Here is our update on the Edmonton real estate market. (Previous week’s numbers are in brackets). For the past 7 days:

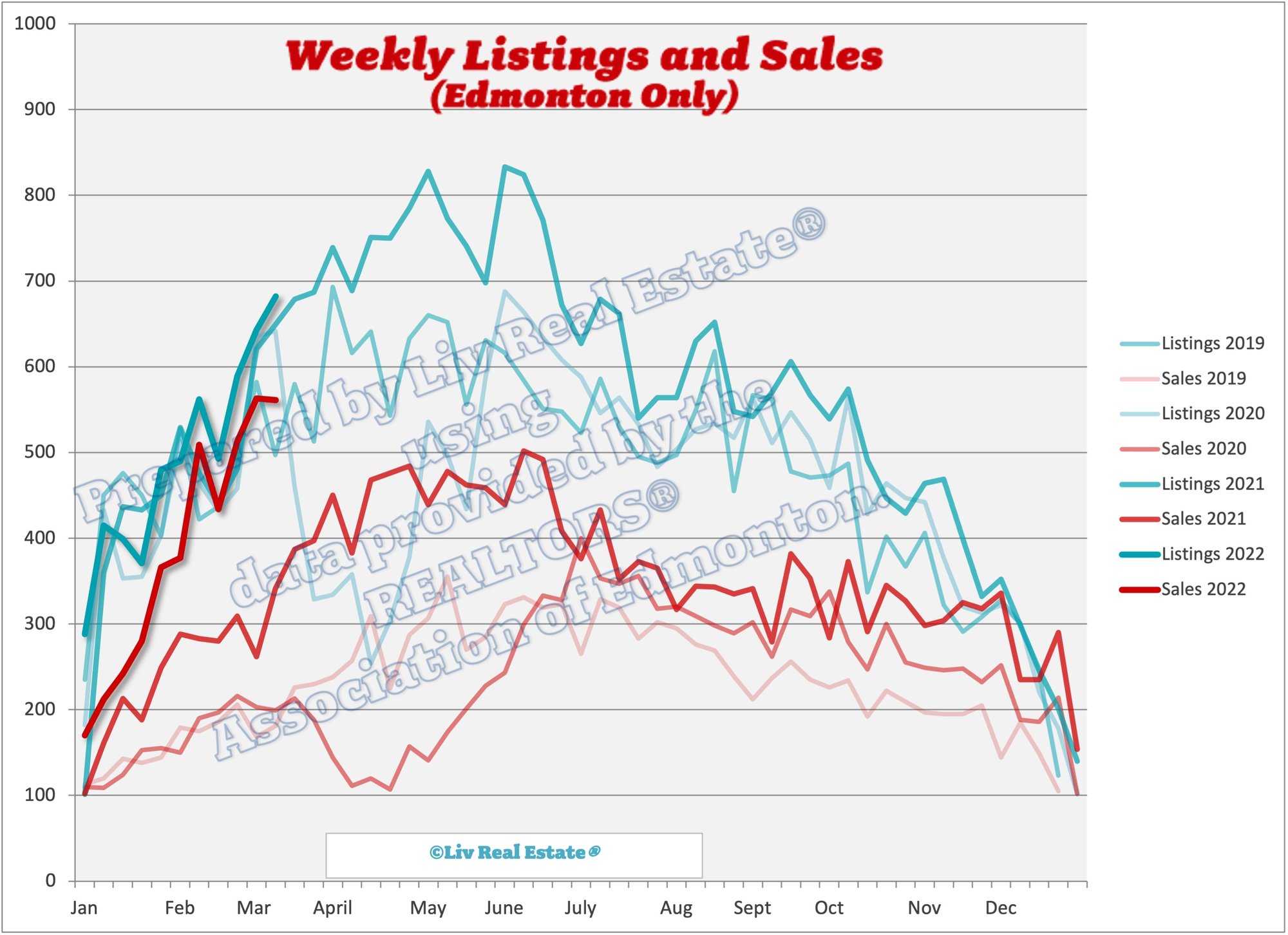

New Listings: 682 (643, 589, 493)

Sales: 561 (563, 513, 434)

Ratio: 82% (88%, 87%, 88%)

Price Changes: 246 (220, 239, 227)

Expired/Off-Market Listings: 107 (95, 209, 110)

Net loss/gain in listings this week: 14 (-15, -133, -51)

Active single-family home listings: 1441 (1370, 1318, 1297)

Active condo listings: 1896 (1865, 1810, 1832)

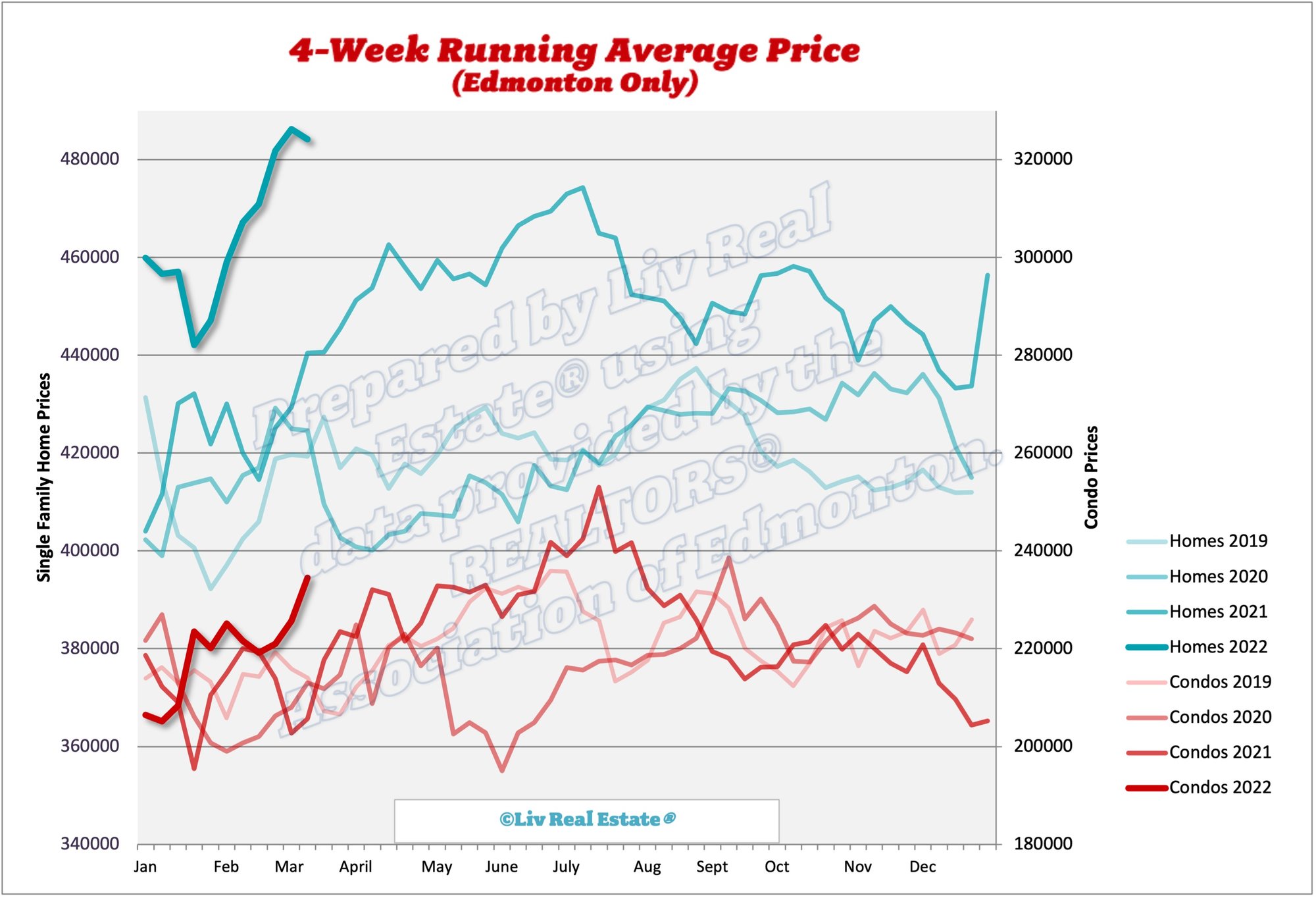

Homes 4-week running average: $484 ($486, $482, $471)

Condos 4-week running average: $235 ($226, $221, $219)

(40).png)

5 Responses to Weekly Market Update Mar.18/22

Looks to me like people are turning to condos now. Maybe they feel house prices have gotten ahead of themselves, or are tired of fighting against multiple offers.

Posted by GM on Friday, March 18th, 2022 at 3:28pmIs there a website like this for Calgary, where they give a graph and update every week? I can't seem to find one.

Posted by GM on Friday, March 18th, 2022 at 3:29pmGM, I've been bearish on Edmonton housing for about 8 years, but not anymore. The ground has shifted and the game has changed. With homes in every major city (1M+ people) in Canada, including their barely commutable suburbs, plus the Okanagan, now all hitting the $1.5M and up for a half-decent SFH, plus the price of oil and the fact that post-Ukraine we're going to see a structural shift to non-conflict oil, Edmonton real estate is under-valued by any reasonable yardstick at this point. Rent ratios, replacement cost ratios, affordability ratios, service access, business and educational opportunities....Edmonton is dirt cheap. It also has cheap dirt, but that is going to start to change as well. The cost of development (new subdivisions or infills) is going up significantly due to sold out builders, at capacity contractors, lack of skilled labor, insanely high equipment capital and maintenance costs, and raw material and energy cost inputs. Those D6's and excavators don't run on good intentions, and with Diesel over $1.80, good operators demanding $45+/hr, and the price of new iron up 20-30% (if you can even get it before 2023 or later) the costs are going way up. For the last 15 years, the cost of land+building kept a lid on resale home prices, because why buy used when a new house can be had for $450k? That pricing has risen substantially this year due to the factors above, and it is pushing everything up along with it. As long as rates rise only modestly (1% or so), I think we'll see Edmonton house prices climb 10-20% this year. Quite simply, houses will still be affordable in the sense buyers will still be able to qualify, the demand will remain high, and the alternatives (buy new) will be so much pricier. Anyone who is thinking about buying in the prairies in general would be wise to do it now, as we're at the beginning of the cycle that has swept southern Ontario, Montreal, and the entire south 1/3 of BC over the past 2 - 15 years while we've been in the opposite end of the cycle. It's taken 15 years, but I think Alberta is finally ready for one heck of a run again.

Posted by T-Rev on Friday, March 18th, 2022 at 4:29pmGM

Posted by Renu Bhattacharya on Friday, March 18th, 2022 at 4:34pmhttps://www.creb.com/Housing_Statistics/Daily_Housing_Summary/

thanks for the post keep sharing

Posted by infosecTrain on Wednesday, March 23rd, 2022 at 12:13amLeave A Comment