Listing information last updated on October 15th, 2025 at 10:53am CDT.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

“The whole secret of a successful life is to find out what is one’s destiny to do, and then do it.”– Henry Ford

Posted by Liv Real Estate

on

“The whole secret of a successful life is to find out what is one’s destiny to do, and then do it.”– Henry Ford

Posted by Liv Real Estate

on

9 Responses to Weekly Market Update May 28/21

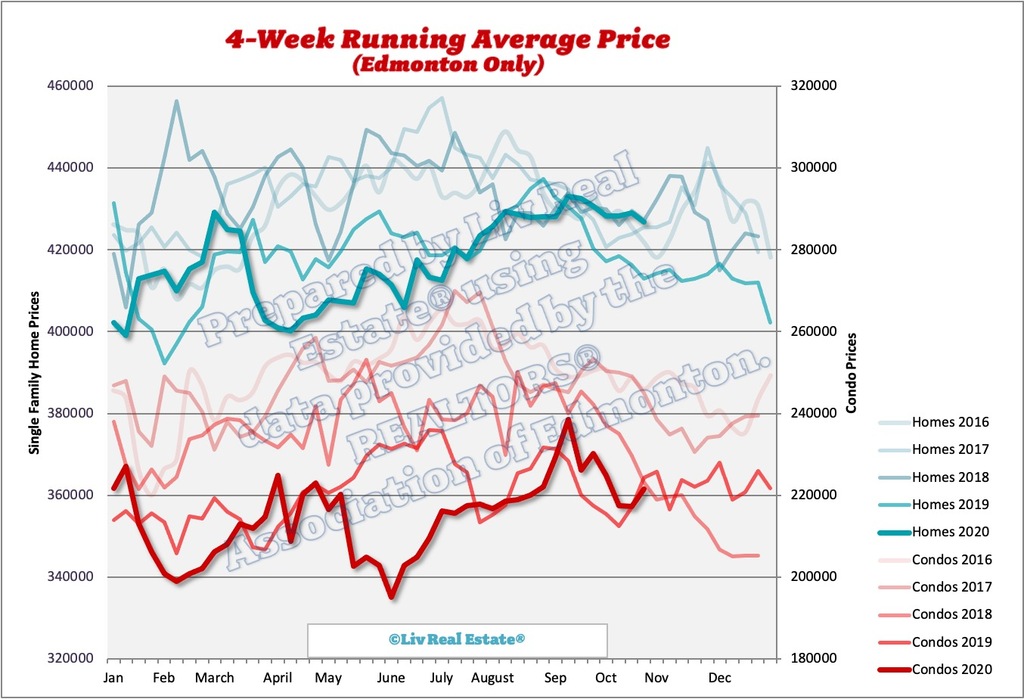

$460,000 is looking like the SFH peak for this year...

Posted by GM on Thursday, May 27th, 2021 at 10:56pmUnless we get a last minute surge in June.

GM, I agree. I think listings and sales have also peaked for this year. Buyers moved their decisions forward this year to take advantage of low interest rates.

Posted by Sara MacLennan on Friday, May 28th, 2021 at 12:00amHow come listings are dropping? Anyone knows?

Posted by Alex on Friday, May 28th, 2021 at 1:26amSara, you wrote "I think listings and sales have also peaked for this year." What is your forecast for Edmonton for the remainder of this year. Do you expect prices to remain flat at these current levels or decline a little. Thank you

Posted by DOK on Friday, May 28th, 2021 at 4:26amEverything now depends on the price of oil and natural gas as listings are blowing though the roof and sales are falling.

Posted by Tony on Friday, May 28th, 2021 at 4:50amListings have spiked by almost ten percent in the last week alone to 778. This was the hottest part of the market.

https://upsiderealty.ca/town.html

Market will stay strong into July. New stress test rules starting June 1st mean everyone who did a pre-qualification is going to be looking to spend their max budget before their purchasing power falls. Listings have dropped off over this last three week lockdown, but sales didn’t move down much meaning we’re eating into inventory. But, by August once people’s Pre-stress test rate holds have been used up, and with the inventory surge I expect to happen starting now through summer as Covid restrictions are eased and the old folks who have been afraid to list their homes begin to do so, but the market will start to balance. There will be decent demand through the fall though, as I don’t see meaningfully open borders until at least this winter, meaning nesting in a newer, bigger home will continue to be desirable. Anyway, I think we’re in the final 90 days of the sellers market, balanced by fall, and once people can go to Mexico and the US without restriction, I think we’ll tip back to a slight buyers market.

Posted by T-Rev on Monday, May 31st, 2021 at 4:10amThe April 20th 2017 stress test that was 20 percent caved the entire Canadian housing market in. This one is almost 5 percent. If this stress test doesn't halt the rise in southern Ontario and greater Vancouver housing prices they'll raise the level of the stress test.

Posted by Tony on Wednesday, June 2nd, 2021 at 1:24amLike before, it will only dampen the market for a short period, and then the price will go up again in both Toronto and Vancouver. Reason: Too much hot cash flowing around and nowhere to invest.

Posted by Jason (Toronto) on Wednesday, June 2nd, 2021 at 4:14amIt will get worse once Canada's border is open again.

@DOK - I expect prices will come down a bit, but remain higher than last year.

Posted by Sara MacLennan on Wednesday, June 2nd, 2021 at 4:17am@Alex - listings normally come down at this time of year.

@ T-Rev - the new stress test only affects uninsured mortgages, it doesn't seem to be having much impact in our market. I don't think we will see a surge in new listings, we've had clients from all walks of life selling their homes to take advantage of the seller's market.

@Tony - the previous stress test did have a major impact on our market for a longer period of time than the rest of the country, because we were already down due to oil prices. The markets in Toronto and Vancouver have already started to cool (don't forget sales are reported when they occur, not on possession, the stress test started impacting the market 3+ weeks ago).

Leave A Comment