Data is supplied by Pillar 9™ MLS® System. Pillar 9™ is the owner of the copyright in its MLS® System. Data is deemed reliable but is not guaranteed accurate by Pillar 9™. The trademarks MLS®, Multiple Listing Service® and the associated logos are owned by The Canadian Real Estate Association (CREA) and identify the quality of services provided by real estate professionals who are members of CREA. Used under license.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

Have a great weekend!

Posted by Liv Real Estate

on

Have a great weekend!

Posted by Liv Real Estate

on

9 Responses to Weekly Market Update, Oct. 26/18

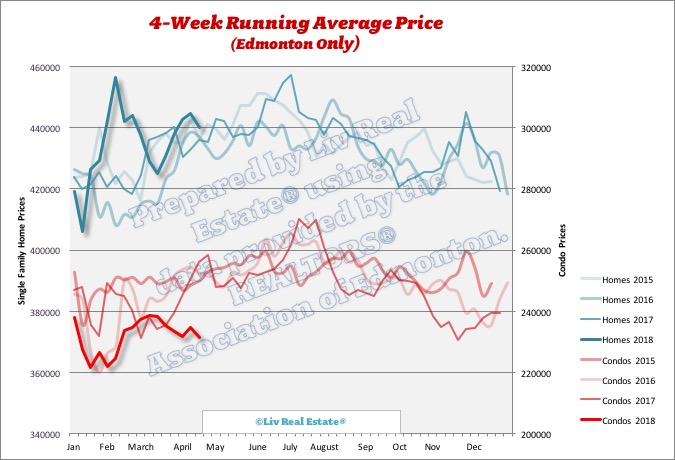

Condo market seems to be in a free fall. I wonder what vacancy rates are. This could present a good opportunity for investors to buy and look for renters?

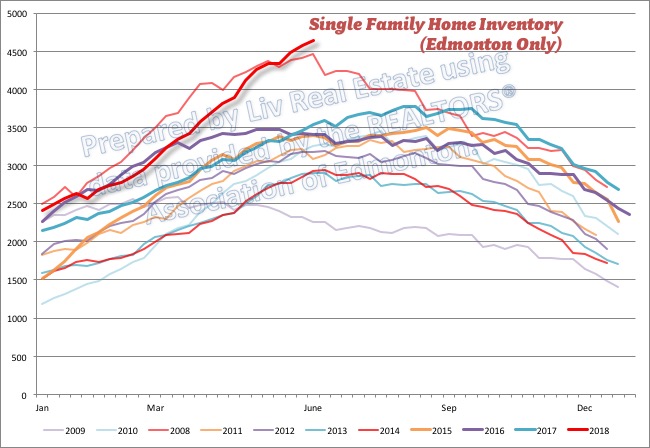

Posted by smitty on Thursday, October 25th, 2018 at 11:15pmI'm not sure how many renters there are. Notley has really slowed down hiring in recent months, which is going to really hurt Edmonton's economy. Hopefully it will pick up again soon after the election, which I feel is our only hope for the housing market. With the rate we're building more houses, employment (let's face it, mostly government hiring) will need to increase at 8% annually in perpetuity to just maintain current prices. In 2016 it was growing at around that rate, but it has slowed down, as I mentioned, in recent months to around 3%.

Posted by Tom on Friday, October 26th, 2018 at 12:01amHopefully Kenney isn't interested in slowing down government hiring, or Edmonton is in a lot of trouble. Condo prices have already plunged from $250,000 to $220,000 in recent months, and my analysis shows that if Kenney were to freeze government hiring for a few years, with the new condo supply coming online, we could be looking at condo prices falling another 35- 40%.

Sounds good I vote for him.

Posted by Andrii on Friday, October 26th, 2018 at 1:45amGM, how do you figure? There are so many government workers in Edmonton, how would slowing the rate of growth help our housing market?

Posted by Tom on Friday, October 26th, 2018 at 9:21pmMeanwhile, in Calgary...

Posted by GM on Saturday, October 27th, 2018 at 5:25amhttps://calgaryherald.com/business/local-business/overbuilding-puts-calgary-housing-market-at-risk-for-further-price-declines-cmhc

Less government will result in a booming economy.

Posted by GM on Saturday, October 27th, 2018 at 7:50amGM,

Posted by tom on Sunday, October 28th, 2018 at 7:32amEdmonton, being a government town, is doing much better employment-wise than Calgary. But we are building too much. We need some sort of 'green belt' to slow growth of housing.

Not sure if Sarah can respond but maybe it’s primarily high end homes and condo sellers who are getting very concerned w rising interest rates which is really affecting the average and median price. IMO it seems to me that rents for lower end and moderately priced condos have been firming up since 2016. Bwalk reit shows vacancy rates moving downward In Edmonton’s according to their latest earnings release.

Posted by Curtis on Thursday, November 1st, 2018 at 2:00amHey Curtis,

Posted by Sara MacLennan on Thursday, November 1st, 2018 at 8:44pmI think everyone who is trying to get a mortgage or renew a mortgage would be concerned with rising interest rates. I don't really follow rental rates, other than the report released by CMHC so I can't really comment on that.

Leave A Comment