Data is supplied by Pillar 9™ MLS® System. Pillar 9™ is the owner of the copyright in its MLS® System. Data is deemed reliable but is not guaranteed accurate by Pillar 9™. The trademarks MLS®, Multiple Listing Service® and the associated logos are owned by The Canadian Real Estate Association (CREA) and identify the quality of services provided by real estate professionals who are members of CREA. Used under license.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

Have a great weekend!

Posted by Liv Real Estate

on

Have a great weekend!

Posted by Liv Real Estate

on

16 Responses to Weekly Market Update May 25/18

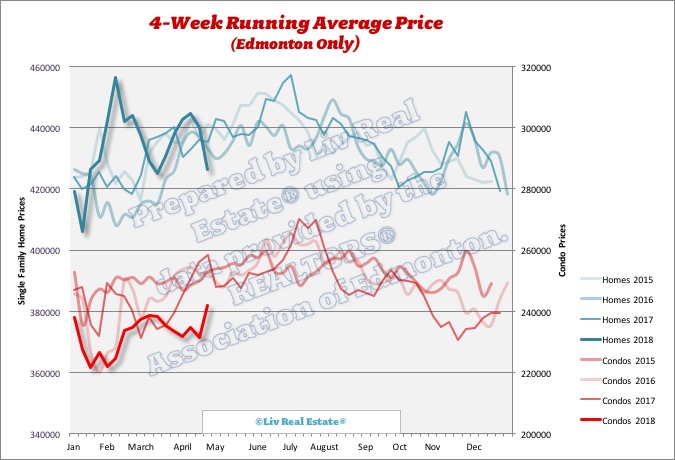

The author is full of baloney. Resale townhouses and resale apartments today in Edmonton are down more than fifty percent in price from the spring 2007 peak. These are the identical townhouses and identical apartments. The author totally forgot the townhouse and condo market.

Posted by Tony on Thursday, May 24th, 2018 at 9:51pmYou understand "5-years" goes back 5 years, not 11 years right?

Posted by a common guy on Thursday, May 24th, 2018 at 10:10pmAnd you are saying that a typical town house that was $350k in 2007 is now $175k?! Even if you set aside that the property is now 11 years older this is pure BS.

Like I said... if the Liberals are voted in again next election the whole housing market in Canada should be "affordable" for everyone. I imagine their goal is to get house prices down 90%. Then everyone would be happy. Right?

Posted by GM on Thursday, May 24th, 2018 at 10:12pmLooking great, five year high for this time of year! Damn, I should have bought more houses.

Posted by Tom on Thursday, May 24th, 2018 at 10:12pm@acommonguy

Posted by Anonymous on Friday, May 25th, 2018 at 3:58amHe's saying that the the new condo in 2007 is now worth about half as much as it was then. He is not comparing new condos then and new condos now; he's comparing what was new then to what is old now.

Why would you still be here? You've lost, houses are doing quite well.

Posted by Tom on Friday, May 25th, 2018 at 9:41pmI am still waiting for the naysayers, and the right wing (and also left wing) ideologues who have been screaming bloody murder and the downfall/crash of the housing markets to come out and spread their horse kah kah.

Posted by 123kid on Saturday, May 26th, 2018 at 2:37amWhere are you all now?

@123kid

Posted by Anonymous on Saturday, May 26th, 2018 at 4:10amWe're still here, don't worry.

Other than looking for an update in Weekly Stats there is not much to be here for Tom, or maybe some entertainment you and your "left wing" comrades are providing with your shortsighted comments.. First, I thought you were investing in sky condos and not houses ... As for this rosy picture of the real estate market you are painting, hopefully this positive outlook will last this fall considering the high inventory but I guess that's not seem to be relevant to you.

Posted by Reggie on Sunday, May 27th, 2018 at 1:00amHey Wally,

Posted by Sara MacLennan on Sunday, May 27th, 2018 at 4:21amThere is a sale that was reported at $200,000,000. I assume this is an error and it hasn't been fixed yet. That one sale is affecting the average. I removed it from our weekly report since it was artificially inflating the average.

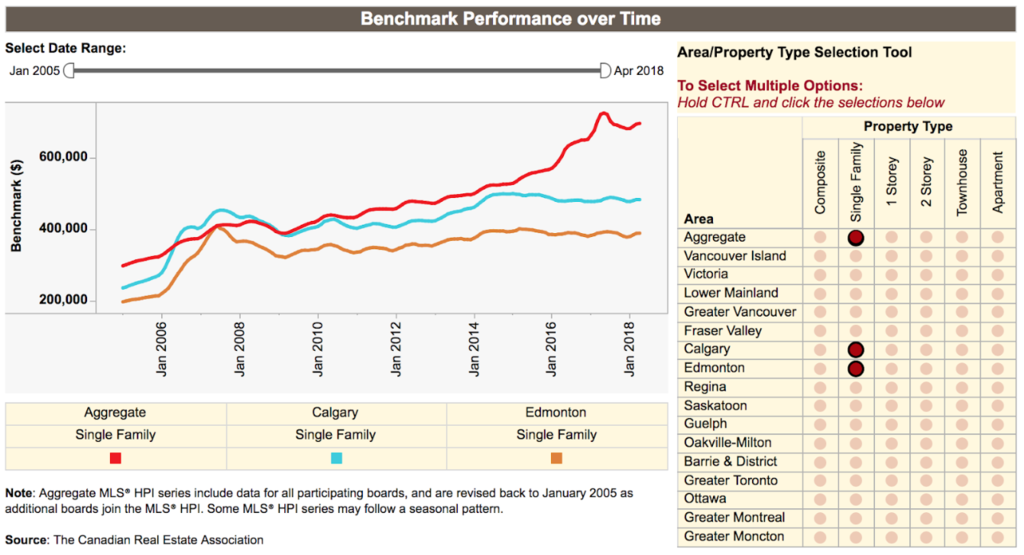

The article and associated graph tells me that there is very modest growth in housing prices in Edmonton relative to other parts of the country. That is good for the young who want to be buy a home but I don't understand why an investor would tie up their hard earned in the Edmonton real estate market.

Posted by Stu on Sunday, May 27th, 2018 at 6:03amThere's something very strange happening just in Edmonton and it was happening last year as well and also only in Edmonton which is if you look at the moving average on Zolo website and I've been looking since last year in most major Canadian cities you notice a very big fluctuation in price I mean a couple of times the average for all houses reached over 1 million where in reality it's around 370-380 k and stayed there for a little while and if you look right now it's in the 600-700 k range.

Posted by Wally on Sunday, May 27th, 2018 at 7:12amOk now I know the average can be skewed up and down at times by luxury properties or very cheap ones but I wonder why it is happening to very extreme levels and only in Edmonton when it is supposed to be happening everywhere normally.

What's going on in Edmonton? Any idea?

Thanks Sara. Now I get it.

Posted by Wally on Monday, May 28th, 2018 at 12:45am@ Stu and some others who have been complaining about the flat market for investors in the last decade in Edmonton I tell them it is normal to have a flat market because Alberta had a very big bubble almost from 2002 to 2007 when prices more than doubled so you know in the real estate cycle in Canada when something like that happens it is normal to have a correction of about 15%-20% for a few years after the bubble and then a flat market for sometimes up to 7-8 or more years.

Posted by Wally on Monday, May 28th, 2018 at 1:27amThe same exact thing happened in Toronto from 1986 to 1989 and a correction followed for almost 12 years.

But again as time passes prices will start to go up again slowly at first until the next bubble hit the same market like in Toronto in 2015-2017 and the bubble was supposed to continue until 2019 but this time they took measures and cut it short in 2017 to avoid a crash and severe recession that would have happened after 2019.

Anyways back to Edmonton the cycle will repeat like in Toronto but it will take time and now that almost 11 years have passed your chances are prices will start going up in a few years but slowly at first and as time goes by be ready for the next bubble probably intensifying somewhere after 2030 but prices will still start to go up before 2030 and like I said probably in a few years but not in double digits at first.

The point of my post is people sometimes are focused on one side of the equation and forget the other side like in Edmonton now they're bored with the flat market in the last ten years but they forgot that prices doubled in just two years 2006-2007 and forgot that those years were not boring at all and many investors who bought before 2005 made a killing but eventually you can't have a continuous bubble for ever because it is unsustainable without a correction.

I bought a built in 2004, 2 bedroom condo in 2007 for $276,000.

Posted by Greg on Monday, May 28th, 2018 at 2:29amI plan to list it this month for a fire sale price of $172,000 (market says might be worth only about $182k?) because I hate being a landlord.

I am one of many people in this situation who are trying to get rid of properties bought in the boom 10 years ago.

Greg, condos are never a good investment unless there's something great about them, like Sky Condos downtown.

Posted by Tom on Tuesday, May 29th, 2018 at 8:11pmLeave A Comment