Data is supplied by Pillar 9™ MLS® System. Pillar 9™ is the owner of the copyright in its MLS® System. Data is deemed reliable but is not guaranteed accurate by Pillar 9™. The trademarks MLS®, Multiple Listing Service® and the associated logos are owned by The Canadian Real Estate Association (CREA) and identify the quality of services provided by real estate professionals who are members of CREA. Used under license.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

Have a great weekend!

Posted by Liv Real Estate

on

Have a great weekend!

Posted by Liv Real Estate

on

2 Responses to Weekly Market Update, Nov. 2/18

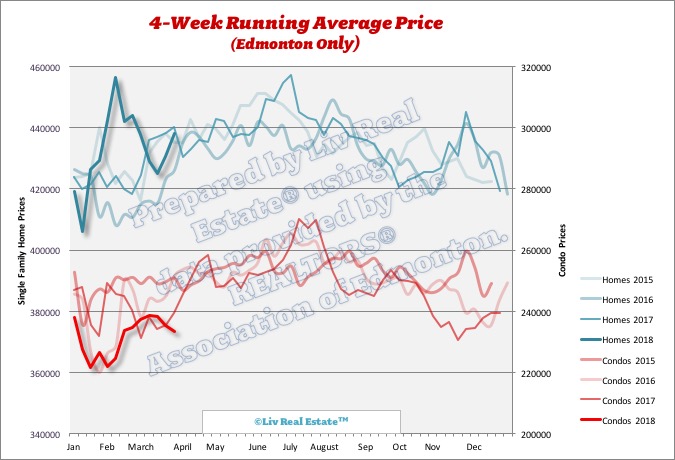

The exact same apartments and townhouses sold for double what they sell for today way back in the spring of 2007, 11 and a half years ago. The CRA tries to hide prices from the public but the people in Edmonton would be dumbfounded if they saw what these townhouses and apartments sold for way back in 2007. It still costs twice as much to rent than to own a resale apartment or resale townhouse. Unlike Vancouver and Toronto the B20 OSFI rules pushed none of the scarce demand to the lower priced part of the housing market.

Posted by Tony on Sunday, November 4th, 2018 at 9:32pmThis is very interesting; I figured for sure that it would be SFH that would see price declines and the condo market would be resilient (more specifically, I thought SFH 3rd and 2nd quartile prices would go down, and the people priced out of SFH 1st quartile would prop up the condos), but instead it's the opposite.

Posted by Anonymous on Monday, November 5th, 2018 at 6:27amFor people who might know, are new condos also hurting, or has the descent just wrecked the condo resale market?

Leave A Comment