Weekly Market Update Jul 14/23

Posted by Liv Real Estate on

Here is our update on the Edmonton real estate market. (Previous week’s numbers are in brackets). For the past 7 days:

New Listings: 664 (602, 516, 526)

Sales: 432 (379, 411, 430)

Ratio: 65% (63%, 80%, 82%)

Price Changes: 418 (371, 398, 344)

Expired/Off-Market Listings: 243 (395, 179, 203)

Net loss/gain in listings this week: -11 (-172, -74, -107)

Active single-family home listings: 2941 (2905, 2976, 2958)

Active condo listings: 1888 (1877, 1914, 1917)

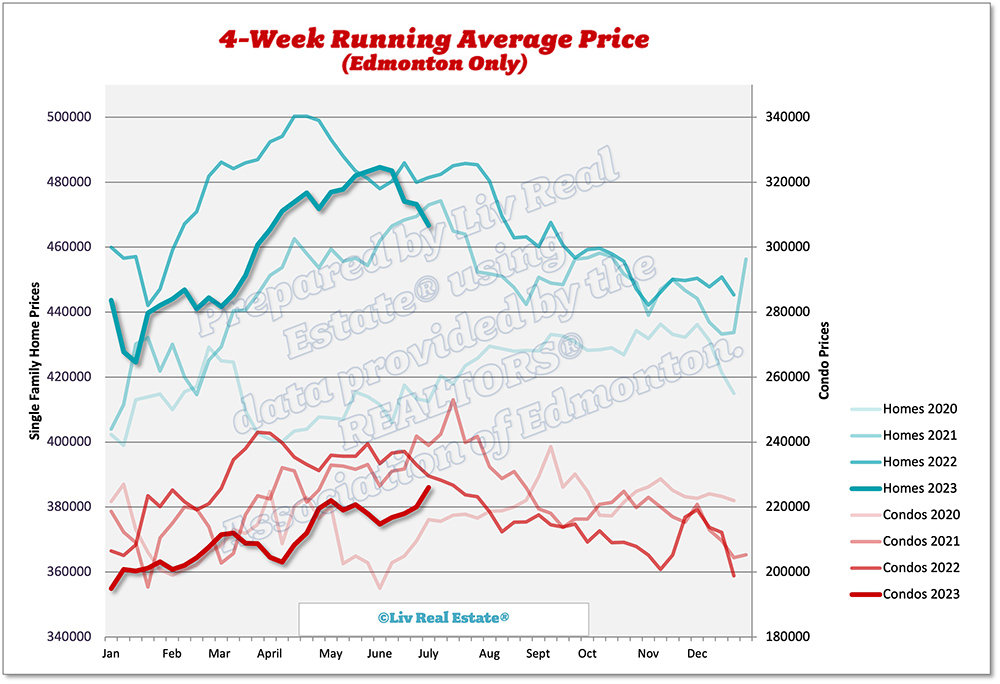

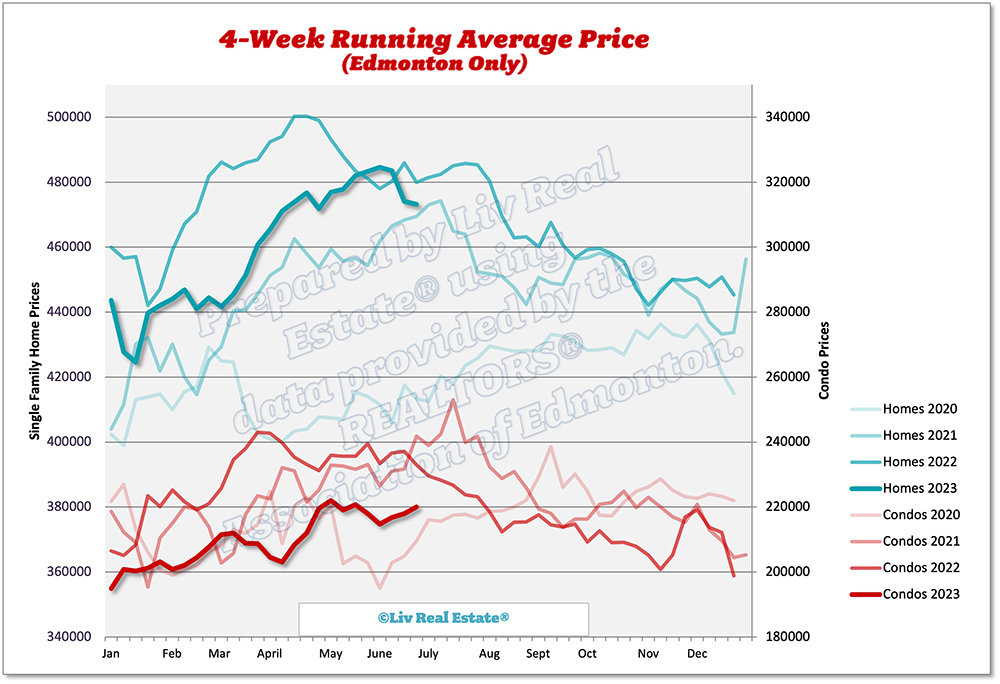

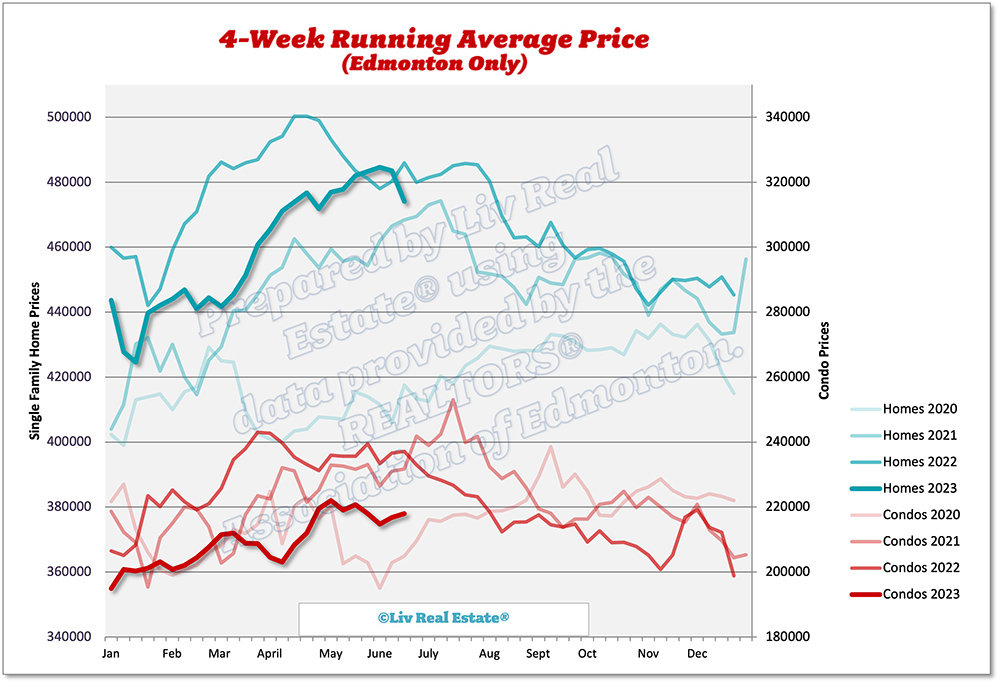

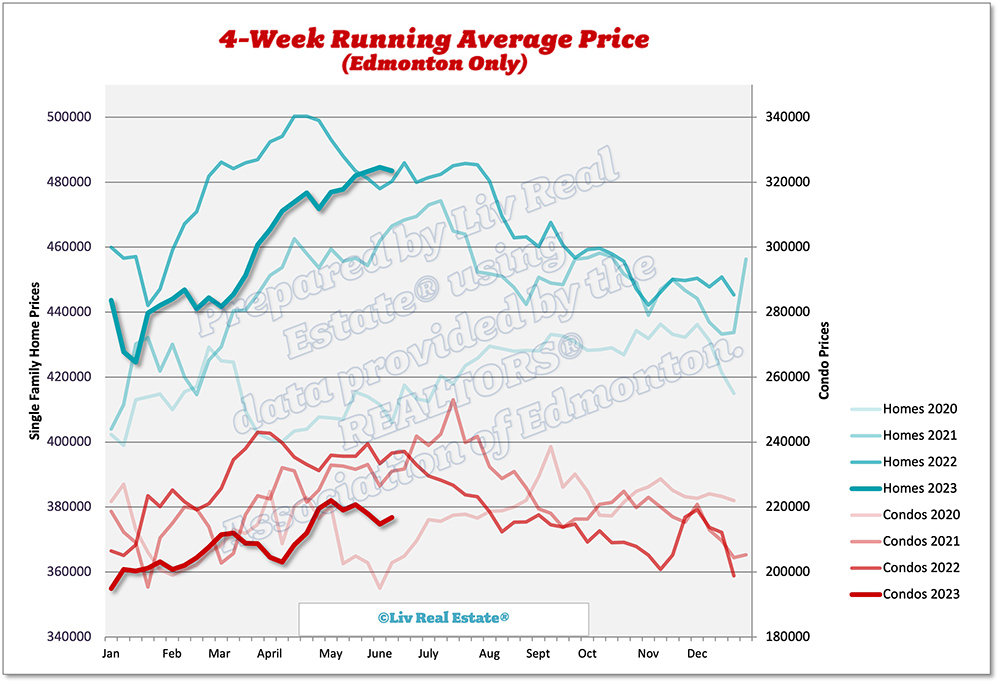

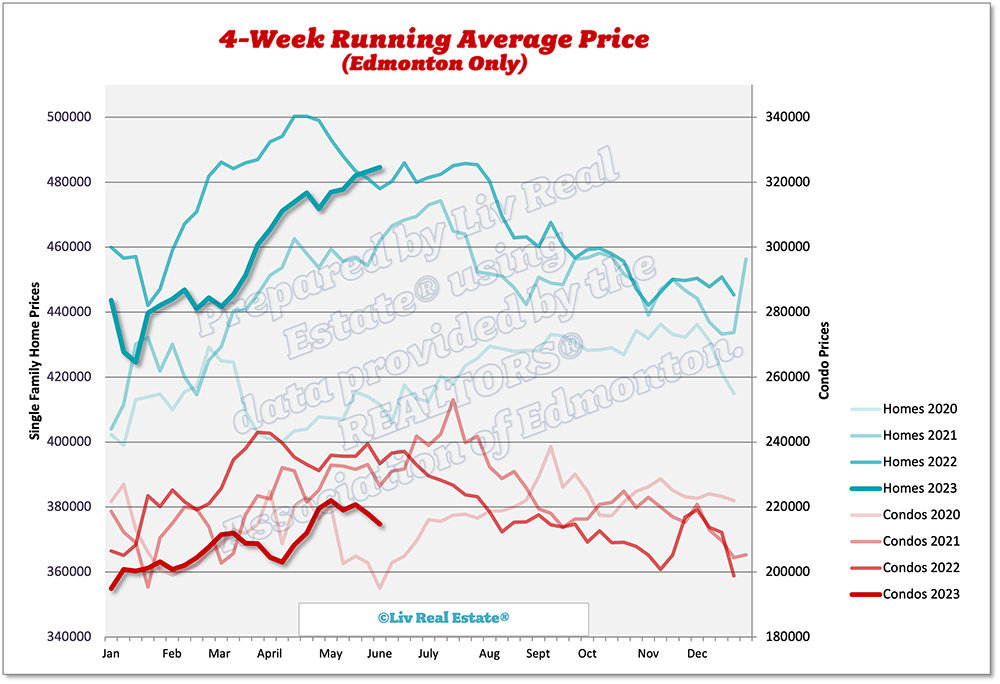

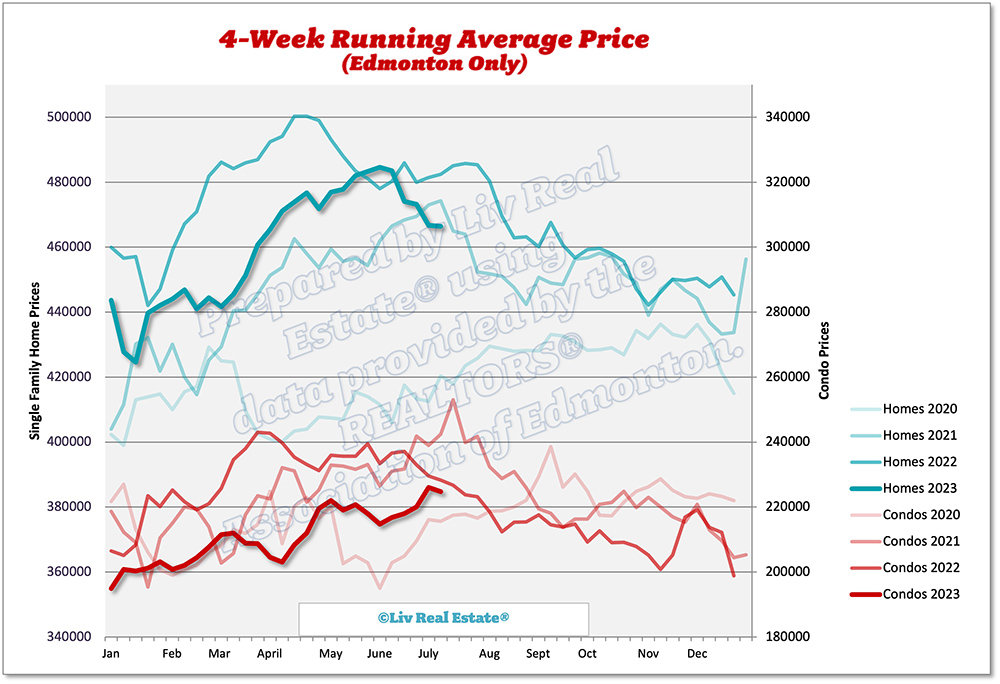

Homes 4-week running average: $466 ($467, $473, $474)

Condos 4-week running average: $225 ($226, $220, $218)

779 Views, 0 Comments