Here is our update on the Edmonton real estate market. (Previous week’s numbers are in brackets). For the past 7 days:

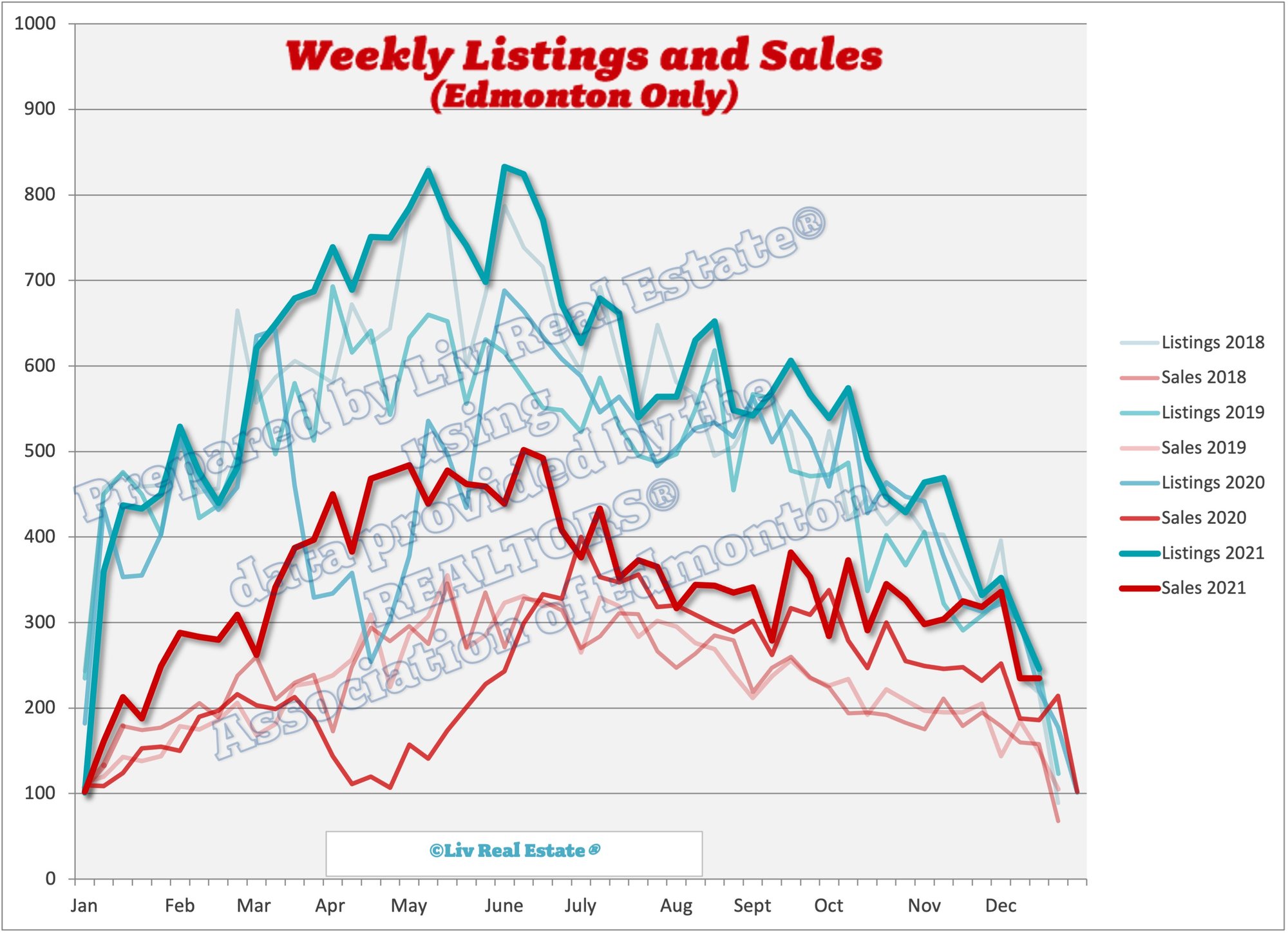

New Listings: 246 (298, 352, 332)

Sales: 235 (235, 336, 318)

Ratio: 96% (79%, 95%, 96%)

Price Changes: 146 (183, 233, 225)

Expired/Off-Market Listings: 244 (191, 501, 195)

Net loss/gain in listings this week: -233 (-128, -485, -181)

Active single-family home listings: 2136 (2255, 2347, 2626)

Active condo listings: 2127 (2201, 2201, 2355)

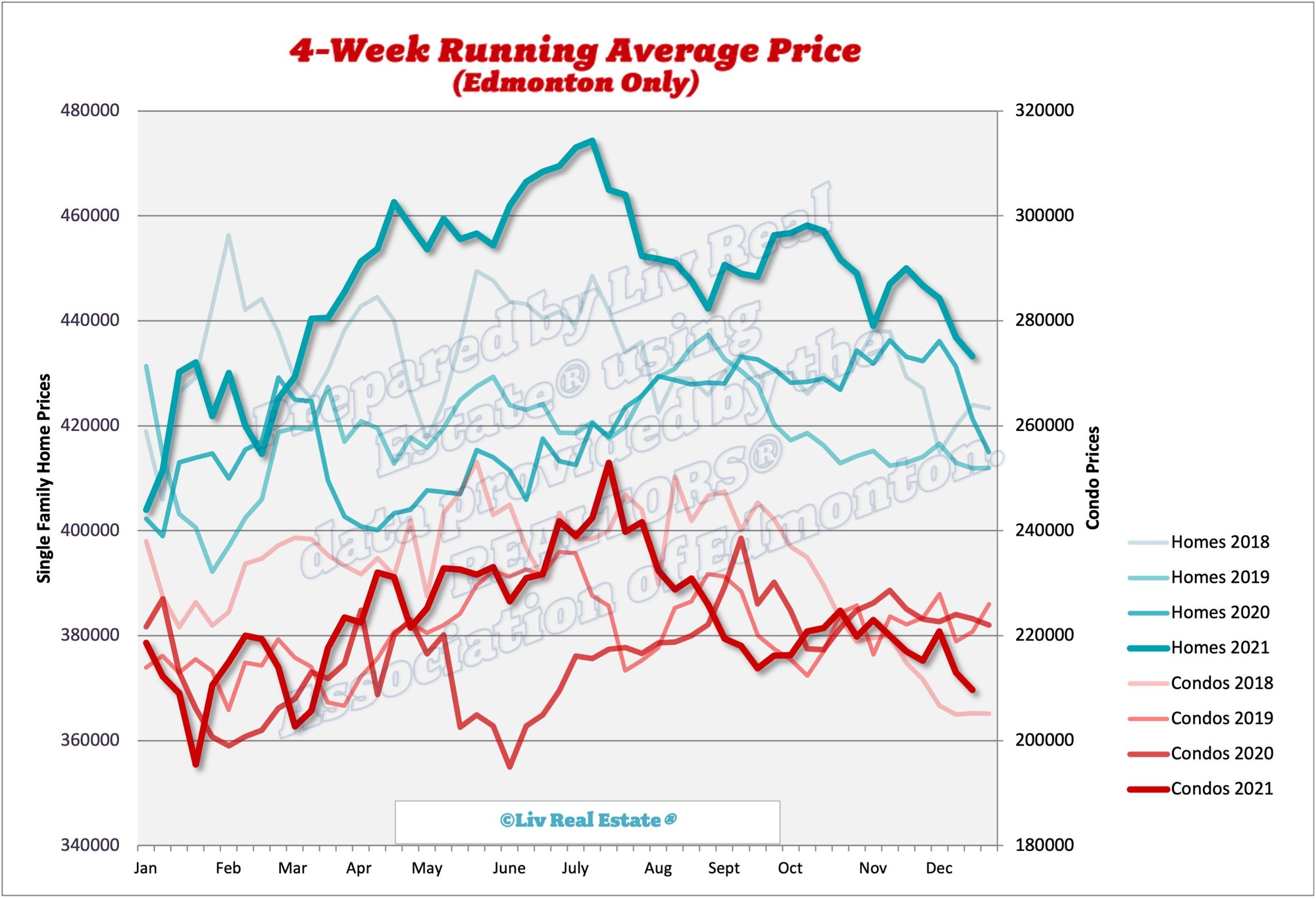

Homes 4-week running average: $433 ($437, $444, $447)

Condos 4-week running average: $210 ($213, $221, $215)

(3).png)

4 Responses to Weekly Market Update Dec.17/21

Trudeau's measures to try to kill real estate will probably have a large effect on Vancouver and the greater Vancouver area but next to no effect on Toronto and the golden horseshoe. Eventually Canada has to raise interest rates or inflation will run into double digits and no one will be able to afford food with a 50 cent dollar. With Omicron this should put downward pressure on oil. It seems The full brunt of Omicron is supposed to be by January 15th 2022. as the entire world will be infected. Alberta will never see price gains seen across Canada unless people out of province buy in Alberta but unlike most other places in the world there's a huge surplus of everything to rent in Alberta.

Posted by Tony on Friday, December 17th, 2021 at 1:51pmIt's not that bad Tony.

Posted by Jason (Toronto) on Friday, December 17th, 2021 at 2:55pmHowever, I fail to see how parliament can go to winter recess for more than a month during a crisis like that! Well, may be it makes no difference whether they are on it or off it.

At least all provinces are taking this omincron seriously.

I don't think the Bank of Canada can raise rates much without hurting the economy, considering real estate is the biggest driver of growth. I suspect that Canada will increase 25 basis points in June, and then if the economy is still somewhat strong, they'll increase another 25 basis points in the Fall. But I'm skeptical about this second increase, considering that Covid stimulus spending will likely be reined in soon, which should naturally slow the economy without the need for a second interest rate increase. Plus, we're a ways off from full employment, and that was just added as a key criteria to the Bank of Canada's revised mandate, in terms of when to raise interest rates. And inflation is a global issue now, so I don't think that factors into the Bank of Canada's interest rate decision.

Posted by Tom on Friday, December 17th, 2021 at 4:12pmI don't think the Bank of Canada can raise rates much without hurting the economy, considering real estate is the biggest driver of growth. I suspect that Canada will increase 25 basis points in June, and then if the economy is still somewhat strong, they'll increase another 25 basis points in the Fall.

Posted by kritika sharma on Friday, December 31st, 2021 at 12:31amLeave A Comment