"Your time is limited, so don't waste it living someone else's life. Don't be trapped by dogma – which is living with the results of other people's thinking." -Steve Jobs

Posted by Liv Real Estate

on

"Your time is limited, so don't waste it living someone else's life. Don't be trapped by dogma – which is living with the results of other people's thinking." -Steve Jobs

Posted by Liv Real Estate

on

11 Responses to Weekly update May 14/21

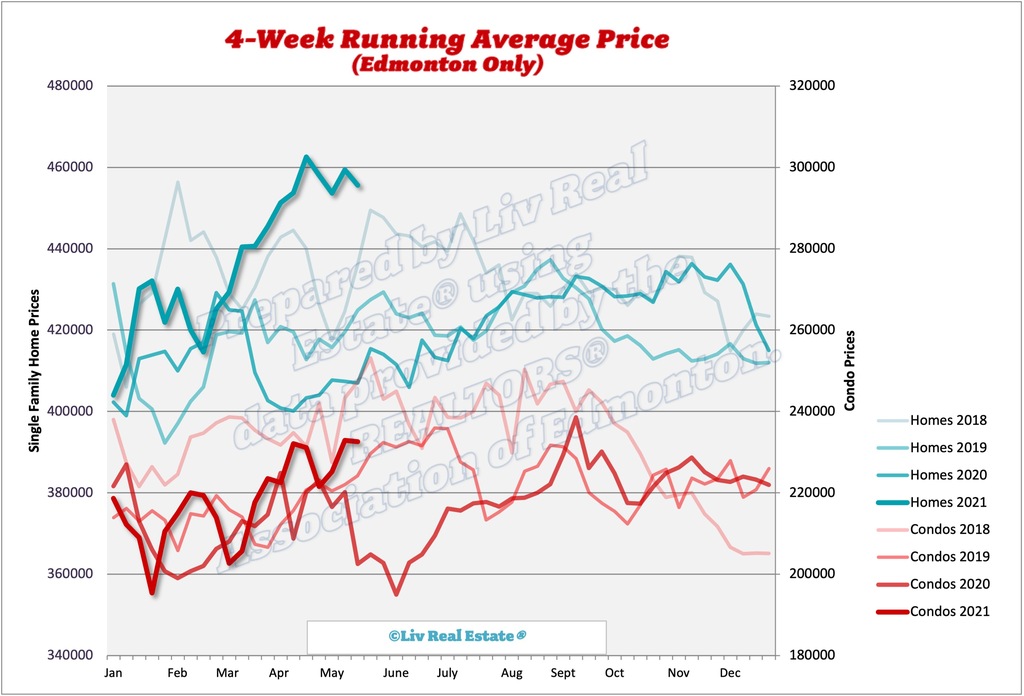

Looks like Edmonton prices may have hit a plateau.

Posted by GM on Thursday, May 13th, 2021 at 10:24pmThe average price in 3.8 times income which matches some of the absolute lowest cities in America for housing prices to income. Calgary is 4.1 times income.

Posted by Tony on Saturday, May 15th, 2021 at 9:43pmUSD to CAD is 1.2, that's really good for us. The peak last year is 1.46

Posted by Jason (Toronto) on Sunday, May 16th, 2021 at 8:39pmIf you take this into account, the real estate is actually doing quite well. I do expect SFH to stay at this level for the moment.

Edmonton and Calgary will probably have some more room to grow because oil price is doing a bit better, but I don't expect much!

On the other hand, here it Toronto, there is nothing available around my area for a typical double garages, 4 beds 4 baths SFH. Nobody is selling! Reason: everyone is afraid to sell because they may not be able to get a house for the price they sold, unless they really downsized or move out of GTA.

We can see the light at the end of the tunnel for COVID ( I hope). After that, hyper inflation; House price in Canada will skyrocket, crypto will go up, interest rate will jump about One percent.

That is my prediction, take it with grain of salt.

Except in America you keep a lot more of your income because they pay less tax.

Posted by GM on Sunday, May 16th, 2021 at 10:44pmYou can see the light at the end of the covid tunnel. Unfortunately, what you can't see is the new virus they're going to release from the lab later this year.

Posted by GM on Monday, May 17th, 2021 at 8:18pmTony,

Posted by GM on Monday, May 17th, 2021 at 10:18pmYou have too much faith in the Canadian government.

We are in bigger trouble than the US. The US has industry, tech, biotech, semiconductors, software...

Canada has maple syrup and a very tiny amount of oil companies still surviving, but even those will be killed off eventually by Trudeau.

Every time the U.S. stock market is going to crash the Fed lowers the value of the U.S. dollar which pushes up the price of oil and natural gas. Judging by what the stock market did from 1973 to 1980 the inflationary years the Fed will have to destroy the U.S. dollar to prevent an implosion in the U.S. stock market.

Posted by Tony on Tuesday, May 18th, 2021 at 4:25amRe: We can see the light at the end of the tunnel for COVID ( I hope). After that, hyper inflation; House price in Canada will skyrocket, crypto will go up, interest rate will jump about One percent.

Posted by Tonyt on Tuesday, May 18th, 2021 at 4:30amThat is my prediction, take it with grain of salt.

America will get hyperinflation while the inflation rate only rises marginally in Canada. The U.S. dollar will plunge while the Canada dollar rises finally back above par with the U.S. dollar.

Anyone knows what is expected to result from BoC’s tightened lending rules announced today? Is it going to push buyers to buy asap, or are we going to see the market to start cooling down?

Posted by Alex on Thursday, May 20th, 2021 at 2:04amTony - you might want to google hyper inflation....

Posted by Karl hungus on Thursday, May 20th, 2021 at 4:48amRe: Anyone knows what is expected to result from BoC’s tightened lending rules announced today? Is it going to push buyers to buy asap, or are we going to see the market to start cooling down?

Posted by Tony on Friday, May 21st, 2021 at 2:21amThe 5.25 percent stress test also applies to uninsured mortgages.

It will affect mostly first time buyers in the Toronto and Vancouver areas. It will likely help Home Capital and the last resort lenders.

Leave A Comment