Listing information last updated on October 17th, 2025 at 1:37am CDT.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

Posted by Liv Real Estate

on

Posted by Liv Real Estate

on

11 Responses to Weekly Market Update Sept.10/21

Well the election is just over a week away and the big issue is no one can afford a house or rent and Trudeau is attempting to make homes even more expensive by bringing in a tax free savings account for a down payment if you're under 40. Hopefully no one will vote for him.

Posted by Tony on Thursday, September 9th, 2021 at 8:01pmTom,

Posted by John on Thursday, September 9th, 2021 at 8:59pmWhy are you so bullish, $500k, when sales are terrible. I see quite a few price reductions, which isn't good sign. I want to get rid of 3 houses, but market not great, probably have to spend 15k getting ready, carrying costs, thousands, hardly making any money after all these years, lucky to sell, if find buyer. If you threw money in stock market, other investments in 10 years, you would have done way better. Why would you pump something that is not there. I can understand if you lived in Windsor and pumping up market.

https://www.google.com/amp/s/windsorstar.com/news/local-news/windsor-has-ontarios-most-affordable-housing-even-with-soaring-prices/wcm/99a33cf2-cf49-4313-b2d6-e793a332b32d/amp/

With it looking increasingly like Trudeau will win again, I do wonder how their anti-flipping tax will impact the market? It sounds like if you buy and hold a house for under five years, any gains will count towards income rather than capital gains. That way you can buy and live in a house long term, and it will still be tax-free. I understand that it's needed, though, but I wonder how the policy will actually look in practice, since the NDP wants something far harsher to penalize home buyers, who tend to be higher income.

Posted by Tom on Friday, September 10th, 2021 at 1:29amIf Trudeau wins again it will be the final death knell for Alberta.

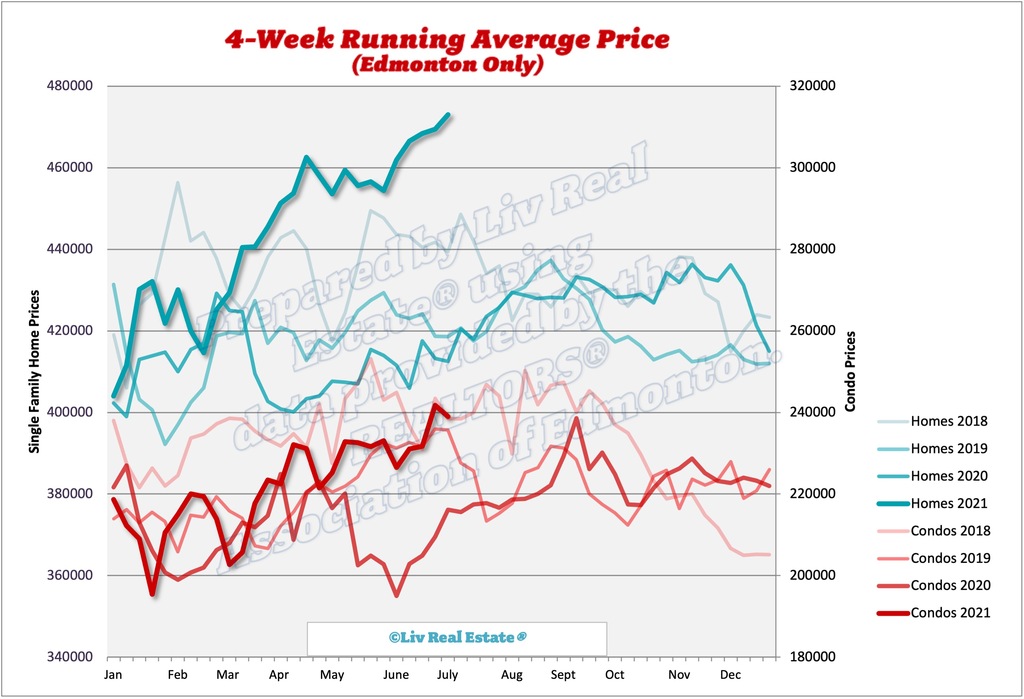

Posted by GM on Friday, September 10th, 2021 at 6:48amToo bad we didn't see an average above $500,000 this year (though we weren't far off), but I have no doubt we'll be well above that next spring.

Posted by Tom on Friday, September 10th, 2021 at 7:18amSo Five years from now is 2026... We will put this into a time capsule and open it in 5 years. LOL

Posted by Jason (Toronto) on Friday, September 10th, 2021 at 8:46pmWe will do that as a percentage of how much it will go up by. Whoever has the higher percentage win, according to government stat.

Remember, I was an Albertan when I came over here, I was bitching at how high the RE was at the time. It took me 10 years for my house to double in Calgary, The house price was already pretty high in GTA at the time, I was thinking if I break even I would consider myself lucky.

5 years ago, nobody knows anything about Crypto and mining, and yet I am doing both. As for stock market, yes, it is risky, but risky and reward comes hand in hand.

Stock market is actually not that bad, it is liquid, and if you are using the money you don't need today and invest in good stock, it is actually pretty safe.

Re: Class Action

Posted by Jason (Toronto) on Friday, September 10th, 2021 at 9:19pmHow about Class Action against U.S. government for printing trillions of USD?

Housing and stock market are not on the same footing. Real Estate is a local market.

Posted by Jason (Toronto) on Saturday, September 11th, 2021 at 2:45amI sold my house back in 6 or 7 years ago in Calgary for $520K, brought a house in GTA 5 years ago for $720. One more than double and the other 10% or so lower.

Sometimes you wonder whether it is wise to just move to GTA, brought a RE and work on some low paying job and get back to Alberta for cheap RE later. The gain in RE is much more than whatever money you make in Alberta.

Stock market is different, everyone is on the same footing no matter where you are. If you brought Apple, MSFT or TSLA, you make the same gain as the other, assuming you just buy and hold.

Uh, Jason, do you expect in 7 years that Ontario real estate will double again while Alberta's drops another 10%? Especially with the recent pressure for government to do something about the rampant speculating in Ontario and BC?

Posted by Justin on Saturday, September 11th, 2021 at 3:09amJason, Edmonton will almost certainly outperform the GTA over the next five years. I can't imagine prices going any higher around Toronto, whereas Edmonton has a lot of price growth, as it's so cheap now relative to salaries.

Posted by Tom on Saturday, September 11th, 2021 at 4:36amRe: Housing and stock market are not on the same footing. Real Estate is a local market.

Posted by Tony on Saturday, September 11th, 2021 at 7:53amThe housing market is based on supply and demand and the U.S. stock market is a ponzi fraud three ring circus sideshow the most overvalued ever in history and much more overvalued than tulip bulbs during the tulip bulb craze. Other countries have jailed the bankers for a log time like in Iceland. America refuses to jail or even prosecute the swines who rig Wall Street. The short sellers need to launch a class action lawsuit against the bankers for the trillions of dollars stolen from them the past 12 years.

Leave A Comment