Data is supplied by Pillar 9™ MLS® System. Pillar 9™ is the owner of the copyright in its MLS® System. Data is deemed reliable but is not guaranteed accurate by Pillar 9™. The trademarks MLS®, Multiple Listing Service® and the associated logos are owned by The Canadian Real Estate Association (CREA) and identify the quality of services provided by real estate professionals who are members of CREA. Used under license.

Data is deemed reliable but is not guaranteed accurate by the REALTORS® Association Of Edmonton. Copyright 2025 by the REALTORS® Association Of Edmonton. All rights reserved.

Trademarks are owned or controlled by the Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA (REALTOR®, REALTORS®) and/or the quality of services they provide (MLS®, Multiple Listing Service®).

Have a great weekend!

Posted by Liv Real Estate

on

Have a great weekend!

Posted by Liv Real Estate

on

12 Responses to Weekly Real Estate Market Update, July 6/18

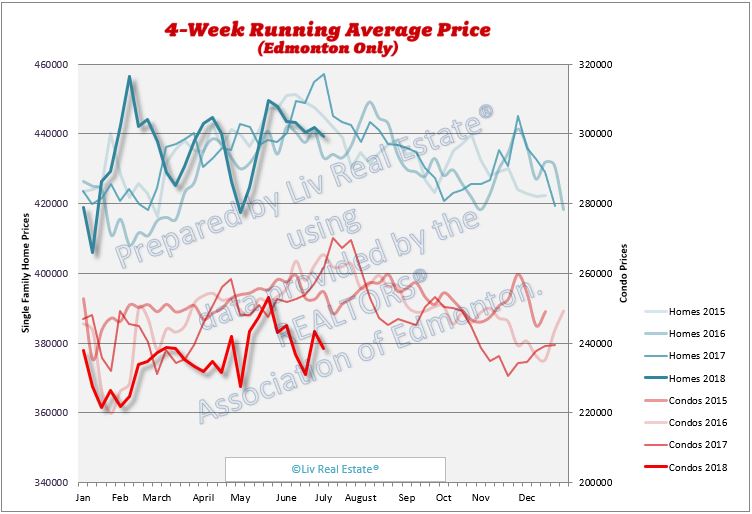

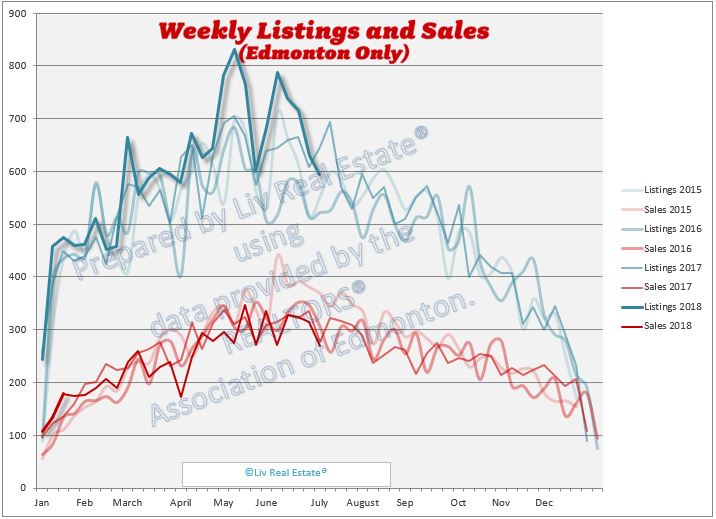

Was listening to a talk show on the radio this week (highway driving) and they were saying inventory is at record levels and prices are down 10% from this time last year.

Posted by arfmoocat on Thursday, July 5th, 2018 at 11:28pmMortgage rates up another 1/4 percent July 11th

Posted by arfmoocat on Friday, July 6th, 2018 at 12:12amI personally decided that I will go with variable rate because with variable you have more flexibility to wait for the bottom in 2019 or 2020 but if you go with fixed you will have the urge to move quickly before rates go up even higher. I don't like to be rushed into an overpriced property thus variable all the way.

Posted by Wally on Friday, July 6th, 2018 at 4:55amI'm not expecting the prices to drop 40 or 50% but whatever they drop it's better than nothing.

There's a problem though with apartment buildings which is the inventory is low as opposed to houses and condos.

Soft U.S. jobs numbers on the wage gains (all 100 percent fabricated data) so oil has a better chance to rise with. Of course with the dollar index above 95 they had to come out with soft data. Presently the crooks, shysters and master manipulators are long oil.

Posted by Tony on Friday, July 6th, 2018 at 7:59amBarista Bob, Tom, where are you guys? No comments about June stats or the interest rate this week?

Posted by bubu on Sunday, July 8th, 2018 at 5:05amLike people's interest in real estate lately, they've just faded away...

Posted by GPC on Wednesday, July 11th, 2018 at 12:37amMathematically today people can qualify for 30% less than in June last year at the same income….2 more increases in the next 6-7 moths and they will qualify for 35% less…

Posted by bubu on Wednesday, July 11th, 2018 at 12:56amGPC, I agree with everything you said with the exception of the first sentence. The market *should be* trending down for a lot of reasons (certainly including those you mentioned) -- but the prices are clearly not doing that yet, and for that simple reason I think you can't say that the market is trending down.

Posted by Anonymous on Thursday, July 12th, 2018 at 1:39amI share the ultrabear perspective, but let's stop pretending like Edmonton is performing anything but sideways for now. Not even 5 updates ago they were making the same noise you are making when things spiked up. Things go up and down, but the trend clearly is sideways; I'll open the champagne and toast you when a April-October average price hits 400 and stays there for a bit. Until then, we're still at 440 and there is no action yet (though I agree record high inventory can't go higher forever).

Posted by Anonymous on Thursday, July 12th, 2018 at 3:13amThat previous comment was directed at GPC, fwiw; I don't know why replies don't nest.

Posted by Anonymous on Thursday, July 12th, 2018 at 3:15amOk sure

Posted by GPC on Thursday, July 12th, 2018 at 3:27amBut that's my point...when we focus on average price it seems like prices haven't moved but I am very confident very few buyers are getting asking prices because of current market conditions...

This market is not trending sideways, it is clearly trending down.

Posted by GPC on Thursday, July 12th, 2018 at 7:21amI wouldn't watch the average price trend at all, it's been up & down as you said. What I would watch are the other factors that indicates the state of a market.

The hallmarks of a downmarket are reflected in the monthly stats since the beginning of the year (and before); High inventory, low sales, sales to listing ratio below 50% and longer weeks on the market before selling.

House prices are like housing markets, you will find differing prices in all housing categories, the one that matters most is the one where you want to live and I would be very comfortable betting that there are bargains to be had in all categories right now which will be even better in the very near future.

Leave A Comment