Data is supplied by Pillar 9™ MLS® System. Pillar 9™ is the owner of the copyright in its MLS® System. Data is deemed reliable but is not guaranteed accurate by Pillar 9™. The trademarks MLS®, Multiple Listing Service® and the associated logos are owned by The Canadian Real Estate Association (CREA) and identify the quality of services provided by real estate professionals who are members of CREA. Used under license.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

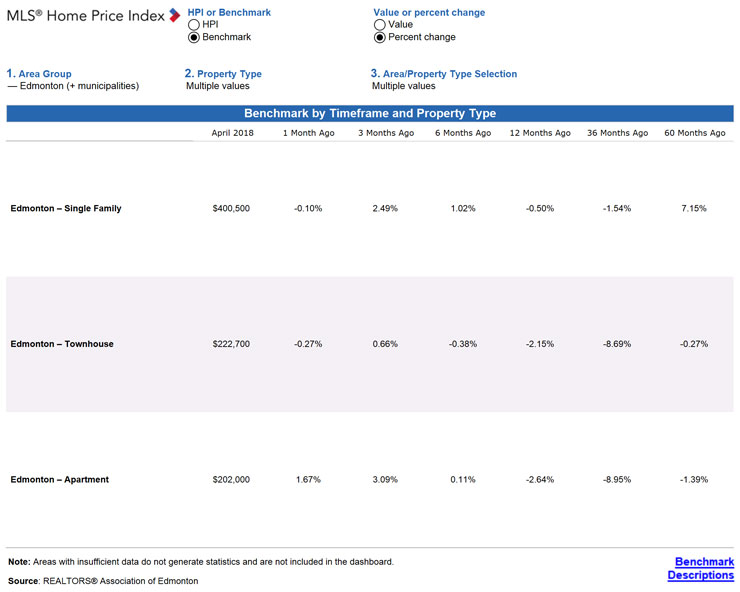

This chart shows the price of benchmark homes over time:

This chart shows the price of benchmark homes over time:

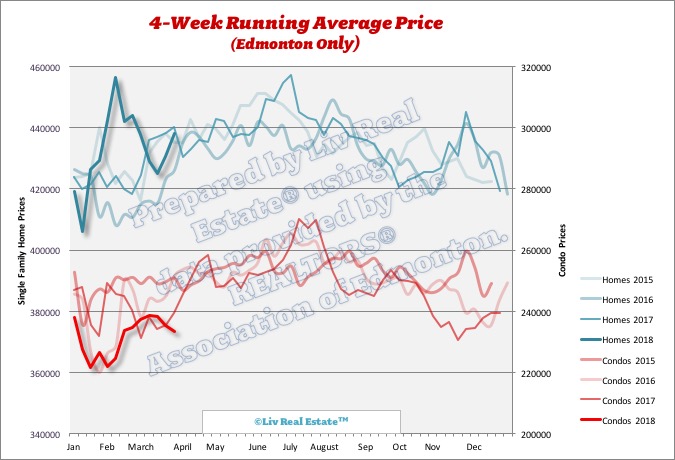

And here are our normal weekly charts:

And here are our normal weekly charts:

May the fourth be with you!

Posted by Liv Real Estate

on

May the fourth be with you!

Posted by Liv Real Estate

on

12 Responses to Weekly Market Update, May 4/18

According to the benchmark and seeing that Alberta was in a recession it looks like a bubble specially in the detached market.

Posted by Wally on Thursday, May 3rd, 2018 at 10:14pmNo chance UCP doesn't win

Posted by Karlhungus on Thursday, May 3rd, 2018 at 11:24pmTom, if UPC will win expect less gov jobs and recession in Edmonton.... NDP actually supported real estate in Edmonton....

Posted by bubu on Thursday, May 3rd, 2018 at 11:32pmI like Sara's comment about government intervention... Why you didn't complain when BoC lowered artificially the interest rate in the last years and why you don't complain about CMHC keeping interest rates even lower by taking the risk from the banks?

Well, no sense beating around the bush- prices falling, inventory climbing, sales:listing low, rates increasing and regulations growing. The question now becomes: how low do prices go, how long until we get to the bottom, and what is the best indicator of that bottom? Real estate is an unbeatable investment in rising markets, and the worst in falling. It’s the whole leverage thing- if you’ve got $50k, you can buy $50k in financial assets. That same $50k buys a $1,000,000 house with the right income, and your gains and losses are amplified 20-fold. The trick is to time it- which is impossible but fun to pretend you can :)

Posted by Trev on Friday, May 4th, 2018 at 1:11amI'd hate to see what would happen to home prices if oil was falling rather than rising in price.

Posted by Tony on Friday, May 4th, 2018 at 7:31amI would also hate to see how low housing and condos would go if the UCP gets in! I think Edmonton will be solidly NDP for that reason in 11 months.

Posted by Tom on Friday, May 4th, 2018 at 7:50ambubu,

Posted by GM on Friday, May 4th, 2018 at 9:59pmGoing with your train of thought, that means if the NDP get in again they should hire 500,000 more government employees. That will make things boom in Edmonton.

In fact, they should hire a million more. That will be even better for the economy.

What could possibly go wrong?

GM, I'm not a NDP fun...My comment is about the stupid level of borrowing to not lay off gov employees... If they would spend what they get in revenue ( only 60% of what they spend), 20% of the gov employees would be unemployed... don't tell me that is not affecting real estate....

Posted by bubu on Saturday, May 5th, 2018 at 12:24amIf people think the UCP will win, you really should save yourself $80,000 over the next few years and sell your house now.

Posted by Tom on Saturday, May 5th, 2018 at 7:22amYou're right that they would need to lay off 20% of the government's workforce to balance the budget, but I'm sure they would just raise taxes instead. They would have to.

Posted by Tom on Sunday, May 6th, 2018 at 6:08amTrev, leverage isn't limited to real estate. An investor can use leverage to acquire any asset such as shares. The difference between property and shares is the price of the asset is not updated daily and the asset is not liquid. Also you are not forced to sell property in a down turn. Shares you will get a margin call which forces you to crystallize losses.

Posted by Stu on Monday, May 7th, 2018 at 6:12amhttps://www.theglobeandmail.com/investing/personal-finance/household-finances/article-canadas-mortgage-test-just-got-tougher/

Posted by bubu on Wednesday, May 9th, 2018 at 1:02amIt looks like by the end of the year who qualified last year for a mortgage at 2% would need to qualify this year at 5.34% now and maybe 5.8-6% by the end of the year.... that is 35-40% less than a year ago.. ups.... Lower price market will be ok but condos at $400k and skinny houses for $6-800k will suffer...

Leave A Comment