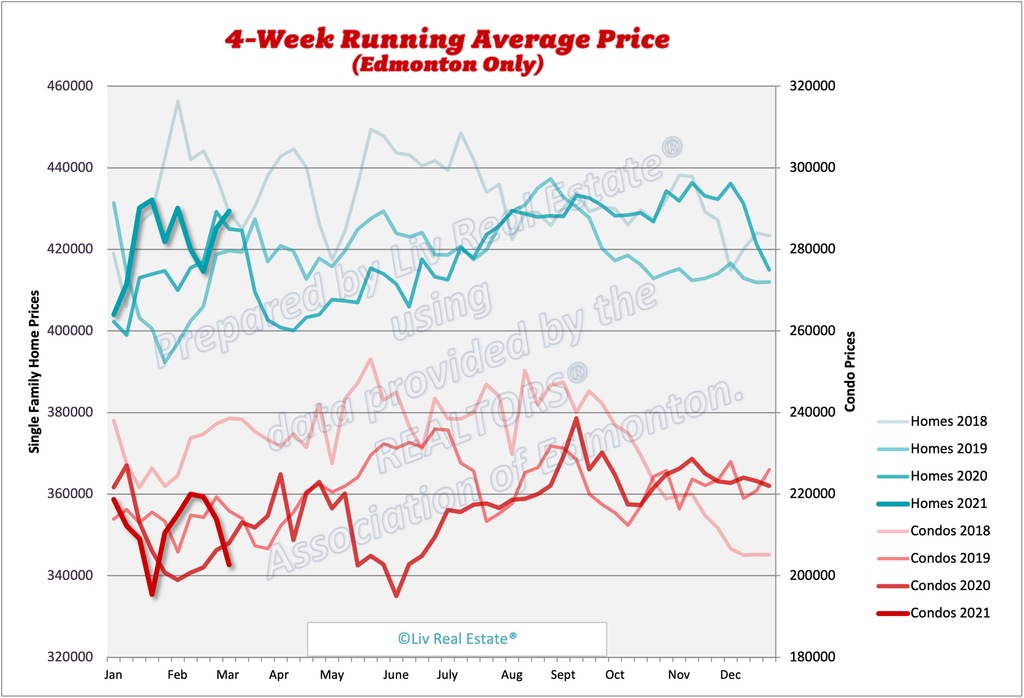

Posted by Sara MacLennan on Thursday, March 4th, 2021 at 10:26pmNo, we're not at record prices for March, we've been in the high $430's in March 2015-2017. I have not heard of any homes going for that much over list price in the Edmonton area, there are certainly multiple offers on a lot of lower-priced homes but the sale prices are much closer to list price than that.

John: You could not be more wrong. Edmonton real estate is destroying Calgary real estate in every way, whether it be price appreciation or sales. Edmonton houses prices are doing extremely well.

Posted by Tom on Friday, March 5th, 2021 at 7:07pmT-Rev,

Posted by GM on Friday, March 5th, 2021 at 7:12pmWhy do you say amateur landlords look for cash flow?

What landlord would buy a rental property that didn't cash flow?

Someone in Vancouver or Toronto hoping for the greater fool theory to make them money I guess.

Sara,

Posted by John on Friday, March 5th, 2021 at 7:13pmUnless I'm readings the numbers wrong, my house in Westmount in the last 5 years, I have lost money, holding 3 properties, really upset. i see listings in Westmount, builders are getting foreclosed. Zolo website, Calgary Single family $530k pre-covid and now $570k Edmonton, $426k pre-covid, now $429. Calgary Aug 2015, stats, single family $515k, now $570k. We are selling around 1.000 homes a month, while Calgary is doing double, don't think this is good. You would have to be a fool to invest here.

The only thing I hope and pray is that we get 50 percent of Calgary's numbers.

Posted by John on Friday, March 5th, 2021 at 7:16pmTom,

Posted by John on Friday, March 5th, 2021 at 7:27pmI have spoken to a few realtors that know both markets and the difference is huge. Just look at the numbers on zolo, numbers don't lie. We have probably 5 percent less population than Calgary. I didn't realize being 45 mins away from the mountains would be so huge, especially in the pandemic. Why did Infosys decide to make their Canadian base in Calgary, not here?

John: As Sara told you, we're dominating Calgary the last five years. The oil collapse has hurt them badly, whereas we have stable government jobs with no layoffs and some salary increases there. I don't think we need Infosys to be honest. Calgary needs it way more, as their economy is doing far worse.

Posted by Tom on Friday, March 5th, 2021 at 10:14pmTom,

Posted by John on Friday, March 5th, 2021 at 10:42pmWhere are you getting this information that we are crushing Calgary, besides what Sara is saying?

Every single news outlet has Calgary destroying us, not even close. I know this blog is Sara, but numbers don't lie, they are almost outselling us 2-1. Sara needs to come back here and shows us numbers that Edmonton is beating Calgary.

https://www.google.com/amp/s/beta.ctvnews.ca/local/calgary/2021/3/2/1_5331214.html

Posted by John on Friday, March 5th, 2021 at 10:50pmI think Sara is looking at the last 6 years not just what has happened in the last 8 months but hopefully she’ll chime back in and give us more of her opinions that many of us here respect.

Posted by Still employed in AB on Friday, March 5th, 2021 at 11:51pmI wonder if supply is about to get dumped on the market as some people have been waiting to exit the market for years after buying with 5% down at the last peak and then leaving the province when their employment disappeared. Condo’s are a disaster but I think they could fall a lot further. My 100 unit building now has 5 on the market. A condo near me (separate entrance no shared air) recently sold for 290 - the seller bought it for 370 in 2017. There’s also many newer landlords that bought an investment condo during the last boom, are cash-flow negative, and experiencing higher vacancy. Lots of larger landlords are offering 1-3 months free rent on a 1 year lease.

Mortgage rates are now on the rise and the feds may introduce new measures to cool hot markets. Changes to down payments or debt service ratios could hurt the market in Alberta as well. Another potential landmine is what will happen to taxes in cities with low transit ridership once the money from Ottawa runs out.

Not sure why you'd look for cash flow when you are planning to "flip" the property

Posted by Karlhungus on Saturday, March 6th, 2021 at 2:55amHi GM,

Posted by T-Rev on Saturday, March 6th, 2021 at 2:58amYou asked why investor money isn’t pouring into AB because our properties can provide instant cash flow. There’s really three main types of investor when it come to RE: Local retail investors who buy to either flip or be landlords, institutional investors who are aren’t looking at individual units or SFHs but at purpose built apartment buildings, and out of town retail investors who might buy individual units or SFHs.

The institutional guys (I.e. pension funds and REITs) are putting money into Edmonton. You just don’t see it because of the type of property they buy doesNt show up on the stats. And yes, cash is king to these guys, but that’s not the category of investor you’re talking about.

You’re asking why average retail Joes like you and me aren’t putting our excess capital into AB properties to become amateur landlords. Some certainly are, as investment properties get purchased every day, but we’re certainly not seeing a buying frenzy or accompanying price appreciation like places outside the prairies. My response above was that local retail investors care about cash flow- they generally buy for the long term and manage the property themselves to save management fees. But the pool of buyers Of this type is limited to the local population for the most part. Even then, I’m not sure the math is that great without price appreciation. After you factor in taxes, insurance, maintenance, and the joys of being a landlord in our increasingly socialist society (evictions ain’t getting easier, and just wait until Notley is premier again In two years), you have to risk an awful lot and I’m not sure cash flow is guaranteed. Might as well get a part time job- guaranteed pay, no risk. Again, I’ve been there, this isn’t from the cheap seats. All this to say, in the absence of price appreciation (ie underlying supply and demand imbalance) it’s no wonder local investors aren’t piling in to drive prices up.

Now, as for non-local investors, they’re not looking for cash flow. There’s no way they can- you have to hire a management company, and that will eliminate any chance you’ve got of cash flow. Out of town investment happens for one reason only: speculation on price appreciation. If a market is hot and going up, capital will pour in as flippers, both local and out of town, buy up property. They’re not worried about cash flow. They’re mainly concerned that the value of the property is increasing faster than the interest rate, as your leveraged bet really pays off in this case. And that ain’t happened in Alberta in many years now.

So, to summarize: long term investors concerned with cash flow probably have better places to park their money, and there’s no climate to attract flippers. Thus, limited investor activity.

NVM I misread your comment

Posted by Karlhungus on Saturday, March 6th, 2021 at 3:14amGM:

Posted by Tom on Saturday, March 6th, 2021 at 3:17amNo real estate investments really outside of a few small town has positive cash flow anymore. It's all about capital appreciation. Considering all of the purpose built rental being completed or under construction in Edmonton, adding thousands of units soon, if a unit is currently cash flow positive, it won't be for long. It's not smart to go for positive cash flow, when that can disappear so quickly as we'll see soon in Edmonton. That's why amateurs seek it out. It will all be about capital appreciation here soon, which is what almost every Canadian city has already transitioned to for real estate investors.

Hi GM,

Posted by T-Rev on Saturday, March 6th, 2021 at 3:55amIf I understand, you asked why investor money isn’t pouring into AB because our properties can provide instant cash flow. Let’s look at this for the different investor types. There’s really three main types of investor when it come to RE: Local retail investors who buy to either flip or be landlords, institutional investors who are aren’t looking at individual units or SFHs but at purpose built apartment buildings, and out of town retail investors who might buy individual units or SFHs.

The institutional guys (I.e. pension funds and REITs) are putting money into Edmonton. You just don’t see it because of the type of property they buy doesNt show up on the stats. And yes, cash is king to these guys, but that’s not the category of investor you’re talking about.

You’re asking why average retail Joes like you and me aren’t putting our excess capital into AB properties to become amateur landlords. Some certainly are, as investment properties get purchased every day, but we’re certainly not seeing a buying frenzy or accompanying price appreciation like places outside the prairies. My response above was that local retail investors care about cash flow- they generally buy for the long term and manage the property themselves to save management fees. But the pool of buyers Of this type is limited to the local population for the most part. Even then, I’m not sure the math is that great without price appreciation. After you factor in taxes, insurance, maintenance, and the joys of being a landlord in our increasingly socialist society (evictions ain’t getting easier, and just wait until Notley is premier again In two years), you have to risk an awful lot and I’m not sure cash flow is guaranteed. Might as well get a part time job- guaranteed pay, no risk. Again, I’ve been there, this isn’t from the cheap seats. All this to say, in the absence of price appreciation (ie underlying supply and demand imbalance) it’s no wonder local investors aren’t piling in to drive prices up.

Now, as for non-local investors, they’re not looking for cash flow. There’s no way they can- you have to hire a management company, and that will eliminate any chance you’ve got of cash flow. Out of town investment happens for one reason only: speculation on price appreciation. If a market is hot and going up, capital will pour in as flippers, both local and out of town, buy up property. They’re not worried about cash flow. They’re mainly concerned that the value of the property is increasing faster than the interest rate, as your leveraged bet really pays off in this case. And that ain’t happened in Alberta in many years now.

So, to summarize: long term investors concerned with cash flow probably have better places to park their money, and there’s no climate to attract flippers. Thus, limited investor activity.

Calgary market is absolutely on fire, prices are up a lot pre-pandemic. Edmonton has all excuses in the world, why property is not going up, low oil prices, pandemic. Calgary is outselling us 2-1 when their population is only a few percent higher. I think the real reason is Calgary is so close to mountains, what is that worth and their downtown, Chinatown is so much more desirable and the weather is normally warmer. I think, world real estate market is up 20+ percent, so who in the right mind will invest here. I can tell you with a couple of properties, Edmonton sucks. Appreciation is so much more valuable compared to cash flow, why is that a topic of debate. When your house goes up year $50,000+, compared to you small cash flow. I know people that have purchased in Toronto have made almost double their property in a couple of years. Most people who bought 8 years ago are still under water.

Posted by John on Saturday, March 6th, 2021 at 5:24amRe: Investors, who can move capital anywhere, generally either invest in REITs.

Posted by Tony on Saturday, March 6th, 2021 at 5:52amThe U.S. stock market is the most overvalued in history by light-years. It's so bad it makes the summer of 1929 look like a good time to have bought stocks.

At least in the housing market in Edmonton where the replacement costs are double or triple losses are negligible and your return is about 5 times that of a GIC if you can find renters.

Wow, you couldn't be more wrong. Edmonton has fared far better than Calgary over the past 5 years.

Posted by Sara MacLennan on Saturday, March 6th, 2021 at 5:54amSara, we need "like" buttons like facebook.

Posted by GM on Saturday, March 6th, 2021 at 6:02amAnd an indication on who we are replying to.

I'd also like to see notifications sent to my email whenever someone replies to me.

If possible...

Its pretty easy to find properties that cash flow in Edmonton.

Posted by Karlhungus on Saturday, March 6th, 2021 at 6:35amGM- only local amateur landlords are looking for cash flow, and prices are still too high to make sense. Investors, who can move capital anywhere, generally either invest in REITs if they’re long term and looking to manage risk, or they’re flippers looking for markets with capital appreciation.

Posted by T-Rev on Saturday, March 6th, 2021 at 6:45amREITs are investing investor capital in Edmonton. Several purpose built rental projects have been completed or are under construction in the City.

Flippers have no interest in Edmonton as there’s little capital appreciation. As a guy who’s done it, it’s all fun and games to leverage 80-95% and buy houses when they’re going up, really sucks when it’s stagnant or declining. Edmonton doesn’t have a trend towards capital appreciation, so it doesn’t matter what the rent to carrying cost is, as no out of town flipper wants to be a landlord.

My $0.02

Tom,

Posted by John on Saturday, March 6th, 2021 at 7:07pmHow are we even close. I have wanted to sell all my houses for 2 years now, but the market has been terrible, so held off. I have 3 realtors give me assessment, pre-covid and quoted same list price. I have been investing for over 14 years and see so much ups and downs, but when whole Canada is going up 10-15 percent, Calgary on fire, this is terrible. I don't know about you, but losing money sucks. I guess we can all have hope.

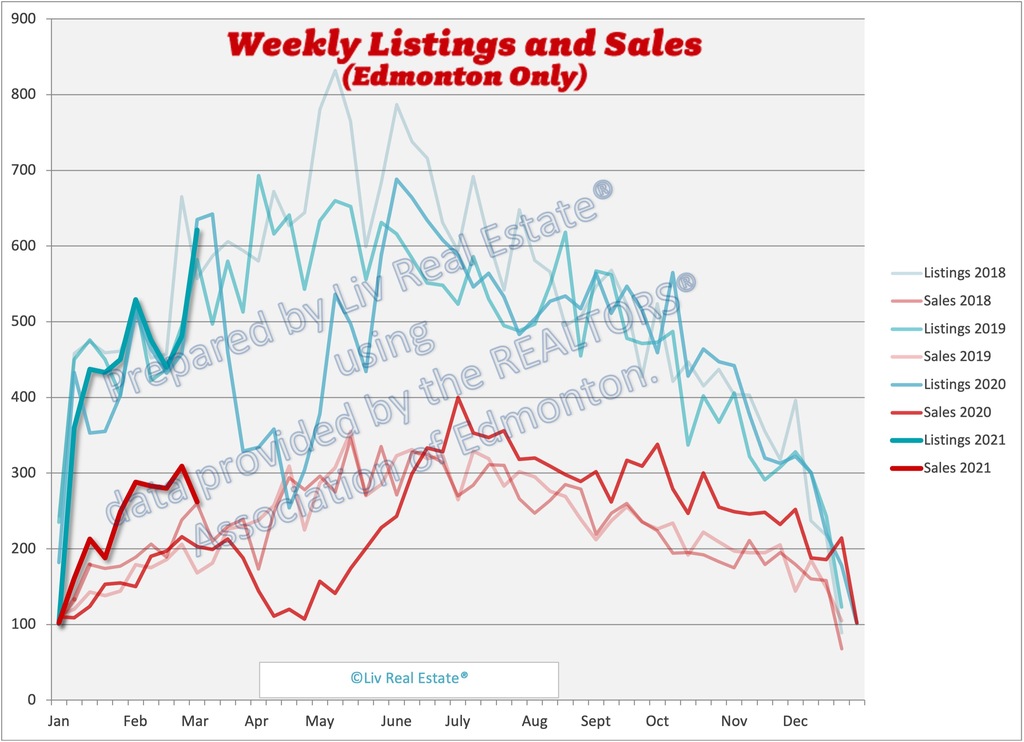

Calgary and Edmonton are both seeing a lot more activity than they've seen in years. Edmonton's sales were up 51% in February year over year.

Posted by Sara MacLennan on Saturday, March 6th, 2021 at 11:35pmhttps://www.livrealestate.ca/blog/2021/03/single-family-home-sales-surge-in-edmonton-in-february.html

Calgary was up 54%.

Calgary's single-family detached benchmark is up 5% over last year and Edmonton is up 5.4%.

I don't see how this makes Calgary's market "on fire" and Edmonton's "terrible."

@GM

Posted by Sara MacLennan on Saturday, March 6th, 2021 at 11:38pmI totally agree, we used to have that and it's disappeared. I'll look into it. It's been a while since we've had a good debate!!

John: Listen to Sarah; she knows more than you. Just because your properties are not desirable, does not mean the rest of us aren't benefiting from our white hot market. Nothing that you're saying has any bearing in reality.

Posted by Tom on Saturday, March 6th, 2021 at 11:52pmJohn: And as Sarah is saying, the statistic show we're doing better than Calgary.

Posted by Tom on Saturday, March 6th, 2021 at 11:52pmJohn: I saw that link. Edmonton is in the same boat. In fact, Edmonton is VERY stable, due to the UCP budget which reversed cuts.

Posted by Tom on Sunday, March 7th, 2021 at 4:44amInteresting read... https://www.theglobeandmail.com/canada/alberta/article-calgary-and-edmonton-housing-market-surge-is-a-head-scratcher-for-many/

Posted by Sara MacLennan on Monday, March 8th, 2021 at 4:47amJohn,

Posted by GM on Monday, March 8th, 2021 at 8:56pmSounds to me like you should have bought in Calgary, not in Edmonton.

Why did you choose Edmonton in the first place. Obviously being close to the mountains, according to you, is a huge selling point. And now the market is taking off, leaving you behind.

I suggest you sell your Edmonton properties for whatever you can get for them and take that money and invest it in Calgary before prices go up 100% there. That way you won't have any more regrets.

By the way, complaining about selling prices won't make them go up. Just like in the stock market - if your stock goes down you can either sell it or wait for it to recover. Complaining about your Microsoft stock going down while Apple stock is soaring won't help your Microsoft go up.

GM,

Posted by John on Monday, March 8th, 2021 at 11:28pmI originally made a point of how Calgary fared way better than Edmonton and everyone was attacking me, not sure why? Yes, I'm in process of dumping them, just waiting for the right opportunity.

John,

Posted by Renu Bhattacharya on Tuesday, March 9th, 2021 at 3:18amIt is true right now Calgary is doing lot better than Edmonton, I am with you on it, but in past few years they were in very bad shape, houses did not sell for 15 months, but now game changed and houses are selling over list price, but that is not happening in Edmonton very much. I do mortgages for both Calgary and Edmonton and I am seeing clients complaining how hard it is now to get a good property below list price, a client just got a 5720000 listed property for 580000. Properteis are selling in couple of days there right now.

Sara,

Posted by John on Tuesday, March 9th, 2021 at 6:17amCalgary is outselling us by 2-1 and prices are driving up. Calgary has 6 percent more population than us, how is it possible that are selling so much more houses? I'm not sure why you won't admit it, when the data is there. Sales in Calgary are as crazy as 2007, which is definitely on fire. How can anyone even dispute that.

This is from your answer to a poster, doesn't sound like Edmonton market on fire. I have spoken to 3 realtors that do both markets and they have all said Calgary is on fire.

Hey Tom,

No, we’re not at record prices for March, we’ve been in the high $430’s in March 2015-2017. I have not heard of any homes going for that much over list price in the Edmonton area, there are certainly multiple offers on a lot of lower-priced homes but the sale prices are much closer to list price than that.

https://www.google.com/amp/s/calgaryherald.com/life/homes/new-homes/february-residential-resales-the-best-since-2014-pushing-calgary-into-sellers-market/wcm/cd21aaa5-ae86-4380-9c1b-120b8377d3ff/amp/

Posted by John on Tuesday, March 9th, 2021 at 6:17amSara,

Posted by John on Tuesday, March 9th, 2021 at 6:31amI have not seen any article on Edmonton, like this crazy and there was another article, Calgary real estate is like Mad Max.

It just makes sense why people are realizing Calgary is so crazy:

45 mins away from mountains

Half distance to Montana, compared to Edmonton

Most flights will connect from Calgary compared to Edmonton

Warmer with chinook

People who relocate from Vancouver, Toronto will probably choose Calgary because of mountains work from home, covid

Being a long term investor, even I can admit that I really screwed up and picked Edmonton to invest. Cash flow means nothing when the property doesn't appreciate. If my houses were in Calgary, I could easily sell with tenants, high price.

In Edmonton, I have to kick out my tenants, spend lots of money and hope I get good price. I'm shocked people are even debating this.

Tom,

Posted by John on Tuesday, March 9th, 2021 at 6:40amMy properties are I'm Westmount, Glenora, Inglewood, single family house, so I think they are in pretty good areas, so I would think they are desirable. Based on what realtors are telling me, I'm not liking what I'm hearing.

Tom,

Posted by John on Tuesday, March 9th, 2021 at 6:59amEdmonton has only sold 1,076 homes compared to Calgary 1,836, so you tell me which market is better? Calgary is almost selling as many houses as Ottawa and that market has gone up a couple hundred grand in a couple of years.

https://realtorsofedmonton.com/web/RAE_Public/Market_Stats/Monthly%20Market%20Statistics/RAE_Public/Market_Statistics/Monthly_Market_Stats.aspx

Leave A Comment