Here is our update on the Edmonton real estate market. (Previous week’s numbers are in brackets). For the past 7 days:

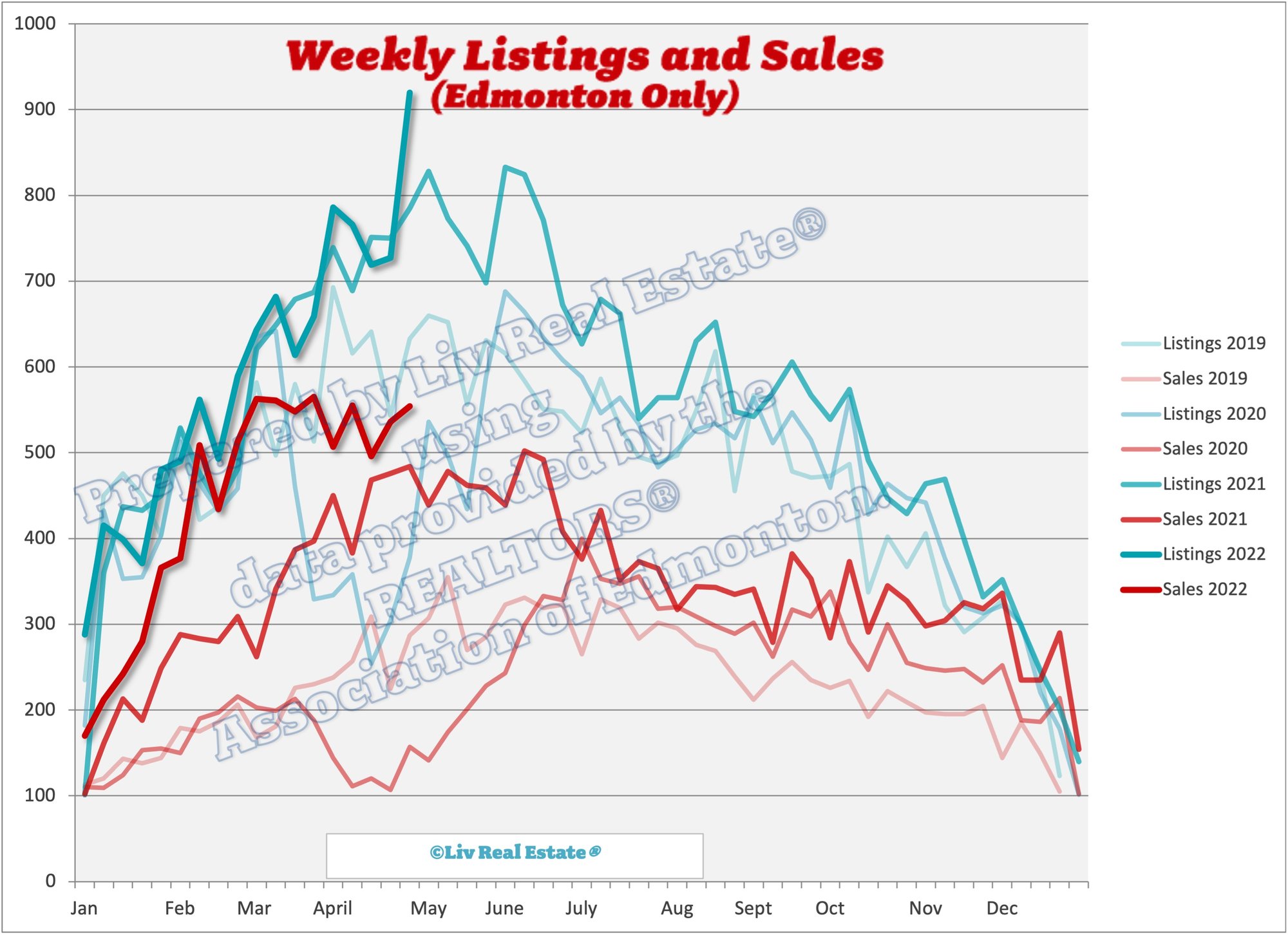

New Listings: 920 (727, 719, 766)

Sales: 554 (536, 496, 555)

Ratio: 60% (74%, 69%, 72%)

Price Changes: 442 (378, 333, 336)

Expired/Off-Market Listings: 246 (148, 126, 128)

Net loss/gain in listings this week: 120 (43, 97, 83)

Active single-family home listings: 2380 (2202, 2034, 1854)

Active condo listings: 2110 (2050, 2035, 2012)

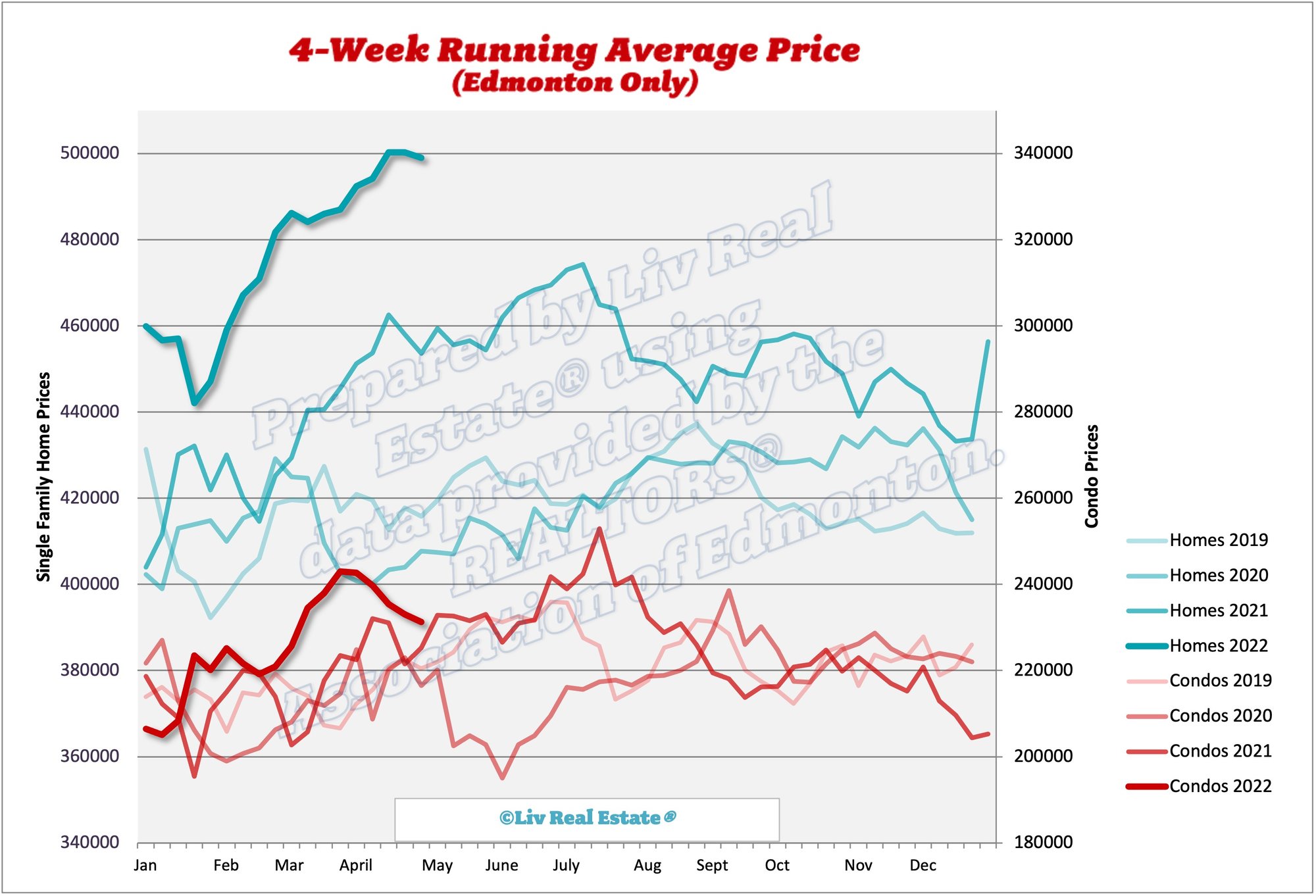

Homes 4-week running average: $499 ($500, $500, $494)

Condos 4-week running average: $231 ($233, $235, $240)

1 Response to Weekly Market Update May 6/22

Want to know what houses will do a year from now? Look at the inflation rate. The cost of construction is up by more than the inflation rate due to the energy intensity of new construction, and energy inflation being even higher than general inflation.

Posted by T-Rev on Friday, May 6th, 2022 at 5:38pmSo if inflation is sitting at 7%, you can bet houses will be 7% higher next year, higher mortgage rates or not. RE is, historically on on average across geographies, an excellent hedge against inflation. So unless you think Edmonton is the next Detroit (it's not), I think you can bet on continued price increases. There will be a short but sweet buyers market this summer/fall as rates rise and people get scared, but it will be short lived, then up she goes again.

Leave A Comment